By Sherilyn Wee

Hawaii leads the nation with the highest per capita installation of solar photovoltaic (PV). High electricity rates—three times the national average, —a generous state tax credit, plummeting PV costs, and net energy metering (NEM) policy have all contributed to the proliferation of PV. Considering future cost savings, PV is an attractive investment, yielding an internal rate of return of 23% with the state tax credit, equivalent to a payback period of four years (Coffman et al., 2016). In a recent analysis I answer the question of how PV is capitalized into a home’s value.

Using econometric tools, I assess the impact of PV systems on home value for single-family resale homes on Oahu. Using home resale and PV building permit data from 2000-2013, I find that PV adds on average 5.4% to the value of a home. This translates to approximately $34,000 relative to the sales price of the median non-PV home of $630,000.

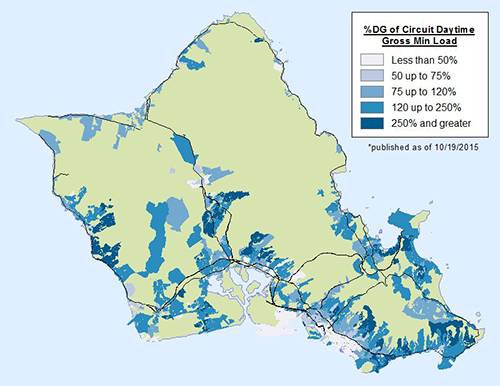

This means that PV already installed on a home is worth about $4,000 more than the median value of a PV permit (approximately $30,000). While this may appear puzzling at first, issues of circuit saturation may well-explain this result. Calculating the stream of electricity savings* over 9 years (the average household tenure) and a typical 30-year mortgage respectively, reveals that a homebuyer is effectively paying $4,000 more for a PV home to receive between $14,000- 30,000 in electricity savings. This makes sense given many of the circuits in Hawaii have reached legal limits for PV installations and therefore new homebuyers have an expectation that future installations will be limited. Thus for many the choice isn’t purchasing a house without PV (and then installing it) but rather to gain access to PV (and future electricity savings).

An area of further inquiry in light of the recent PUC ruling is to extend the dataset to examine whether homes that are grandfathered under the NEM program are worth more.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

Coffman, M., Wee, S., Bonham, C., and Salim, G. (2016). “A Policy Analysis of Hawaii’s Solar Tax Credit Incentive.” Renewable Energy, 85, 1036-1043.

*The net present value calculation assumes a 5% discount rate, electricity price of 30 cents/kWh, a system cost of $4.50/watt (year 2013), 5.2 solar hours per day, 75% efficiency factor, and daily household consumption of 18 kWh.