Over the past three months the Japanese Yen has depreciated significantly against the US Dollar and other major currencies as policy makers in Tokyo try to kick start the Japanese economy. The Yen initially began to slide on speculation that newly elected Prime Minister Shinzo Abe would successfully pressure the Bank of Japan to ease monetary policy and finally kick the deflationary conditions that have plagued the Japanese economy. In mid January the Bank of Japan announced a pair of new policies designed to do just that. First the Bank adopted an explicit 2% inflation target and offered guidance that it would act to achieve the target as soon as possible. In addition to the new inflation target, the Bank announced a new round of quantitative easing that will begin in 2014 and continue indefinitely.

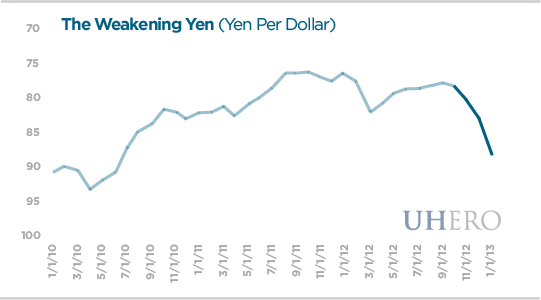

While these policies are not direct interventions in the foreign exchange market, there has already been an observable effect on the Yen. The prospect of an increased money supply thanks to “QE” and increased inflation eating into real Yen interest rates make the Yen less desirable on the margin. Over the past three months the Yen has depreciated by more than 15% against the Dollar, reaching levels not seen since mid-2010. A weaker Yen versus the Dollar, which means that a Dollar can be exchanged for more Yen and conversely that it takes more Yen to exchange for each Dollar, helps Japanese firms exporting goods to the US but makes American goods and services relatively more expensive for Japanese consumers.

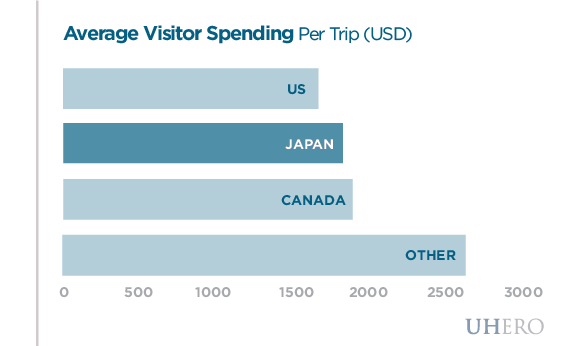

The effect this swing in the Yen/Dollar exchange rate will have in Hawaii remains unclear. Given the volatile nature of currency markets it’s difficult to say whether the Yen will continue to depreciate against the Dollar, stabilize at current rates, or return to the long-standing trend of appreciation. However if there is a prolonged period of Yen weakness, Japanese visitors to Hawaii would start to feel the effect of reduced purchasing power in the State.

Japanese visitors might cut back on shopping or opt for lower priced accommodations. Additionally given that Oahu hotels were almost completely full this year, Japanese visitors might start to get squeezed out by big spending visitors from fast growing markets like Australia, South Korea, and China. For now, we’ll just have to wait and see, stay tuned to UHERO for the latest updates!

Japanese visitors might cut back on shopping or opt for lower priced accommodations. Additionally given that Oahu hotels were almost completely full this year, Japanese visitors might start to get squeezed out by big spending visitors from fast growing markets like Australia, South Korea, and China. For now, we’ll just have to wait and see, stay tuned to UHERO for the latest updates!

– James Jones