Last week both the U.S. Federal Reserve and the European Central Bank made big policy commitments to support the global economy (see Pacific Beat— U.S. and Europe Central Banks Announce Major Policy Changes). But monetary policy is facing an uphill battle at home and in Europe as governments implement austerity programs aimed at reducing deficits. In the U.S. the bleak fiscal situation has come to be known as the fiscal cliff. What is the fiscal cliff, and what policy actions might be implemented to avoid a Thelma and Louise moment come January?

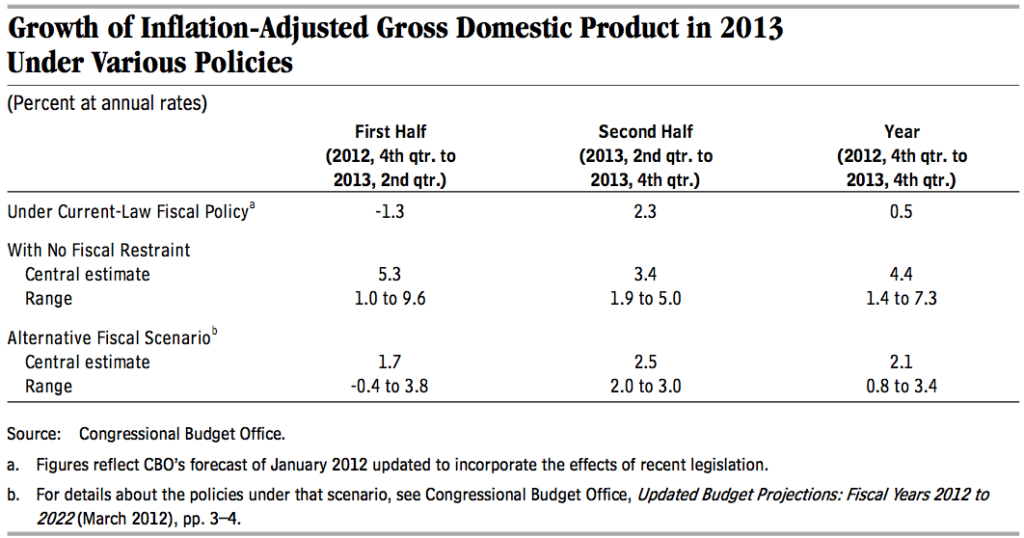

The fiscal cliff refers to the end of a variety of tax provisions plus the start of the sequesters agreed to as part of last year’s debt ceiling compromise. On January 1, 2013, the Bush tax cuts are set to expire for the second time, as are the temporary payroll tax holiday and extended unemployment benefits. According to recent estimates by the Congressional Budget office, the tax increases and spending cuts written into current law will lead to a recession in 2013. The CBO expects the economy “to contract at an annual rate of 1.3 percent in the first half of the year and expand at an annual rate of 2.3 percent in the second half.” The table below shows the CBO’s projections based on current law, i.e. the fiscal cliff, a no fiscal restraint scenario, and an alternative fiscal scenario in between the two.

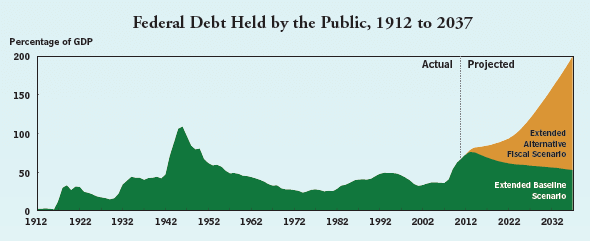

While Congress is unlikely to permit the full brunt of these changes to be felt, election year politics and an uncertain November result will make compromise extremely difficult. But compromise is what is called for to address both the need for short-term restraint in deficit cutting and an honest medium- and long-run plan to cut deficit spending. Unfortunately, if past behavior is any guide to what we can expect from Congress, then federal deficits will remain high and pulling back from the fiscal cliff will be an ugly uncertainty inspiring event. The graph below from the CBO projections shows the impacts on the Federal deficit as a percentage of GDP. The extended baseline scenario assumes all current laws remain unchanged. In other words, we drive right off the fiscal cliff, the US economy goes into recession as detailed in the table above, but deficits as a percentage of GDP decline steadily towards more sustainable levels. In contrast, if you assume that congress not only pulls back from the fiscal cliff (such as another extension of the bush tax cuts) but also fails to make meaningful progress towards long-term deficit reduction, then deficits soar and this extended alternative scenario is downright scary.

Immediately following the election, what is called for is a balanced backing away from the fiscal cliff along with a long-term plan to reduce deficits through a combination of tax increases and spending reductions that are phased in gradually so as not to throw the US economy back into recession. For example, increase revenue through an overhaul of the US tax system that broadens the base and eliminates most deductions and credits, gradually increase the retirement age and raise Medicare copays, and means-test both Medicare and Social Security. The bi-partisan plan released by the Debt Reduction Task Force in November 2010 is a great place to start. In a recent article in the New York Times, Christina Romer suggested that we cut the deficit with compassion by doing so in a way that “does as little harm as possible to people, jobs and economic opportunity.” Dr. Romer will be sharing her knowledge and ideas with us at The UHERO FORUM on Hawaii’s Economy this October 29th, just eight days before the election. I hope you can join us for what promises to be a very interesting event.

– Carl Bonham