The US housing market turned the corner in 2012 and is set for healthy expansion for the next several years. This according to economists at the annual policy conference of the National Association for Business Economics meeting in Washington last week. Median single family resale prices rose 6-10% last year, depending on the measure one uses, and similar or stronger price gains should be seen going forward.

Economists in a session on The Landscape for Housing Recovery described how conditions have emerged that are now very supportive of home prices and renewed building. On the supply side, the virtual disappearance of new home building during the recession has left a dearth of new home inventory. Foreclosure activity has declined substantially, helping to pull down resale inventory. On the demand side, past price declines and low interest rates have raised affordability to high levels. Improving economic conditions will free up some latent demand from young people who have doubled-up with parents during recent years. Demographic factors are also favorable to household formation, at least in the near term.

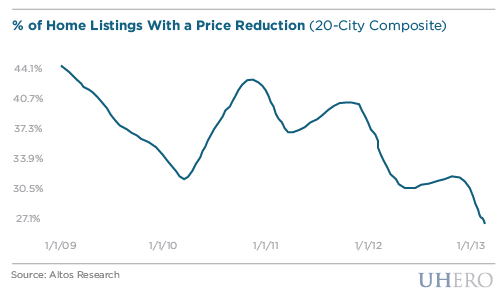

Rapidly improving home price conditions are most evident in active market statistics. According to Mike Simonsen of Altos Research, the percentage of homes that have had to take price reductions from initial listing prices has declined considerably since 2011. And the prices of new listings are up strongly year-on-year. This is important since according to Simonsen listing prices are highly correlated with actual contract prices several months down the road.

These conditions led industry economists on the NABE panel to project sustained home price gains in the high single digit to low double-digit range, depending on the forecaster. And new home building will pick up strongly, although well off the torrid pace of the pre- recession period. This will provide important support for the US recovery and, through property taxes, to struggling states and municipalities.

Many of the same factors at work in the national economy are also in play here in the islands. Stay tuned for our Hawaii construction forecast coming up soon!

– Byron Gangnes