By Ashley Hirashima and Carl Bonham

In 2014, while the legislature was debating Senate Bill 2609, which eventually raised Hawaii’s minimum wage from $7.25 to $10.10, we wrote about the growing body of evidence that small minimum wage increases reduce poverty and have little or no adverse effects on employment levels. At the same time, we cautioned that findings of research based on the historically small increases in minimum wage levels might not apply to the much larger increases now being contemplated in Hawaii. Back in 2014, no state or city had even a $10 minimum wage. Since then, ten large cities and seven states have adopted minimum wage policies in the $12 to $15 range.

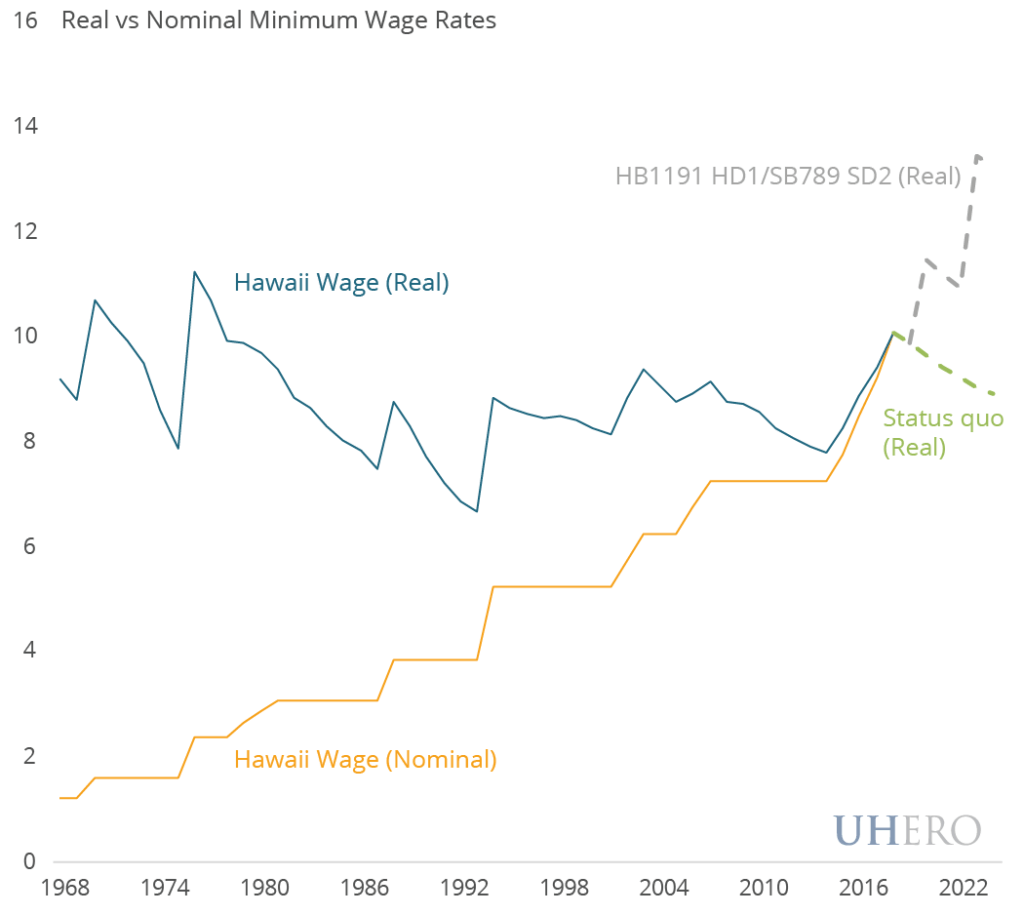

The legislature is currently advancing two bills that would raise Hawaii’s minimum wage. Senate Bill 789 and House Bill 1191 would both increase the minimum from $10.10 today to $12 per hour in January 2020 and $15 per hour in 2023. This blog discusses results from two recent studies that have examined the impact of large minimum wage hikes that states and cities around the country have launched over the past five years. Based on this research, we argue that there is good reason to proceed with caution. While much of the new research continues to find that minimum wage increases to the $10-$15 range may have very small negative employment effects, some studies provide tentative evidence of much larger negative impacts that warrant additional careful analysis.

Economists studying the impact of minimum wage policy changes are inevitably faced with two important challenges. First, we are rarely able to conduct actual experiments. We simply do not observe policy changes that raise the minimum wage for a randomly selected group of workers while leaving a control group unaffected. Instead, they use quasi-experiments where statistical methods are used to identify minimum wage impacts. Much of the debate in the literature has focused on which method is most convincing for accurately identifying the causal effects. In fact, the growing consensus that modest minimum wage increases help reduce poverty and cause little or no negative employment effects was based in large part on the argument that researchers were using better methods for identifying control groups.

A second important problem facing researchers is that we don’t actually observe employment, hourly wages, and hours worked by low-wage workers. To address this second problem, the vast majority of research on the minimum wage has studied total employment and total wages paid in a low-wage industry such as the food service industry. But using total employment and wages paid to an entire industry group means that some of the workers being counted should actually be considered part of the unaffected control group. By lumping all workers in an industry together, we are including workers who are unlikely to be affected directly by minimum wage changes because they were already earning a wage above the new higher minimum wage. In other words, the use of aggregate data may lead to biased estimates of the impact of the policy change. The research we discuss below addresses these problems differently and, unsurprisingly, reaches different conclusions.

Research by Allegretto et al (2018) examines citywide minimum wage policies adopted in Chicago, Washington DC, Oakland, San Francisco, San Jose, and Seattle from 2009 to 2016, where minimum wages were raised to the $10-13 per hour range. They compare data on total employment and average earnings in the food service industry in each city with a minimum wage change (the treatment group) to the employment and average earnings for synthetic controls that closely matched the treated group prior to the policy change 1. Their results are very similar across the cities and for alternative statistical methods. They find that a 10% increase in the minimum wage increases average earnings in the food service industry by 1.3-2.5%, with no significant negative impact on employment. Specifically, for a 10% increase in the minimum wage, they find average employment effects that range from a 0.3% decrease to a 1.1% increase.

Recent analysis by Jardim et al (2018) at the University of Washington focuses on the impact of Seattle’s minimum wage increase from $9.47 to $11 in 2015, then to $13 in 2016. Most minimum wage research uses data on total employment and wages paid to a low wage group most likely to be affected by policy changes, such as teenagers or restaurant workers. In contrast, Jardim et al (2018) use individual-level data on hours worked and employee earnings to compute hourly wages for the entire state of Washington 2. This allows the authors to identify actual individuals who would be affected by minimum wage policies. While Allegretto et al. (2018) calculate average weekly earnings for the food services industry, Jardim et al (2018) study the effect of minimum wage changes on hours worked, since employers may reduce working hours in response to a minimum wage hike. They find that the increase in Seattle’s minimum wage from $9.47 to $11 in 2015 led to reductions in employment or hours that approximately offset the impact of the higher minimum wage on total worker earnings. And, the subsequent increase to $13 led to large reductions in hours for low wage workers of 6-7% that completely offset a 3% rise in the average hourly wages in such jobs. The overall impact was a $74 per month average reduction in the amount paid to workers in low-wage jobs in 2016. So Jardim et. al (2018) not only find evidence of significant and large negative employment effects associated with Seattle’s minimum wage policies, but they also find evidence that the negative effects may increase as the wage floor increases. Bigger minimum wage hikes have larger effects than smaller ones.

Like all minimum wage research, the Seattle study has its shortcomings and its critics. While their data set allows them to study the impact on wages, hours, and employment, because of data limitations they are missing an important segment of Washington state employers: those businesses with multiple locations that only report their unemployment insurance information from a single account/location 3. Such workers represent 29% of employees statewide. While the authors address many of the limitations of their study, these limitations have also been the focus of their critics. Zipperer and Schmitt (2017), for example, are highly critical, arguing that the Seattle study suffers from fatal data and methodological flaws.

All existing studies of the minimum wage suffer from data and methodology shortcomings, so that there remains a great deal of uncertainty about the employment effects of a $15 or higher minimum wage. Clearly, many more workers in Hawaii will be impacted in a move from $10.10 to $15 than the increase from $7.25 to $10.10 over the past four years. And this larger jump will be harder for employers to absorb through adjustments to prices, productivity, and efficiency. The results could be unintended.

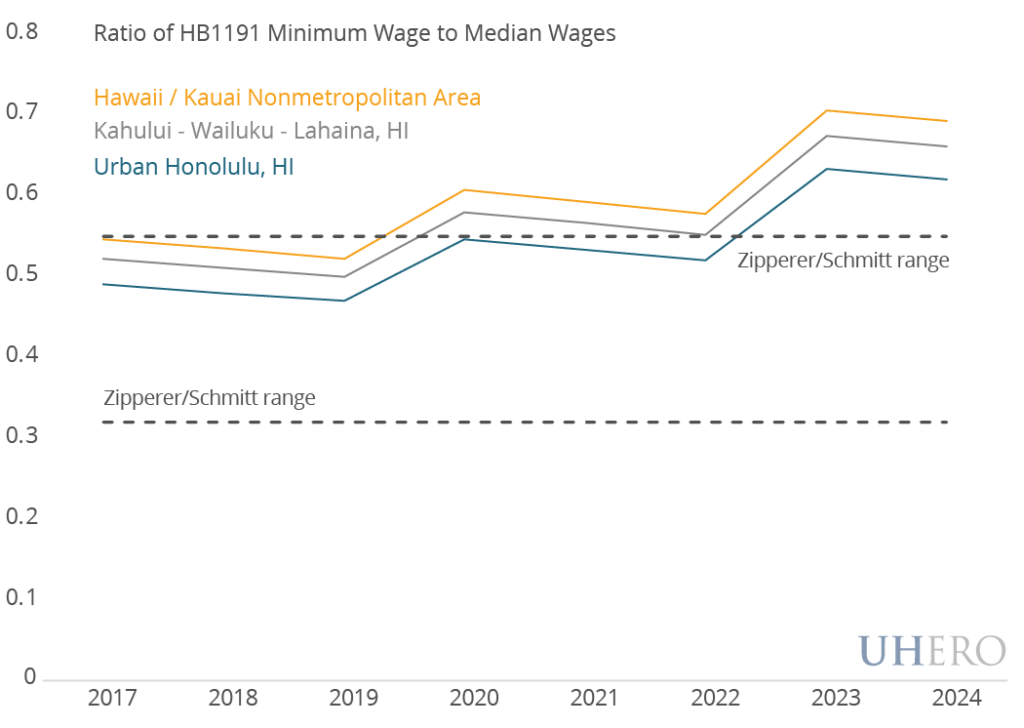

The impact of minimum wage increases may depend in part on how high the minimum wage is relative to the existing median wage in that region, what researchers have dubbed the Kaitz index. Zipperer and Schmitt (2017) argue that studies finding little to no negative impact of minimum wage hikes on employment levels are based on the experience of local areas with Kaitz indices in the 32 to 55% range. They go on to argue that Seattle’s minimum wage increase to $13 left Seattle’s Kaitz index within that range, at 50.7%, and therefore it is unreasonable to expect any negative impact on employment.

How does Hawaii stack up in this respect? The median hourly wage statewide in 2017 was $20.02, so with a minimum wage of $10.10 the Kaitz index for the entire state is 50.4%. At the County level, the 2017 median hourly wage for Hawaii/Kauai was $18.51, while Maui’s median wage was $19.37 and Honolulu’s $20.62. So the Kaitz index in 2017 ranged from 49% for Honolulu to 54.6% for Hawaii/Kauai. The implication is that the statewide minimum wage is highest when applied to Hawaii and Kauai counties where the overall median wage is lower. We calculate Kaitz indices for potential minimum wage increases under HB1191 and assume that the median hourly wage for each county grows at the same rate as UHERO’s county forecasts of average wage growth. The resulting Kaitz indices fall from 2017 to 2019 as the minimum wage remains $10.10 per hour, and the median hourly wages grow. The indices then rise and fall as the minimum is raised sporadically, reaching a high point in 2023 of 70.6% for Hawaii/Kauai, 67.4% for Maui, and 63.4% for Honolulu.

The point we are trying to make is not that the $15 minimum is too high, but that it is well outside the range that has been studied extensively for US minimum wage changes over the past 25 years. This, along with the changing Hawaii economic landscape with rising unemployment, falling employment, and dramatically slowing job growth all suggest that a cautious and possibly more gradual approach may be called for. At least until we have a more comprehensive view from the economic literature about the impacts of large minimum wage hikes.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

[1] They use synthetic controls in addition to the more common nearby communities controls. Synthetic controls use algorithms to select data from a large number of locations that did not experience similar minimum wage changes but share similar characteristics necessary to identify the causal impact of new minimum wage rules in the treated economy.

[2] Washington is one of only four states that, as part of the administration of unemployment insurance, collects data on both employee quarterly earnings and hours worked.

[3] Their analysis relies on geographic identification of employers at the Unemployment Insurance account level, so they are only able to include employers that operate from a single location, or multi-site firms that choose to establish UI accounts from each location.