It was a busy week in Washington as Congress has struggled with potential solutions to the looming US debt ceiling crisis. Two very different plans have floated to the surface. First, the so called Gang of Six has revived a version of the Bowles-Simpson bypartisian deficit reduction plan. They have widespread support in the Senate and from President Obama. The proposal calls for $500 billion in “immediate” deficit reduction and requires future cuts to Social Security, Medicare, and other programs as well as an overhaul and simplification of the tax code. The Gang tells us that over 10 years the plan will stabilize US finances and cut the deficit by nearly $3.7 trillion through a combination of spending cuts of nearly 3 trillion and new tax revenue of roughly 1 trillion.

Unfortunately, nothing in the plan calls for an increase in the debt ceiling, and the plan is a relatively murkey proposal for future cuts to spending and tax overhaul. The clearest part of the plan is the “immediate” cut of $500 billion in spending (presumably spread over a number of years). The sooner those cuts occur, the more they threaten the health of the US economy. And more importantly, even if the Senate passed the plan, the House is highly unlikely to support raising tax revenue.

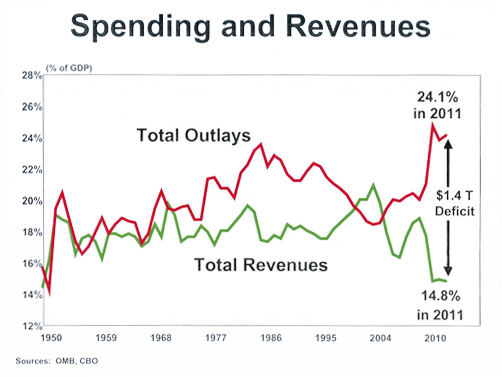

To demonstrate how out of touch the House is with the debt ceiling crisis, on Tuesday members passed their “Cap, Cut and Balance Act” by a vote of 234 to 190. This bill will not allow any increase in the debt ceiling until Congress sends a balanced budget amendment to the states for ratification. It calls for $1.5 trillion in spending cuts this year and would cap federal spending at 24% of GDP. So this bill does nothing to solve the debt ceiling crisis, and has no chance of passing the Senate and being signed by the President.

Unless we see real progress on raising the Debt Ceiling by early next week, we will see increasing signs of financial market distress including increased volatility, and rising cost of insuring against default. My bet is that such signs of distress will result in some stop gap measure (such as the plan put forth by Senate Minority Leader Mitch McConnell) that raises the Debt Ceiling by small amounts under the condition that work proceed on serious long-term deficit reduction plans.