Solar photovoltaic (PV) tax credits are at the center of a public debate in Hawai’i. In their policy brief “Tax Credit Incentives for Residential Solar Photovoltaic in Hawai’i” UHERO’s Makena Coffman, Carl Bonham, Sherilyn Wee and Germaine Salim find that the typical residential solar PV investment has an internal rate of return of 9% even without state tax credits. With the current state tax credit rules, the internal rate of return is as high as 14%. If most of Hawai’i’s households choose to take advantage of these high rates of return, state tax credit expenditures could reach $1.4 billion for residential units alone.

Background:

HRS 235-12.5 allows taxpayers to claim a 35% non-refundable tax credit against Hawai’i state individual or corporate net income tax, for eligible renewable energy technology, including PV. The policy has a $5000 cap on the tax credit per system, and excess credit amounts can be carried forward into future years until they are exhausted.

Is PV A Sound Household Investment?

In purely economic terms, and assuming that the net-metering agreement remains unchanged, the rational decision is to make the PV investment, regardless of tax credit policy. Because systems are warrantied for 25 years or more, a payback period of 10 years or less makes the PV installation a very lucrative investment. The statewide average “payback period” is 8 years with no State tax credit and 6 years under the current set of rules. Of course other factors play a role in the household decision—there are questions of expected house tenure and whether the solar investment adds value to the sale of a home.

How Many PV Installations Can We Expect in the Future?

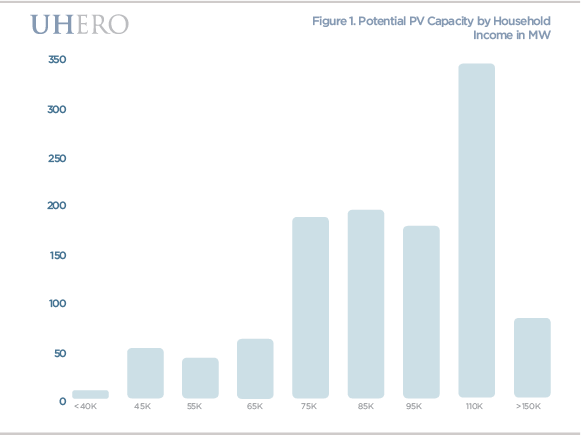

While it is difficult to understand why households do or do not choose to make what is currently an economically rational decision, we estimate the potential for solar PV installations on owner-occupied single family homes by household income, as provided in the most recent Census Data.

Making the heroic assumption that all owner-occupied single-family residences install solar PV such that they are net-zero users of electricity, we estimate a potential of up to 1,100 MW of capacity. This is a tremendous amount of PV and, without upgrading grid capabilities, would result in some neighborhoods exceeding the 15% circuit limit.

How Will This Affect State Expenditures?

If the total 1,110 MW of PV are installed, we estimate that under the current rules that defines PV systems by their output capacity, households could claim as much as $1.4 billion in state tax credits. This is solely for residential installations.

An Alternative

We suggest that an improved role for policy is to facilitate PV deployment rather than making direct payments. We encourage the State’s inquiry into on-bill financing for PV. This “pay-as-you-save” mechanism is a way to potentially deploy solar PV to a wider population, as well as limit the state’s expenditures.