A little more than half way through 2011, Hawaii finds itself facing more economic uncertainty as the EU and US economies deal with slow growth, financial market volatility, and nervous consumers. What a disappointment given the early prospects for a year of strengthening tourism. But early in the year the tourism outlook was tarnished by the Great Tohoku Earthquake and Tsunami which devastated Japan. Even then, the loss of Japanese visitors was not expected to derail Hawaii’s tourism recovery. Unfortunately, there were other problems confronting Tourism in 2011 including a rapidly slowing US economy which has grown by less than one percent during the first half of the year. Other problems include rising energy costs that ate into consumers discretionary spending, contributed to rising airfares and to a drop in consumer confidence. So how has Hawaii’s tourism industry faired in the face of such difficulties?

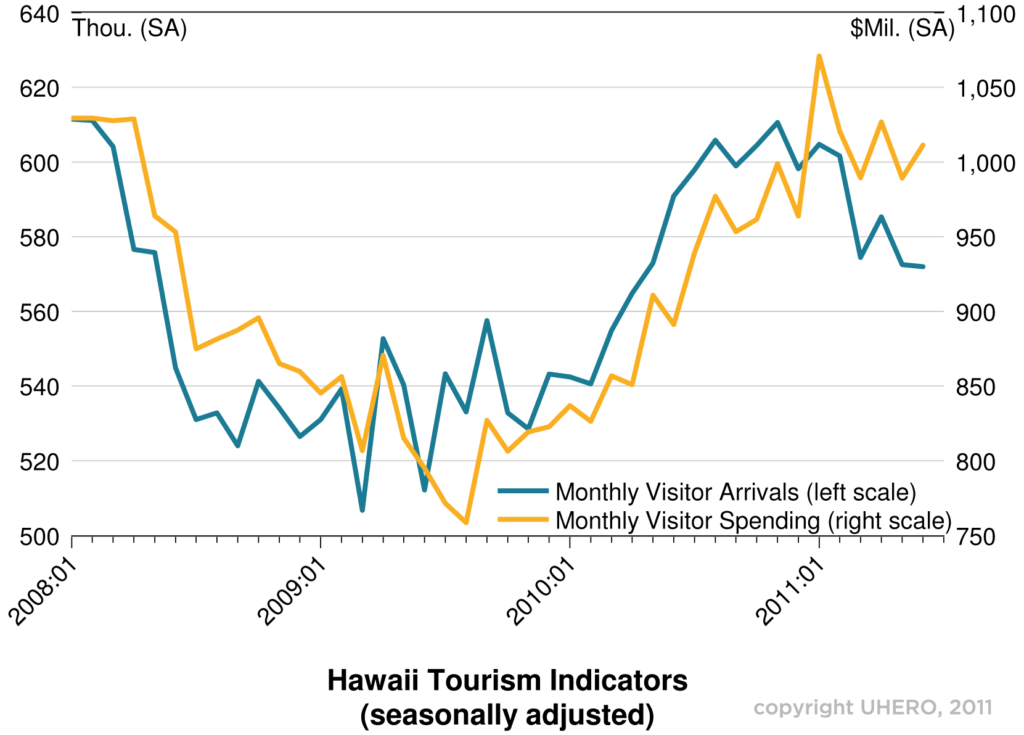

Monthly visitor arrivals peaked at near six hundred and ten thousand visitors in November of 2010 capping a very strong second half when arrivals grew by more than seven percent over the first half of the year (seasonally adjusted). Unfortunately total arrivals to the state have gradually declined since November. For the first six months of 2011 visitor arrivals are almost three percent below the second half of last year. This may come as some surprise as most agencies and news outlets have consistently reported strong year-over-year growth, +4.3 % when compared with the first half of 2010. It is common to report numbers as year-over-year percentage changes when seasonally adjusted month-to-month comparisons are not available. That is why UHERO makes the seasonally adjusted visitor data available on our Data Portal.

As I mentioned above, one of the challenges for Hawaii’s visitor industry has been the rising cost of all of the other goods and services consumers purchase. In particular, the increasing cost of energy, rising airfares, and of course the nearly nine percent increase in the average room rate for Hawaii lodging. With these rising prices, total visitor spending continues to remain fairly steady despite the falling number of visitors month to month. After growing by almost 20% in 2010, spending peaked in January 2011 at $1.71 billion and has been at or near $1 billion per month since then.

Of course the challenges for Hawaii tourism are not going away. In recent weeks we have seen continued anemic US job growth and US consumers cutting their spending significantly in June. The political wrangling and the self induced debt ceiling crisis cannot have helped consumer confidence, and the wild stock market gyrations add to the worries that the US economy is in for a long anemic expansion, or even a second recession. If this uncertainty doesn’t diminish quickly we will see the negative impact on visitor arrivals and spending over the next six months or so. As a result, UHERO will likely lower its forecast when we release our Annual Hawaii Economic Forecast in early September.

There are a few bright spots. Japanese visitor numbers have begun to show signs of recovery—seasonally adjusted Japanese passenger counts were up in both June and July. And scheduled airlift from Japan is up more than 2% for the August-October period. Oil prices have fallen by $30 dollars a barrel in the face of economic weakness, and that will lead to lower gasoline prices and (eventually) some easing in airfares. This week saw the first regularly scheduled flight from China, and APEC will provide a much-needed boost in October and November.

— Carl Bonham

Watch UHERO discuss this topic on KITV’s Project Economy.