By Junko Mochizuki and Makena Coffman

Lignocellulosic ethanol has been touted as a cleaner, next generation alternative fuel. Turning abundant resources like grasses into a transportation fuel sounds like a good idea. But, is this a viable option in Hawaii? What’s the state of technology now? What would it cost to produce it locally? Will it reduce Hawaii’s greenhouse gas (GHG) emissions?

The recently completed study titled “Market, welfare and land-use implications of Lignocellulosic bioethanol in Hawaiʻi ” seeks to answer some of these questions. In this interdisciplinary study, bottom-up bioenginering and top-down computable general equilibrium (CGE) models are combined to estimate the likely cost of bioethanol production and its impact to Hawaii’s economy. The study assumes lignocellulosic bioethanol is produced via the state-of-the art Simultanerous Saccharification and Co-Firmentation (SSCoF) of Napiergrass, and is used to meet an alternative fuels standard (AFS) of 10% and 20% of the state’s gasoline demand, respectively. The four policy scenarios evaluated are: i) a federal blending tax credit, ii) a long-term purchase contract, iii) a state production subsidy financed by a lump-sum tax and iv) a state production subsidy financed by an ad valorem gasoline tax.

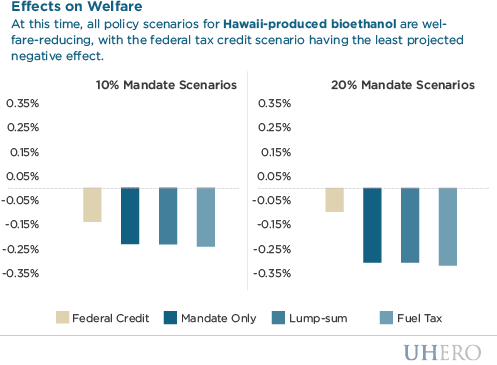

The modeling results indicate that Hawaii-produced bioethanol is relatively costly. Given the state of technology and economic conditions, all scenarios reduce local residents’ welfare (estimated to be around -0.14% and -0.32%). Unsurprisingly, Hawaii’s economy fairs best under the federal blending tax credit scenario: the policy support makes Hawaii’s ethanol competitive, and produces a positive impact to gross state product of $49 million. Otherwise, impacts on gross state product are estimated to be negative (up to -$63 million).

The study also finds that Hawaii-based bioethanol is unlikely to offer substantial GHG emissions savings in comparison to imported biofuel. The fuel tax scenario achieves the most GHG emissions reductions estimated at -2.3% (the 20% mandate) and -0.5% (the 10% mandate) of the total GHG emission in Hawaii. The federal credit case achieves the least reductions estimated at -1.4% (the 20% mandate) and -0.06% (the 10% mandate). The policy cost per tonne of emissions displaced ranges between $130 to $2,100/tonne of CO2e. The study also highlights that the value of pasture land could increase by as much as 150% in the 20% AFS scenario.

Overall, the study shows that technological and economic hurdles remain, but a number of emerging solutions could make this local option viable: a bioethanol plant may adopt an anaerobic digestion system, which may process local animal manure as an additional energy source of biogas. Further, a plant may produce an innovative fungal-based co-product to be used as a local animal feed substitute, such as those being evaluated at the UH MBBE department (Takara and Khanal, 2011). Also, the emerging concept of a biorefinery aims to produce a range of fuel products such as jetfuel and industrial chemical substitutes. Future studies are needed to evaluate such novel options in Hawaii.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

References:

Mochizuki J, Yanagida J. & Coffman M(2013) Market, welfare and land-use implications of Lignocellulosic bioethanol in Hawaiʻi. UHERO WorkingPaper No. 2013-10.

Takara. D., & Khanal, S. K. (2011) Green processing of tropical banagrass into biofuel and biobased products: an innovative biorefinery approach. Bioresources Technology 102(2); 1587-92.