By Jim Roumasset

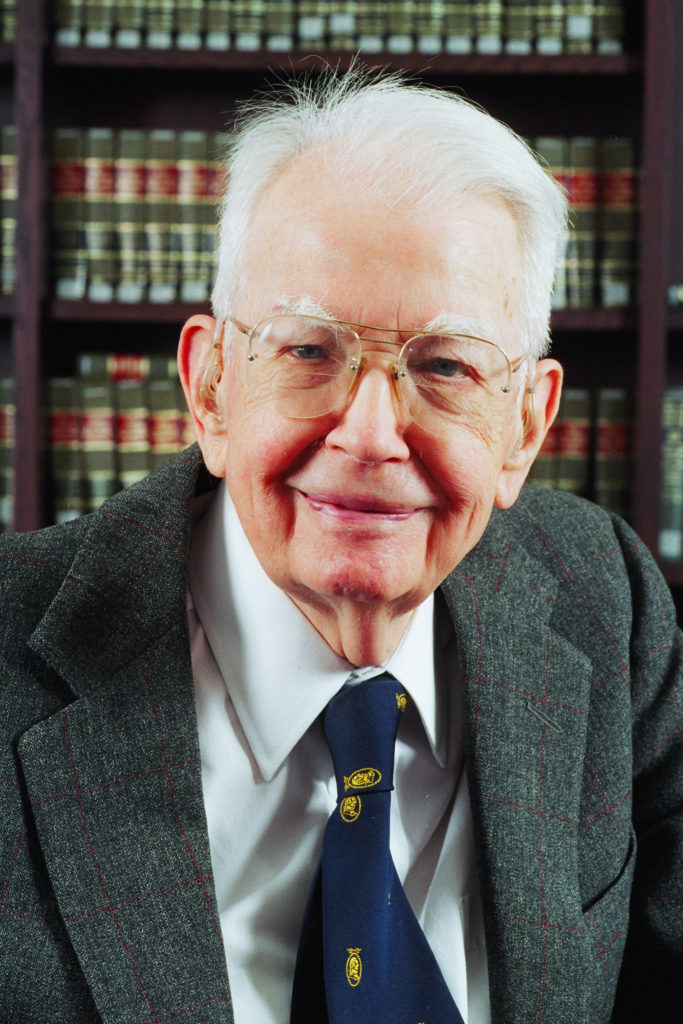

Nobel Laureate Ronald Coase passed away unexpectedly on September 2. Despite his age, Professor Coase was planning a trip to China, following up on his 2012 book, How China Became Capitalist. Coase gave a great interview in 2009 about his contributions regarding the market, the firm, and property rights. He modestly dismisses his 1937 “The Nature of the Firm,” central to his Nobel award, as the naive musings of an undergraduate. But as the University of Chicago piece notes (and his fellow Nobelian Oliver Williamson has acknowledged), this paper provided the basic insights undergirding the field of transaction cost economics. And while Coase disparages economic theory, theorists continue to find substantial grist for new models in his more recent remarks about the firm — an organization that is all about friendships, alliances, antagonisms, and strategies — subjects that can be illuminated by game theory and the theory of endogenous coalitions.

In an apparent departure from Hayek’s spontaneous order, Coase asserts that “markets have to be created” and goes on to discuss the difficulty of designing contracts that are clear and administratively feasible enough that sufficient numbers for a market will use the contract. (Hayek would presumably reply that spontaneous doesn’t mean costless.)

In the same interview, Coase talks about his 1940s discovery (from a sample of contracts collected by James Meade) that long-run contracts are too vague to be the basis of transactions and can only be meaningfully interpreted from the perspective of relationships among contracting parties. This anticipated the theories of relational contracting (e.g. by I.R. Macneil, Victor Goldberg and Oliver Williamson). In 1959, Coase recommended to the FCC that electronic transmission rights be auctioned. It took the FCC 35 years to follow his advice, and some years later the government had generated 53 billion dollars in revenue from such auctions and stimulated the development of today’s wireless technology and mobile devices.

Bloomberg News provides a nice tribute, including a link to a 1997 interview with Reason magazine. Given the many versions of the Coase Theorem, Coase’s own summary may be instructive: “Whether someone is liable or not liable for damages that he creates, in a regime of zero transaction costs, the result would be the same.” “All it says is that the people will use resources in the way that produces the most value. I still think it’s an obvious point. You wouldn’t think there was a need for a Coase Theorem.” As it turns out, however, this version of the Coase Theorem can only be proved with extremely restrictive assumptions, including something like quasi-linear preferences to rule out income effects.

At the famous 1959 dinner at the home of Aaron Director where Coase convinced the University of Chicago faculty of what later became known as the Coase Theorem, he stressed the importance of ex ante competition. This suggests a version of the theorem that can be rigorously proved: As the number of contracting pairs increases, the set of viable equilibrium contracts shrinks to the competitive equilibrium. For example, in an apple-bee economy, the competitive contractual equilibrium is identical to the competitive equilibrium with apple owners paying bee keepers for pollination services. So you don’t need Pigouvian subsidies. (The same logic applies to the Pigouvian imperative that taxes are needed to internalize pollution externalities.) The upshot of this “equivalence version” of the Coase Theorem is that given the appropriate restrictions, many institutions (contracts, limited markets with Pigouvian taxes, and universal markets) are capable of achieving the same value-maximizing solution. As Coase himself noted after winning his Nobel award, voluntary contracting is likely to be inappropriate for most industrial pollution because there are typically many victims who would have to come to an agreement about negotiating strategy and dividing up the payments from one or multiple polluters.

Many observers deride any version of the Coase theorem, referring to the mythical Coasean world of zero transaction costs and Coase as a Panglossian. This entirely misses Coase’s central thrust. It is precisely because institutions are equivalent aside from transaction costs that they can only be meaningfully compared with transaction cost economics, specifically according to the tradeoff between how closely an institution approximates the transaction-cost free ideal and how much it economizes on transaction costs. By advocating this comparative institutions approach in his own work and as editor of the Journal of Law and Economics, Coase spawned not only the field of law and economics but the new institutional economics as well.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.