By Sumner La Croix

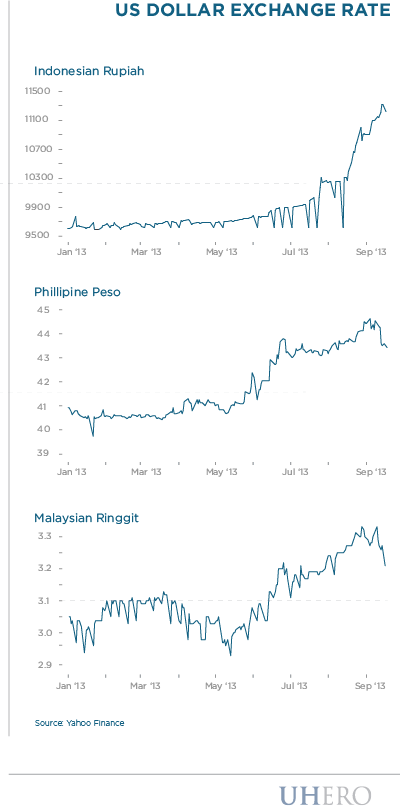

1. The last few months have seen 10-20 percent declines in the exchange rates of many Pacific countries against the US dollar. The decline in the value of Indonesia’s currency has been particularly notable. Why is this happening?

Each country has its own story, but the driving force behind the decline of Indonesia’s currency—the rupiah—stems mostly from anticipated changes in U.S. monetary policy. The US Central Bank—the Federal Reserve System has for the last 4 years been engaged in a huge bond-buying program. This has lowered interest rates in the United States and pushed a lot of liquidity into money markets. Investors, disappointed with the low U.S. interest rates, have moved much of the extra liquidity overseas to emerging markets with higher interest rates.

The surge in short-term investment was one factor that helped emerging economies to boom over the last few years. But investors are now anticipating that the Fed Reserve System will start to wind down its bond-buying program. This has caused interest rates in the U.S. to rise even before the Fed starts to taper its bond-buying program. The rise in U.S. rates has caused investors to unwind their overseas investments in emerging economies, returning their funds home to the safer U.S. market. The movement of funds has led emerging exchange rates to decline against the dollar. This has sparked some fears that Asia-Pacific emerging markets may experience a financial crisis, as firms, individuals, and governments adjust to the lower purchasing power of their currencies.

2. Is a financial crisis likely or are these fears overblown?

Let’s look at both sides of this question. For a crisis to be avoided, Pacific central bankers need to make sure that they don’t make big mistakes in trying to shield their economies from crisis. Other circumstances are also important. Rising oil prices or instability in financial markets due to the political crises in the Middle East could spark a flight to the dollar and push emerging market exchange rates down even further, making the central bankers’ jobs more difficult.

But there are many good reasons to believe that Pacific emerging economies such as Indonesia are in better shape than they were in 1998 when the Asian Financial Crisis hit and that they will be more resilient to the exchange rate shock. Consider that exchange rate systems are more flexible, central banks tend to be better managed than they were in the late 1990s, bank regulation in emerging economies has improved, and emerging countries in the Asia-Pacific region have accumulated much bigger stocks of foreign exchange to buffer their currencies and economies against an outflow of foreign money. All of these factors make it less likely that we will see a financial crisis.

3. What should the United States be doing to minimize the chance of a crisis?

The Federal Reserve System needs to do a good job of winding down its bond purchases at the right time and in a gradual manner. It needs to communicate well with U.S. and international financial markets even as the leadership of the Federal Reserve System changes hands, from Ben Bernanke to his yet unnamed successor.

The bottom line is that with good leadership at both the Fed and at Pacific central banks, a crisis is unlikely. That said, it is a situation that needs to be monitored carefully. Good leadership can never be taken for granted.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.