By Timothy Halliday and Randall Q Akee

The Compacts of Free Association (COFA) are treaties between the United States (US) and three Micronesian nations: the Republic of Palau, the Republic of the Marshall Islands, and the Federated States of Micronesia. Collectively, citizens of these nations are often referred to as “Micronesians.” COFA guarantees Micronesians free entry into the United States, the ability to work, and access to health care. Because of these provisions, many citizens of these nations have immigrated to the United States. Most COFA migrants reside in Hawai‘i and Arkansas. Currently, Hawai‘i is estimated to have about 28,000 COFA migrants. While precise motives for migration vary, economic considerations and threats from climate change throughout Micronesia provide strong incentives to leave COFA nations to come to the US. In addition, many citizens of COFA nations come to the US due to the lack of adequate health care in Micronesia.

Prior to 1996, COFA migrants in the US were eligible to obtain health insurance from the federal Medicaid program. However, welfare reform in 1996 made this group ineligible for federal funds through Medicaid. Note that Medicaid reform provided provisions for many immigrants to be eligible for Medicaid after residing for five years in good standing in US. However, because most COFA migrants are not classified as immigrants, but as “non-qualified aliens,” this provision did not apply to them. Hence, on one hand, COFA guaranteed this population access to health care in the US, but on the other hand, the 1996 welfare reform prohibited COFA migrants from obtaining it from the federal government.

Despite the lack of federal Medicaid financing for COFA migrants, the State of Hawai‘i continued to provide coverage via state-funded health insurance in various forms for many low income COFA migrants, including through a state Medicaid plan provided by the State of Hawai‘i Medicaid agency (called Med-QUEST). Due to a court ruling in April of 2014, however, state Medicaid coverage for this population was suspended 1. As a consequence, most non-disabled, non-infant, non-pregnant, and low income COFA migrants were ultimately denied access to traditional Medicaid benefits in March of 2015. Instead, they were asked to obtain private health insurance through the health care exchanges set up under the Affordable Care Act.

There are several reasons to suspect that this move from Medicaid to private insurance might have reduced the use of medical services. First, take-up rates of insurance may have declined as a consequence of the transition which may, in turn, have reduced the use of medical services. For example, enrollment in private insurance in the exchanges is notably more complicated than enrollment in the State’s Medicaid program. Medicaid has a year-round enrollment period, whereas the enrollment period on the exchanges is only six weeks. In addition, COFA migrants must first apply for Medicaid and get rejected before they can apply for insurance on the exchanges which are also not translated into COFA languages (Hofschneider 2019). Second, cost-sharing is minimal on Medicaid, whereas most private plans have co-payments and co-insurance which can be prohibitive for poorer migrants. While the premiums for this population were covered by Medicaid, payment processes and expectations can still be complex to understand and navigate, particularly, for this population.

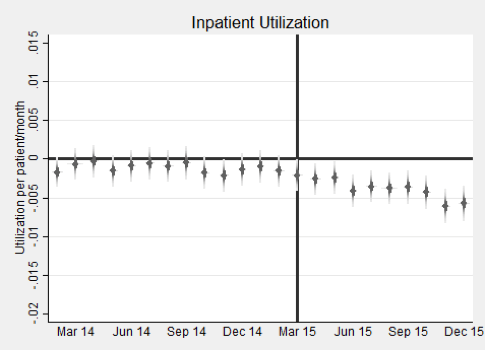

In a recent UHERO working paper titled, “The Impact of Public Health Insurance on Medical Utilization in a Vulnerable Population: Evidence from COFA Migrants,” we investigate the effect of the expiration of Medicaid benefits on medical utilization among COFA migrants. We show that there was a sharp reduction in the number of emergency and in-patient medical care admissions charged to the State’s Medicaid program after the expiration of benefits for COFA migrants relative to the non-Hispanic white and Japanese populations in Hawai‘i. In particular, Medicaid-funded ER visits and inpatient admissions declined by 69% and 42%, respectively. This sharp reduction in utilization is consistent with other studies that have investigated the impact of the expiration of Medicaid benefits such as studies on Tennessee after it discontinued Medicaid benefits (see DeLeire 2018, Tarazi 2017, Tello-Trillo 2016). At the same time, there was a substantial increase in the number of emergency room (ER) visits and inpatient admissions charged to private payers, indicating that there was a move towards private insurance among COFA migrants after Medicaid benefits expired. However, the magnitude of this increase was smaller than the reduction in Medicaid-funded utilizations. As a result, net inpatient admissions and emergency visits declined.

These findings can clearly be seen in Figure 1. The figure shows the utilization of COFA migrants in Hawai‘i relative to our control groups for each month between January 2014 and December 2015 for both inpatient and ER utilization. The vertical line corresponds to the official expiration date of March 2015. The left panel shows a net decline of inpatient utilization after the expiration date but no relative impact prior to the official expiration date. In the jargon of the empirical microeconomics literature, this means that there were no pre-trends which is a precondition for valid causal inference. Note that these utilizations could have been charged to any payer and so they include those charged to both private and public insurers. The right panel shows that there was also a dramatic decline in emergency room (ER) visits charged to any payer. By-and-large, this decline took place after the official expiration date. However, and in contrast to inpatient utilization, we do see that the downward trend in utilization pre-dated the official expiration date. This implies that the actual treatment effect is greater than what we have estimated. While it is not entirely clear why the decline in ER utilization pre-dated March 2015, we suspect that the confusion surrounding the policy may have led many providers to believe that COFA migrants could be not enrolled in Medicaid even while they were still eligible.

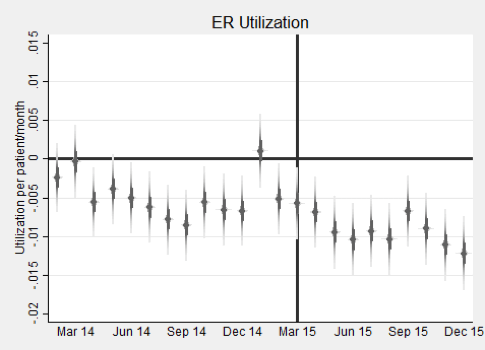

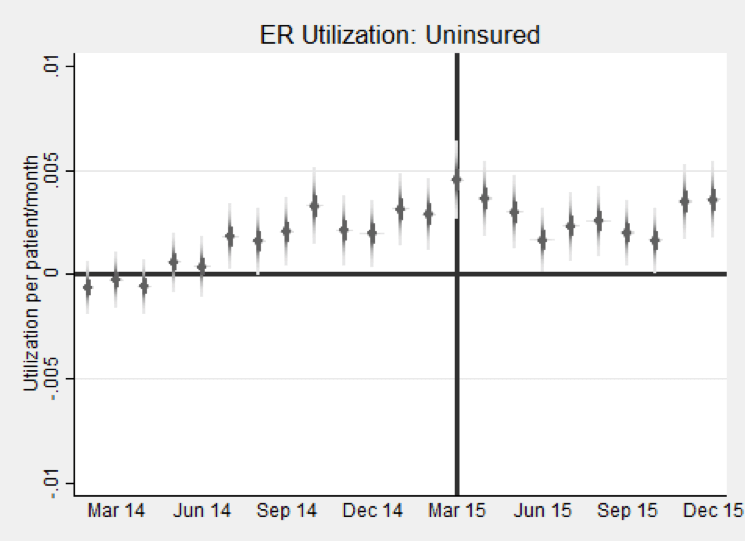

This confusion can be seen by a commensurate run-up in uninsured visits to the ER by COFA migrants after and just prior to the expiration of benefits. This is shown in Figure 2 which displays uninsured ER visits of COFA migrants relative to our control groups in each month during 2014-15. First, this figure shows an increase in uninsured ER visits after the expiration of Medicaid benefits. This indicates that, in the immediate aftermath of the expiration of benefits, many COFA migrants were not enrolled in private insurance plans. Second, the figure also shows that the ramp-up in ER visits pre-dated March 2015, which is a period when COFA migrants should have been enrolled in the State’s Medicaid plan. Typical practice at most hospitals with emergency rooms is to support the enrollment of eligible, uninsured patients into Medicaid; this guarantees that the hospital will get paid for the visit. That we do not see this in the period just prior to the expiration date indicates a rigidity preventing this from happening 2.

This implies that the reduction in insured COFA migrants’ ER visits was offset by an increase in the number of uninsured visits to ER. The corresponding increase in uninsured ER visits was about one-third of the decline in Medicaid funded ER visits. These were visits that ostensibly should have been covered by private insurers.

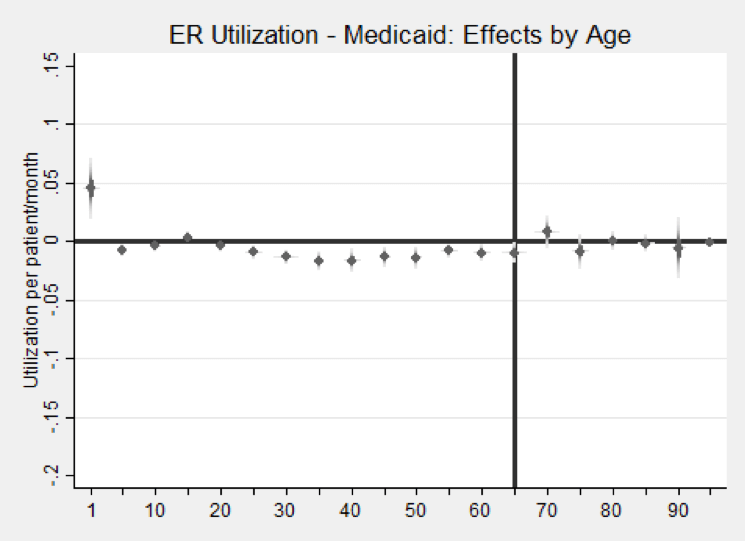

Another important result from our study is that the expiration of Medicaid benefits appears to have increased ER visits of Micronesian infants that were funded by Medicaid. This can be seen in Figure 3 where we show the effects of the transition from Medicaid by age on Medicaid-funded ER visits. We break the treatment effects down by age into five year age bins, except we used a separate category for infants. The figure shows that Medicaid-funded ER visits declined for most ages under 65 except for infants who experienced a dramatic increase. While the hospital data that we use makes it hard to pin down the precise mechanism, we suspect that the expiration of benefits for most COFA migrants may have led many to believe that their newborns were also not covered by Medicaid contrary to fact (infants remained eligible for Medicaid after March 2015). This may have led to a decline in ambulatory care for newborns that was made up for by an increased use of the ER for Micronesian infants.

In some sense, this can be viewed as a reverse woodworking effect. Benefits expired for a large swath of the Micronesian population in Hawai‘i. Many COFA migrants were actually still covered by the State’s Children’s Health Insurance Program (CHIP) program. However, it appears as if the salience of the expiration of benefits for the majority of migrants led many eligible migrants to believe that they were not covered. In a similar vein, but in the opposite direction, Frean, et al. (2017) found that the expansion of Medicaid under the ACA increased enrollment in Medicaid among people who were previously eligible for Medicaid benefits.

Our findings indicate that medical utilization declined for COFA migrants after Medicaid benefits expired. This could be good or bad. It could be good if the transition to private insurance increased the use of preventative services that reduced the need for ER visits and hospitalizations. However, many aspects of our analysis are not consistent with this story. Notably, the increase in uninsured ER visits after and just-prior to the expiration of benefits is not consistent with increased prevention. It also indicates low take-up rates of private insurance which is a pre-condition for better use of preventative care. In addition, the increase in ER visits by Micronesian infants after benefits expired appears to be consistent with a substitution of ER visits for ambulatory care, which is also not consistent with increased prevention. Our interpretation of our findings then is that the decline in utilization is probably not a reflection of increased prevention. We suspect that it is a reflection of low take-up of private insurance and the effects of costs sharing on utilization. This most likely reflects a decline in needed care.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

References

DeLeire, T. (2018). The Effect of Disenrollment from Medicaid on Employment, Insurance Coverage, Health and Health Care Utilization (No. w24899). National Bureau of Economic Research.

Frean, M., Gruber, J., and Sommers, B. D. (2017). Premium subsidies, the mandate, and Medicaid expansion: Coverage effects of the Affordable Care Act. Journal of Health Economics, 53, 72-86.

Hofschneider, A, “Micronesians in Hawaii Still Struggle to Get Health Care” Civil Beat, April 3, 2019.

McElfish, P.A., Hallgren, E. and Yamada, S., 2015. Effect of US health policies on health care access for Marshallese migrants. American journal of public health, 105(4), pp.637-643.

Tarazi, W. W., Green, T. L., & Sabik, L. M. (2017). Medicaid disenrollment and disparities in access to care: evidence from Tennessee. Health services research, 52(3), 1156-1167.

Tello-Trillo, D. S. (2016, June). Effects of Losing Public Health Insurance on Healthcare Access, Utilization and Health Outcomes: Evidence from the TennCare Disenrollment. In 6th Biennial Conference of the American Society of Health Economists, Ashecon.

[1] For details, see McElfish, et al. (2015).

[2] Private communication with physicians working at Queens Medical Center in Honolulu indicated that just prior to the expiration of Medicaid benefits, there was a sense that it would be difficult to enroll uninsured COFA migrants in the State’s Medicaid program so many providers may not have put forth the effort.

Published: Teresa Molina, Tetine Sentell, Randall Q. Akee, Alvin Onaka, Timothy J. Halliday, and Brian Horiuchi, 0: The Mortality Effects of Reduced Medicaid Coverage Among International Migrants in Hawaii: 2012–2018 American Journal of Public Health 0, e1_e3, https://doi.org/10.2105/AJPH.2020.305687