By Michael Roberts

It seems that our political and administrative leaders worry about the bond rating agencies. Their fear is understandable. The cost of capital looms large in all manner of infrastructure projects, and the cost of that capital depends on how risky investors perceive repayment to be.

The cost of capital also looms large for our investor-owned electric utility. HECO has a lot of capital to finance, some of it through corporate bond issues. It is also the sole “off-taker” for many independent power producers, so its financial health may affect the borrowing costs of these counterparties.

This worry was one predictably raised in response to a bill, now on Governor Ige’s desk, that would force the Public Utilities Commission to:

“…establish performance incentives and penalty mechanisms that directly tie an electric utility revenues to that utility’s achievement on performance metrics and break the direct link between allowed revenues and investment levels.”

What does this mean?

It helps to know a bit about the convoluted underbelly of utility regulation. Here in Hawaii, and I believe every other state with investor-owned utilities, Public Utilities Commissions (PUCs) set an allowed revenue that utility companies can collect. That revenue comes from a formula that looks something like the following:

Fuel + Purchased Power + O&M + (Capital Investment) x (Allowed Rate of Return)

The utility has to justify these costs to the PUC, which it must approve. Most costs are basically a pure pass through to customers. The utility makes its profit, enough to provide dividends to shareholders, in basically two ways:

- It can try to cut operation and maintenance costs and pocket the savings, although it may lose that allowed revenue in the next rate case.

- The allowed rate of return on capital.

If the allowed rate of return exceeds what the utility must pay in dividends to shareholders and/or interest rate payments, then utilities have a perverse incentive to tilt everything it does toward maximizing its own capital investment. The only check on the prudency of its investments is the PUC, which must approve most such expenditures.

The good thing about this strange profit mechanism is that, because it basically guarantees that the utility will earn a return on its investments, it’s quite easy for utilities to sell stock and bonds to finance the investment. All of which brings us to the bill on the Governor’s desk and our leaders’ fears of bond-rating agencies.

The bill tries to eliminate this perverse incentive, which basically rewards the utility for maximizing costs, by instead setting revenue based on performance metrics – outcomes that measure value to the utility’s customers and the larger community. These can be anything from measures that show better operation of its power plants to save costs, higher customer satisfaction, and better pollution outcomes.

Performance adjustments already exist in a limited form, but to my knowledge, performance outcomes are not used as the main source of return for any utility. The bill pushes for an unprecedented break from the status quo, and I gather that the Governor is worried (after very intense lobbying by certain interests) that if he signs the bill, HECO’s stock price and its bond rating could be punished by Wall Street.

So, two questions:

- Is this fear of bond-rating agencies well justified?

- Regardless of bond-rating fears, is this a good bill?

First, I think bond-rating fears are overblown. I don’t believe the bill casts reasonable doubt on the idea that the utility will be allowed to make a reasonable return on its investments. It just says that we need to break the “direct link” with capital investments. All manner of corporations easily raise capital monies with debt and equity issues under the expectation of an indirect link between the investments they make and the value of what they produce with those investments. I think it’s clear that this is the bill’s intent.

More pointedly: the PUC must, due to Supreme Court precedent, allow the utility an opportunity to make a fair return. If I were reading this bill the wrong way – and I think it’s clear that I am not – and the bill were to unfairly keep HECO from making a fair return, it would be quickly struck down by the courts. Wall Street knows this. The bond-rating agencies know this.

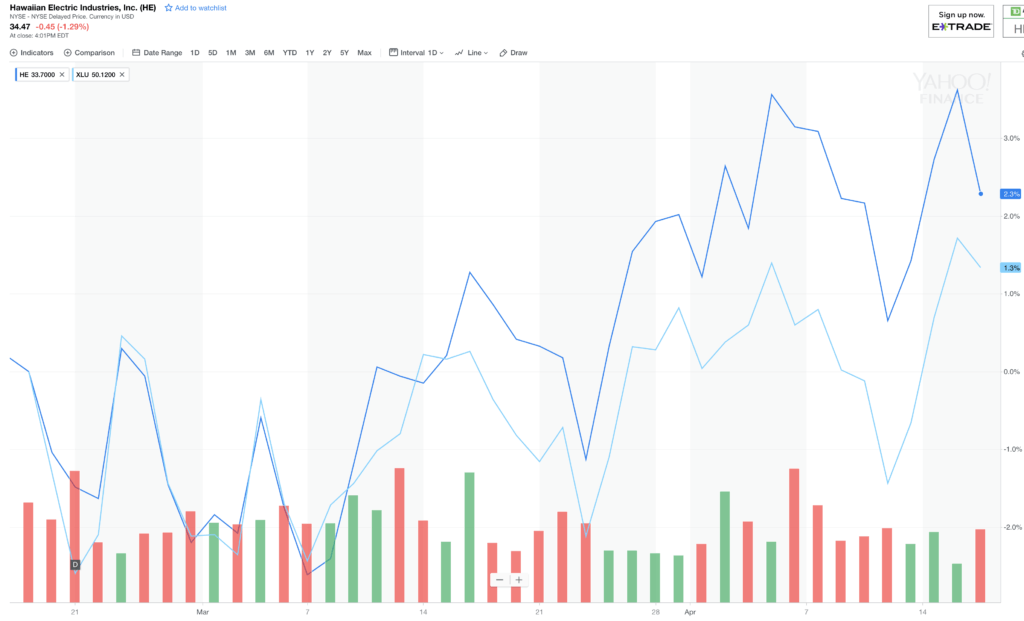

Incidentally, HECO’s stock price is up relative to a standard utility index since the bill passed the legislature.

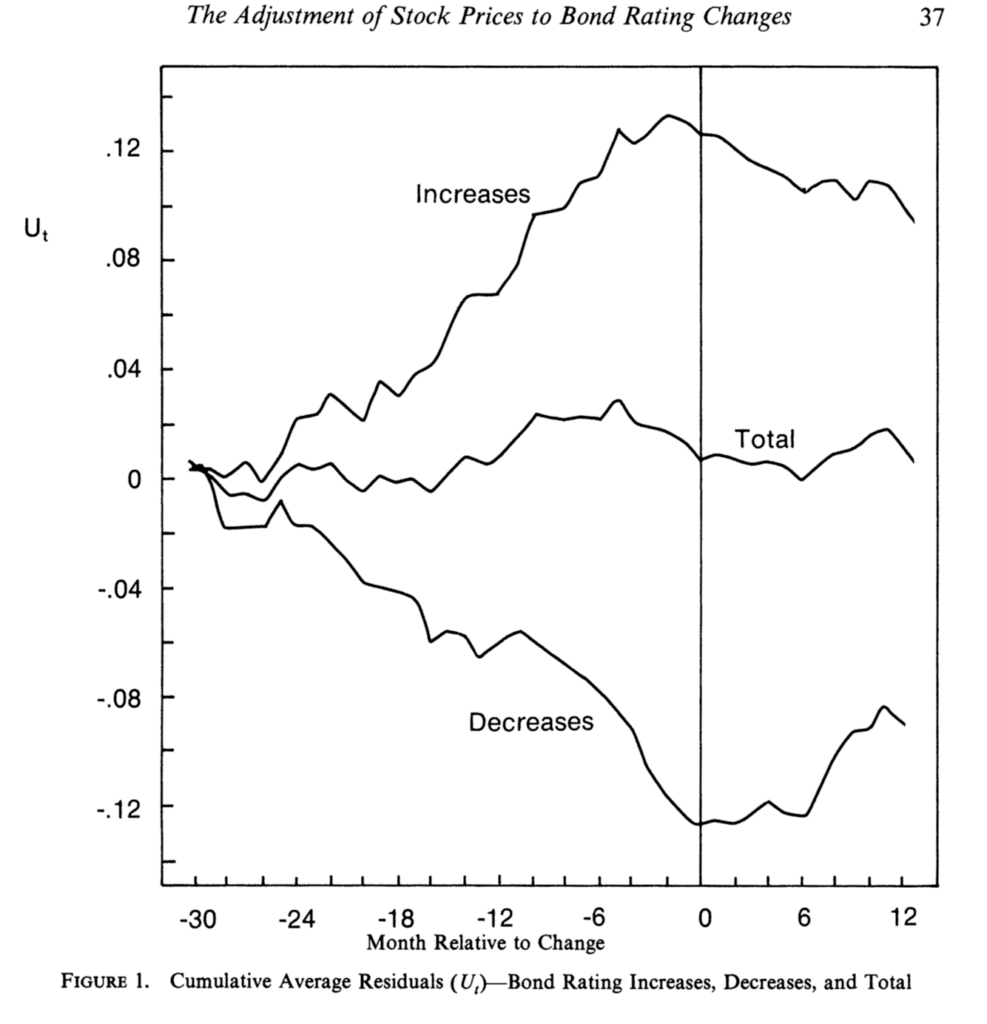

Besides, bond rating agencies have a famously poor track record of predicting anything. (Anyone recall AAA stated-income mortgaged-backed securities?) The academic literature indicates that ratings changes mostly follow the market, with a long lag. Below is a graph from an early classic paper on the link between bond rating changes and stock market returns. It shows that upgrades follow good performance and downgrades follow bad performance. But the upgrades and downgrades have no apparent effect – or possibly even a countervailing effect — on returns after the rating change.

The literature shows that bond yields bear a similar relationship with rating changes. Some papers seem to show a subsequent effect for small firms with persistently low-rated corporate debt. But the size of the effect is small.

I’m not the only economist who is cynical about the bond rating agencies. Paul Krugman has noted how markets shrugged after US and Japanese debt got downgraded.

So, don’t fear the bond-rating agencies. Instead, look squarely at fundamentals. Which brings us to the second question: Is this bill a good idea?

Economists have long criticized rate-of-return regulation given its perverse incentive to maximize capital investment and the difficulty of the PUC in policing every investment decision. Here in Hawai‘i, our PUC has famously difficult staffing issues due to limited funding and a revolving door between them, the utility and other interests. Unsurprisingly, the utility pays higher salaries. It’s a challenging dynamic, to put it politely.

Worse, rate-of-return regulation gives the utility no incentive to find innovative solutions. If there is any advantage to having an investor-owned utility rather than a municipality or cooperative like KIUC (Kaui‘i’s electric utility), it is that they should have strong incentives to control costs and find innovative solutions to problems. Rate-of-return regulation undercuts that advantage.

This bill comes at a time when innovative solutions are increasingly important, capital investment is about to explode, and regulation is increasingly difficult. These changes are happening due to rapidly changing technologies and our transition toward 100% renewable energy. These changes expand the scope for innovation to better integrate and manage the variability of sun and wind resources. Many if not most of these opportunities involve investment by customers and independent power producers. Under rate-of-return regulation, these third-party investments can be efficient, but may be explicitly or implicitly resisted by the utility since they displace their own capital investment and source of profit. In other words, rate-of-return regulation causes more problems today than it has in the past.

So, the spirit of this bill is right on target.

The gaping hole in this bill is what it excludes: specific performance metrics that would replace rate-of-return and provide the new source of the utility’s revenue allowance. It kicks these details to the PUC. Getting these metrics right for the utility of the future is critical. It’s also largely unchartered territory.

The PUC, of course, knows about all of these issues and could make all of these changes unilaterally. It doesn’t need this bill to change the way it determines the utility’s allowed revenue. And just the other day the PUC opened a docket on performance-based regulation. The timing of the docket’s opening and the Governor’s decision about whether or not to sign this bill is unlikely a coincidence.

The PUC is telling Governor Ige: Don’t sign the bill! We got this!

But do they?

We have a laudable PUC and Consumer Advocate. These agencies are underfunded and overworked, and I think it is clearly evident that despite all the pressures they face, they do work tirelessly for the public interest. They are not captured by the utility.

But I do fear that the regulatory process is largely captured by the utility industry and the armies of consultants and vested interests that travel the country to testify on their behalf. And while change can occur within this process, it is slow. Very slow. With regard to this particular feature of regulation – the excessively high rate of return on the utility’s own capital investment – there appears to be a universal intransigence. To my knowledge, no PUC in the country has accomplished more than a tiny reduction in the allowed rate of return, much less a complete removal of the direct link and full reliance on performance metrics.

So, I gather that the PUC, and the utility, worry about how this law would constrain them. It would force profound change between now and January 2020 when the bill would go into full effect. That’s not much time to completely reinvent the utility’s revenue model. The standard process does not normally invoke that much change so quickly.

While I can understand why the PUC feels this is a risky bill, I fear that the risk is greater if we do not change fast enough. HECO’s costs are rising and technological change is relentlessly advancing, giving customers more options. The utility is pushing hard for grid upgrades that are expensive, but could become obsolete if enough customers leave the grid. A grid defection death spiral could be near.

The larger risk is a mountain of stranded assets, combined with punishingly high electricity prices for the most vulnerable customers—renters who cannot defect. This risk is also the State’s risk, since it may be on the hook for a bailout if the PUC approves investments in assets that quickly become obsolete. (I am told that the State probably would not be on the hook legally, due to this precedent, but the end game here would be ugly regardless.) And political leaders who enabled the catastrophe will, of course, have to answer to voters.

We can’t kick this can anymore. We have to act. This bill isn’t ideal—it doesn’t tell us the right performance metrics that would better align the utilities incentives with the public interest. But it does force us to make these hard choices soon.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.