BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

By: Steven Bond-Smith and Sumit Ilamkar

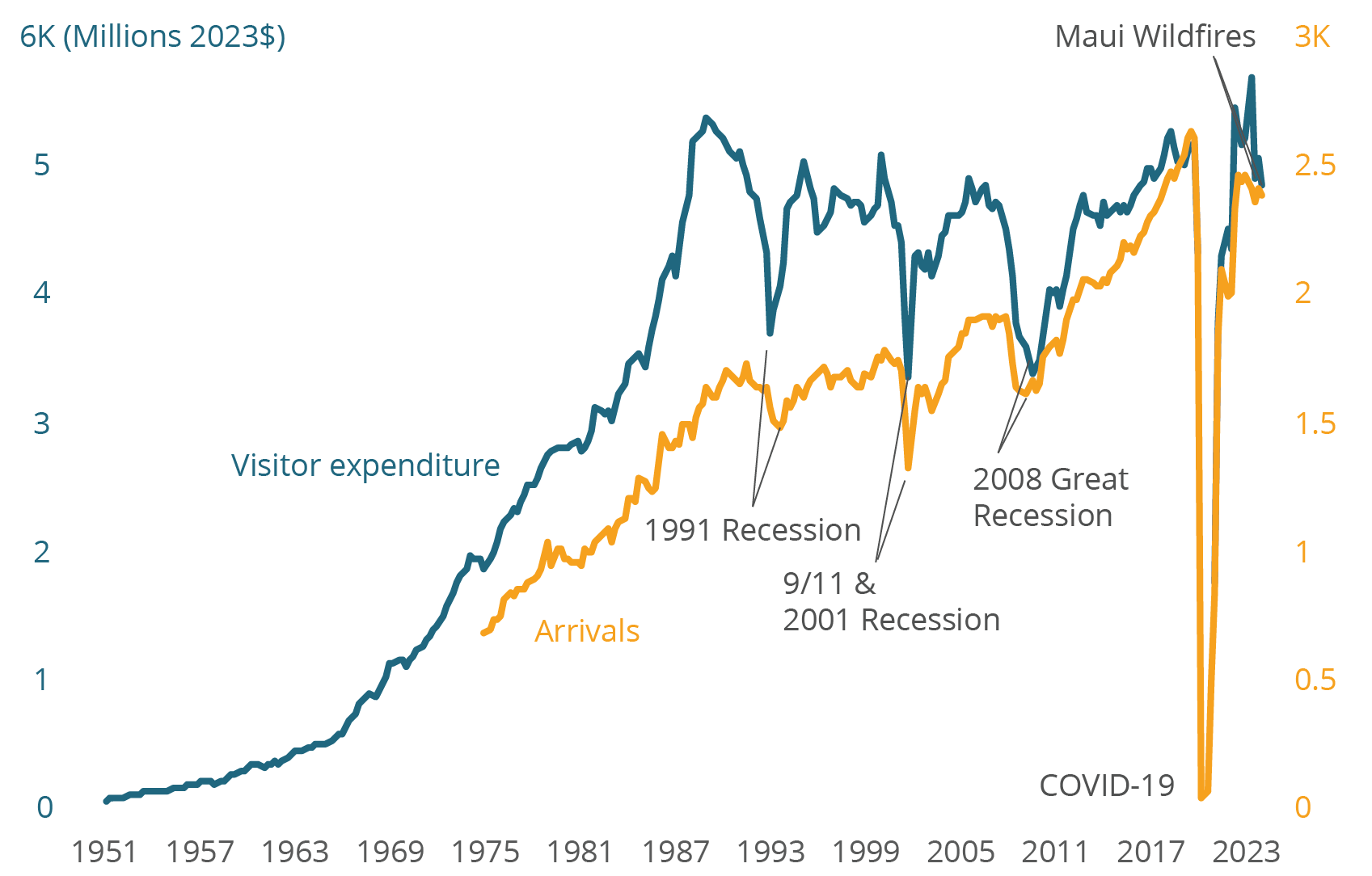

The economy of Hawaiʻi is extraordinarily concentrated in the tourism industry. As a result of tourism’s dominance, Hawaiʻi’s economy faces short-term risks from shocks that impact visitor numbers and long-term stagnation from flat and volatile tourism spending over the last three decades. In response to these issues—which became especially salient during the COVID-19 pandemic—policymakers in Hawaiʻi increasingly emphasize the need to diversify. Still, it is not clear which industries Hawaiʻi could diversify into.

To consider this question, we analyzed the locations of industries across the US and the industries in Hawai‘i’s counties to identify potential opportunities to diversify. The information in this report will be useful for policymakers seeking advice for economic development policy and for businesses and entrepreneurs seeking new opportunities. It also presents Hawai‘i as a case study of an approach that will be useful for other places looking to diversify. There are three main questions addressed in this report:

What is the case for diversifying the Hawaiʻi economy?

Specializing is natural for a small open economy. Small and isolated economies are less able to access the productivity benefits of external increasing returns to scale. External increasing returns describe how the productivity of firms can increase with the size of something external to the firm such as a market, city, or industry. Small, open, and isolated places tend to become more specialized because it creates a local external scale—the scale of their industry specialization—that offers similar productivity advantages. Specialization initially generates growth due to external scale economies. But if various developmental barriers have prevented some industries from emerging, then Hawai‘i could be over-specialized. Specialization generates both short and long-term risks due to greater exposure to a single industry.

With this theoretical basis, we show how Hawaiʻi initially benefited from specializing in the tourism industry and how this specialization now exposes Hawaiʻi to short and long-term risks. These risks are especially apparent when we examine how total visitor spending has been relatively flat for decades, punctured by periodic crises. In this way, diversification is not an end in itself but aims to build a more resilient economy that is less exposed to the short- and long-term risks that to some extent can be expected in a small and open economy like Hawai‘i.

Figure 1: Quarterly real visitor spending (2023 $) Q1 1951 to Q1 2024 and quarterly tourist arrivals Q1 1975 to Q1 2024

What are the opportunities for diversifying Hawai’i’s economy?

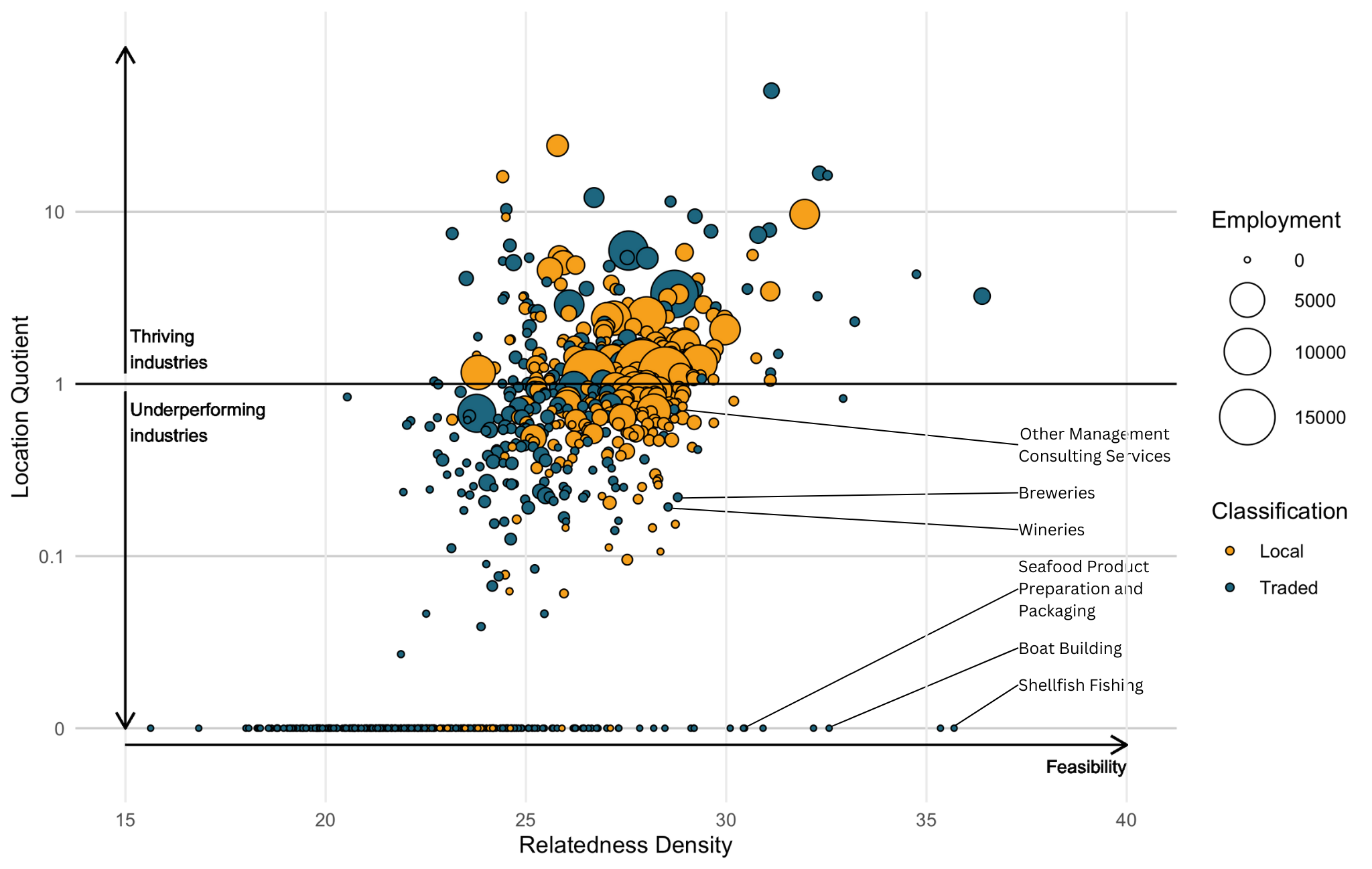

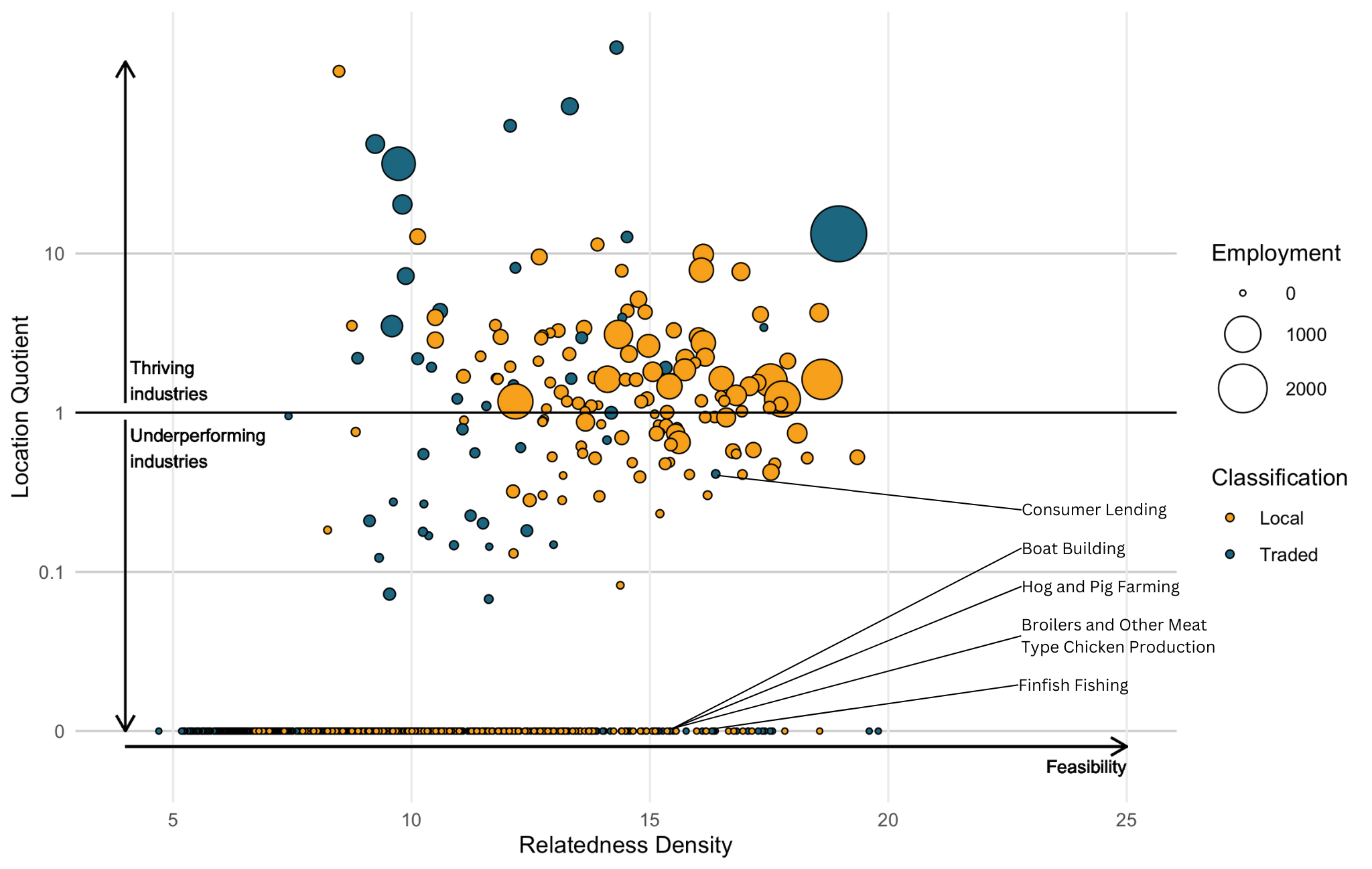

To find diversification opportunities we apply the Principle of Relatedness (Hidalgo et. al., 2018), which predicts regional diversification patterns and informs prioritization of economic development initiatives. We studied the industrial composition of all counties in the US to measure relatedness between industries. Two industries are described as related because they probably require similar conditions if they appear together frequently. With this understanding of the relationships between industries in US counties, we examine the industrial composition of Hawaiʻi’s counties to identify underperforming industries with a higher probability of being stronger because they are related to existing strengths.

Figures 2 and 3 show how related each industry is to the existing industries in Honolulu and Kaua‘i and the relative scale of each industry. Charts for Maui and Hawai‘i Island can be found in the report. Location quotient measures the local relative size of an industry. A LQ of one implies that a county has the same share of employment in that industry as the country overall. The diversification opportunities are industries that are more related to existing industries—meaning the county is more likely to have all the necessary capabilities—but are relatively small. Several opportunities are related to the ocean. These ocean-based industries include Finfish Fishing, Shellfish Fishing, Boat Building, Port and Harbor Operations, Finfish Farming and Hatcheries, and Seafood Preparation and Packaging. These all seem logical diversification options given Hawaiʻi’s location in the Pacific Ocean providing the necessary natural resource. Industries are also more likely to remain in the long term if they rely on local resources.

Figure 2: Example—Identifying diversification opportunities in Honolulu

Figure 3: Example—Identifying diversification opportunities on Kaua‘i

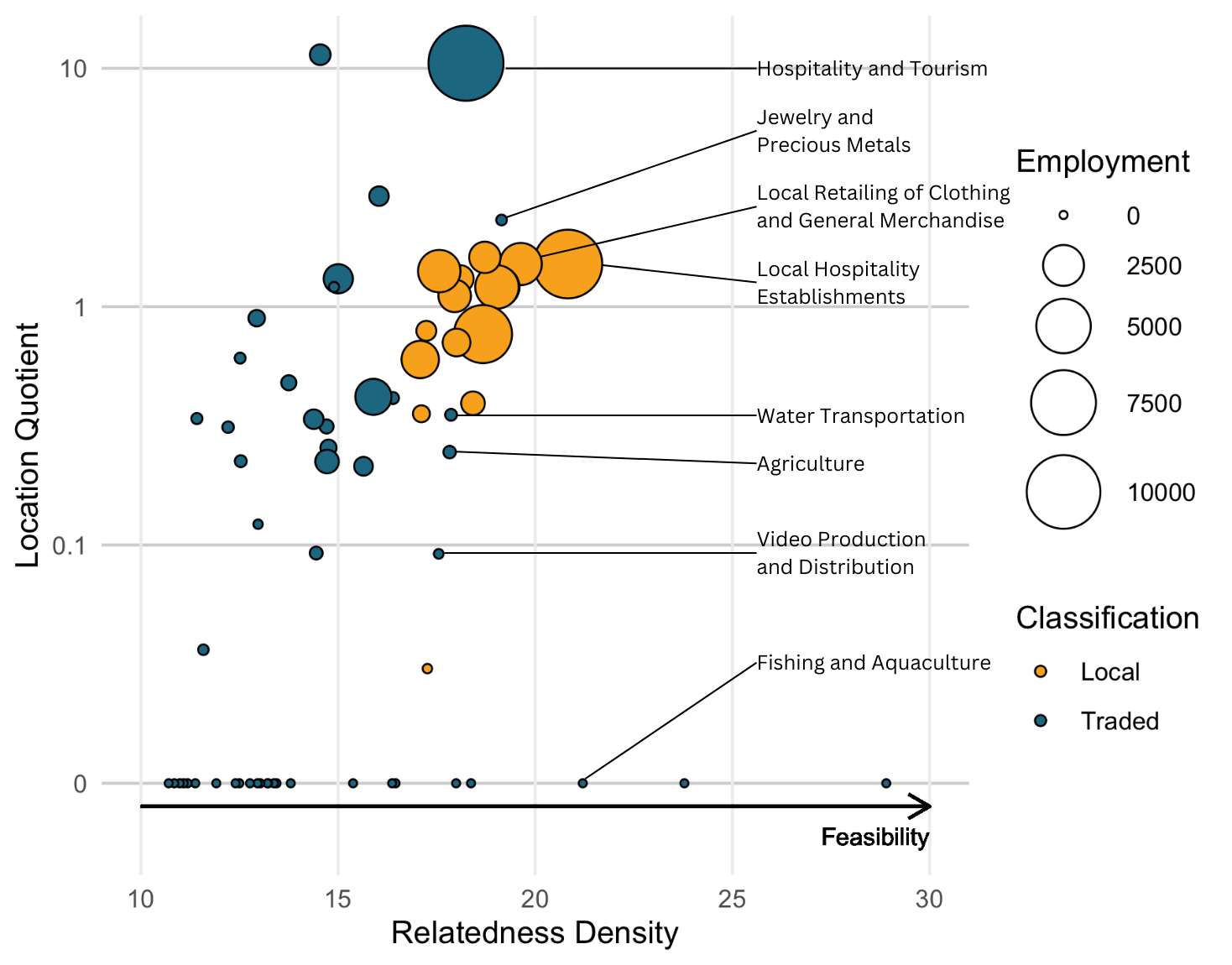

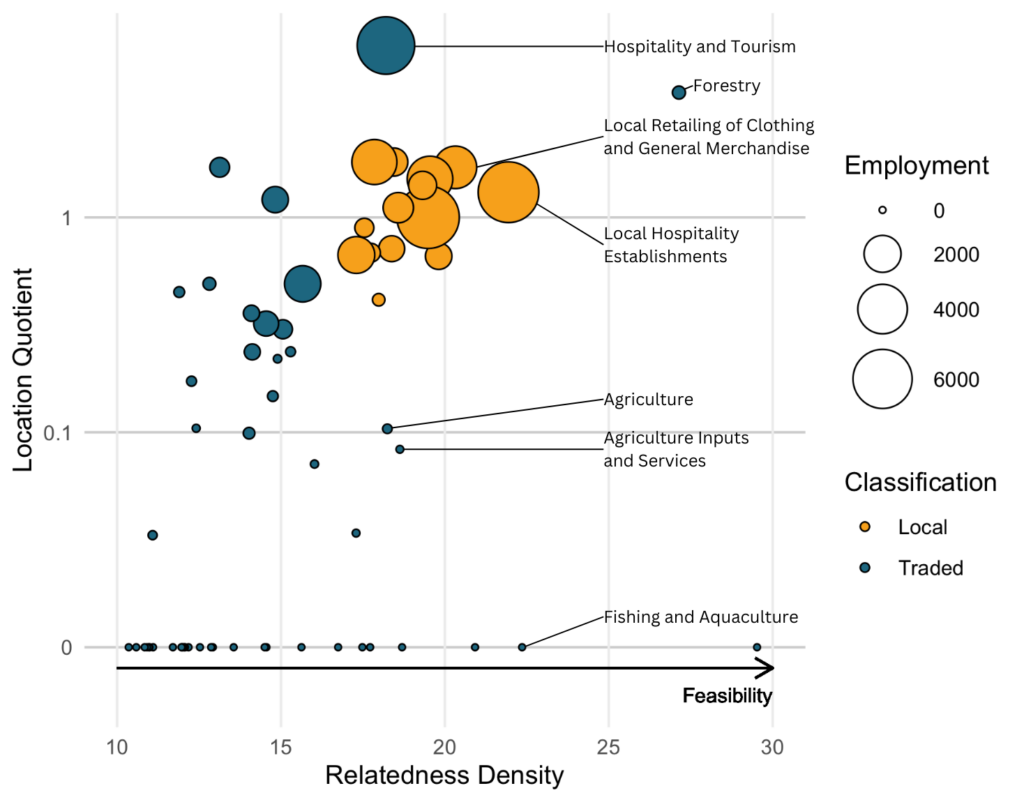

The results also offer the opportunity to prioritize the clusters that are related to Hawaiʻi’s industries, which would support diversification both within clusters and beyond. Clusters are firms and industries that benefit from locating close to one another through factors like labor market pooling, knowledge spillovers and supply-chain linkages. By using relatedness density to prioritize clusters, a regional economic development strategy can focus on the clusters that are likely to have greater potential to support both current economic strengths and diversification opportunities. Figures 4 and 5 show how related each cluster is to existing industries in Maui and Hawaiʻi Island respectively and their relative scale. Charts for Honolulu and Kaua‘i can be found in the report. Relatedness density is the only criteria used for prioritizing clusters as each cluster includes both existing strengths and diversification opportunities.

Perhaps most notable of all, the Fishing and Aquaculture cluster stands out with a higher relatedness density also across all four counties. As expected, the two hospitality clusters of Local Hospitality Establishments and Hospitality and Tourism feature in all four counties, both serving tourists. A Water Transportation cluster features strongly in Honolulu, and moderately on Maui. And a Video Production and Distribution cluster features moderately in Honolulu but is also an option for Maui and could be relevant on the Big Island and Kaua‘i. Interestingly, this modern analysis of industrial location reflects in part what is already known to Kanaka Maoli, given Hawaiʻi’s history of Polynesian ocean-faring and fishponds.

Figure 4: Example—Prioritizing Clusters for Diversifying Maui County

Figure 5: Example—Prioritizing Clusters for Diversifying Hawaiʻi Island

What is the appropriate policy response?

The results highlight the difficulty of diversifying. Many of the related industries on O‘ahu are already thriving. And the Neighbor islands are more specialized in tourism, so have fewer branching opportunities. While related industries are expected to be more feasible, the weakness of the identified related industries indicates that they face developmental bottlenecks. Indeed, it is not surprising that the industries identified have a history of various start-up attempts and failures. It seems that these are industries that have potential but consistently fail because various developmental barriers exist such as infrastructure requirements, market failures, or government failures. Policies that address those bottlenecks would allow market discovery processes to support a more diversified economy.

Rather than an economic development policy that focuses on sectors that are already growing, policy efforts to diversify will be more productive if they target industries facing challenges that have not yet been adequately addressed. This is a new and ambitious approach because it targets the barriers to diversification, rather than targeting industries that are already showing signs of growth. Industries can be disregarded if those barriers are too difficult to address. But for many industries, there may be a role for cost-effective policies to address the developmental bottlenecks that are constraining those industries, enabling the market discovery process to diversify the economy.

Economists are cautious of policies that “pick winners” because the market combines private information, so any selection by policy-makers is unlikely to contain as much information as the market. But, our study is not intended to “pick winners”. Rather, the principle of relatedness reveals additional information about Hawaiʻi’s economy from market outcomes across the US—information that the market could not incorporate on its own. So, it can be used to prioritize initiatives where there may be developmental bottlenecks constraining these industries. Nonetheless, policymakers do not usually have the deep industry knowledge required to identify and address industry-specific bottlenecks. Instead, policies can be designed to reveal industry bottlenecks from private information and evaluated, in part, by the results of our study. Policies that address general or common bottlenecks are also likely to improve efficiency and support diversification. Ongoing monitoring and governance are required for policies to be effective.

The information in this report will be useful for Hawaiʻi policymakers seeking advice for economic development policy and businesses and entrepreneurs seeking new opportunities. It also presents Hawaiʻi as a case study of an approach that will be useful for other places looking for strategies to diversify.