BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

By Rachel Inafuku and Justin Tyndall

Of the state’s 565,000 total housing units, 30,000 are listed as Short-term Vacation Rentals (STRs), meaning roughly 5% of local housing units operate as tourist accommodations. In a tight housing market with high prices and barriers to creating new supply, removing supply from the long-term housing market could harm residents by raising housing costs. However, we don’t know exactly how much STRs impact rents and home prices.

The founding of Airbnb in 2008 made it possible to convert housing stock into visitor accommodations with minimal effort and cost. In subsequent years, many other online platforms began offering similar services to facilitate STRs. The impact of these services on the housing market has been a topic of concern for many cities, particularly tourist destinations with high housing costs. With the highest housing costs in the nation, Hawaii fits that description.

To track the use of STRs in Hawaii, the Hawaii Tourism Authority (HTA) commissioned the collection of data on all major STR providers in the state. As shown in the maps below, STRs have a significant presence in almost every neighborhood in the state, despite being prohibited in several jurisdictions. The maps display STRs available for at least one night during February of 2023, as a share of the area’s total housing stock. While STRs are present almost everywhere, STRs have a much higher concentration in tourist centers, such as Waikiki and West Maui.

The maps display data by census tract. The color of each tract shows the number of STR platform listings in February of 2023 divided by the number of local housing units according to the 2021 American Community Survey.

The current prevalence of STRs has been fairly constant since 2019, as shown in the graph below. In the summer of 2019, Oahu increased penalties for operating an STR outside of designated resort zones, which resulted in a notable dip in listings. Despite evolving STR policies across counties, the stock of operating STRs in the state remains high.

The total number of STR listings over time are shown.

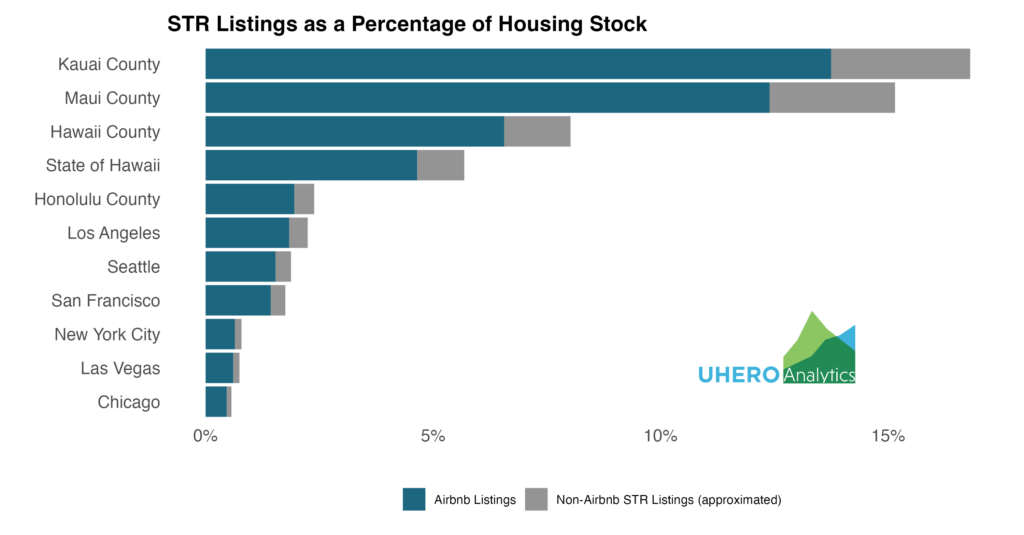

Comparing STR prevalence in Hawaii to other jurisdictions can give an idea of the scope of the issue. While we do not have national data across all STR platforms, we do have national data on Airbnb listings specifically. In Hawaii, 82% of STRs are posted on Airbnb (although many are cross-posted on other platforms, which we control for to avoid double counting).

Comparing Airbnb listings specifically can therefore provide a useful point of comparison. US cities that have been particularly concerned with the rise of STRs include San Francisco, where 1.4% of housing units are Airbnbs, New York City (0.6%), and Las Vegas (0.6%). In Hawaii, the situation is relatively extreme. The share of the state’s housing stock posted on Airbnb is 4.7%, more than three times higher than San Francisco and more than seven times higher than New York City. On the Neighbor Islands, the rates are higher still. Maui County has 12% of all housing units listed on Airbnb and on Kauai the figure is 14%. In the graph below, we provide an estimate of the full STR counts across jurisdictions by assuming that Airbnb’s market share in other cities is the same as it is within Hawaii.

Because STRs in Hawaii comprise a large share of total housing, especially in certain areas, STRs have the potential to wield significant influence on local rents and home prices. Each STR represents a housing unit that could otherwise be part of the local supply of permanent housing, exacerbating the state’s current housing shortage. While many factors contribute to high housing costs, the economic logic linking STRs to increases in the cost of housing is fairly unequivocal: diverting units from the pool of long-term housing reduces long-term housing supply and pushes up rents and home prices. The direction of the price effect is clear, it is the size of the impact that is difficult to estimate.

Supply and Demand Graph of Housing

Using findings from peer-reviewed studies that estimated the effects of STRs on home prices in other cities, we can estimate the likely housing cost impact of STRs in Hawaii. A Barcelona study comparing STR activity near and far from tourist attractions found that adding 50 STRs to a neighborhood increased rents by 2% and home prices by 5%, with larger effects in the most touristy areas. A study from Los Angeles looking at an STR policy change showed that reducing Airbnbs by 50% led to a 2% reduction in home prices and rents. A study of London found that a doubling of the Airbnb stock led to an 8% increase in rents.

By borrowing findings from the Los Angeles, Barcelona, and London studies, we provide estimates of the effect STRs have had on local rents and home prices on Oahu. The prevalence of STRs on Oahu (2.4% of housing units) is not dramatically different from that of LA (0.9%), Barcelona (2.6%), and London (3.0%), when those cities were studied. However, the share of STRs on the Neighbor Islands is significantly larger than in any of the study areas, making them much less comparable. Therefore, we only apply the estimates from prior studies to Honolulu County.

To estimate the effect of STRs on home prices and rents, we apply findings from the previous studies, but linearly scale their results to match the STR prevalence on Oahu. In the figures below, we estimate the level that median home prices and rents would be on Oahu if STRs were completely eliminated. This is a somewhat more extreme policy than has been considered. However, as of February, 73% of STR units on Oahu were operating outside of designated resort zones.

Looking at median home prices, estimates from the LA and Barcelona studies imply that, in the absence of all STRs, prices on Oahu would be 4-6% lower than they are currently. The median sale price across all housing units on Oahu (house or condominium) in 2022 was $860,000. Based on the estimated price effects from these studies, removing all STRs would push the median price down to the $810-$820,000 range. As for rents, there is a slightly wider range of estimates. The LA study implies that eliminating all STRs would decrease Oahu’s rents by 2%. Estimates from Barcelona suggest a 6% drop and estimates from London suggest an 8% drop. The median rent paid on Oahu is currently $1,880. According to prior studies, removing all STRs could lower the median monthly rent by anywhere from $35 to $160.

While Honolulu County’s STR prevalence is not dramatically different from the other study areas, other characteristics of Hawaii’s housing market are significantly different. Using the findings provided by prior research can provide only rough estimates of the possible magnitude of STRs’ impact on home prices and rents. The accuracy of estimates relies on the assumptions underlying the prior studies, as well as our assumption that the housing market on Oahu would behave comparably to changes in STRs.

The first bar shows the actual median home price on Oahu, the subsequent bars show an estimate of what home prices would be if all STRs were eliminated. The London study focussed only on rents rather than home prices and is therefore not shown.

The first bar shows the actual median monthly rent on Oahu, the subsequent bars show an estimate of what rents would be if all STRs were eliminated.

Whether the estimated price effects should be considered small or large is a matter of interpretation. If these price reductions were realized, Oahu would still suffer from extremely high home prices. Oahu’s median home price would still exceed the median price of any state in the US. However, the roughly 5% reduction in housing costs would represent a sizable improvement in the standard of living for renters and first-time home buyers, particularly lower-income residents for whom housing costs represent a large share of overall expenses.

There is evidence from other markets that STRs increase both home prices and rents. In Hawaii, STRs play a truly outsized role in the housing market compared to other locations. While far from a silver bullet to address the state’s housing shortage, the scale of the market suggests that changes to the regulatory environment around STRs would have significant consequences for the housing market.

The authors would like to thank India Alford for her valuable research assistance on this project.

Funded by the Coronavirus State Fiscal Recovery Fund: Data Infrastructure and Analysis for Health and Housing Program and Policy Design – Response to Systemic Economic and Health Challenges Exacerbated by COVID-19 (State of Hawai‘i award number 41895)

References

Koster, H. R., Van Ommeren, J., & Volkhausen, N. (2021). Short-term rentals and the housing market: Quasi-experimental evidence from Airbnb in Los Angeles. Journal of Urban Economics, 124, 103356.

Garcia-López, M. À., Jofre-Monseny, J., Martínez-Mazza, R., & Segú, M. (2020). Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona. Journal of Urban Economics, 119, 103278.

Shabrina, Z., Arcaute, E., & Batty, M. (2022). Airbnb and its potential impact on the London housing market. Urban Studies, 59(1), 197-221.