Almost four years after the start of the great recession total output of goods and services in the US has surpassed its pre-recession peak. The Bureau of Economic Analysis first estimate of Q3 2011 real GDP (in 2005 dollars) was $13,352.8 billion, just slightly higher than the $13,326.0 billion in Q4 2007. After falling by more than 5% from peak to trough, the US economy has grown at an annualize rate of 2.5% for the past nine quarters. In contrast, after the peak in Q3 1990, real GDP fell for only two quarters by a total of 1.4% and then grew by an average of 2.9% for the nine quarters following the trough.

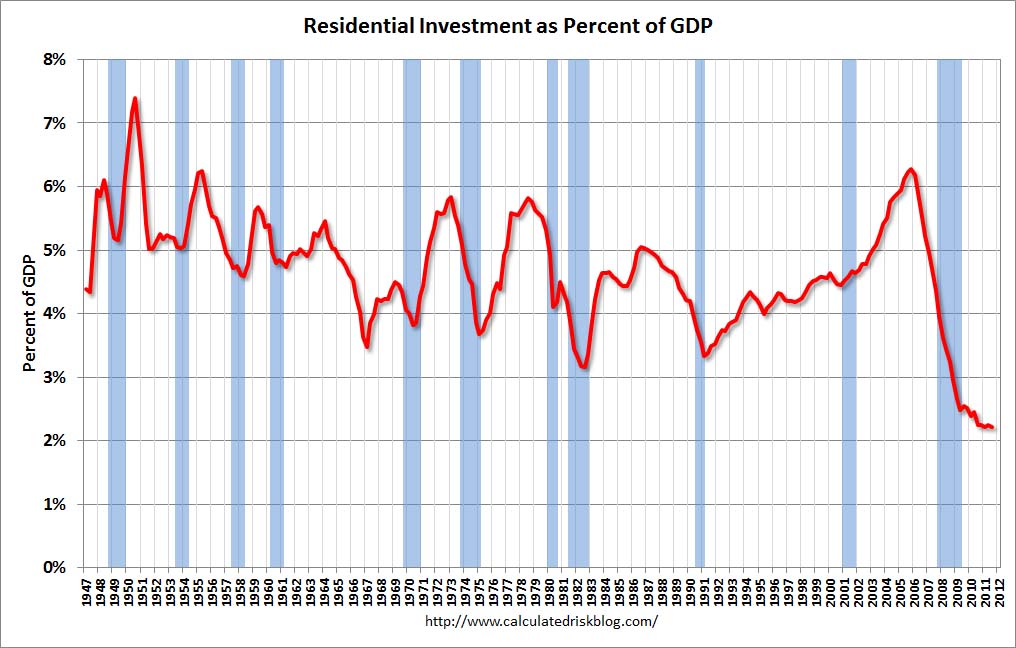

An ongoing debate amongst economists and policy makers has been the cause of this sluggish recovery. Is there some deep, dark foreboding uncertainty that haunts businesses and prevents them from investing and hiring workers? Or is there a more basic problem of lack of demand resulting from consumers, businesses and governments working through the excess debt accumulated during the bubble years, two wars, and a deep recession? Bill McBride at CalculatedRisk shared an interesting chart this morning that points to one of the most obvious causes of the continuing dismal recovery—housing.

As a share of the economy, residential investment has collapsed to levels not seen since the 1940s. This incredible collapse of residential investment is directly related to the dismal pace of economic growth during the past two years. In a typical recovery, residential investment leads the economy out of recession. Yet, a combination of factors ranging from more restrictive lending standards to weak household formation and the overhang of foreclosed properties has prevented residential investment from pulling the US economy out of its slow growth pattern. The recent announcement that Fannie Mae and Freddie Mac will begin allowing refinancing of mortgages with LTV of 125% is a welcome step. But, until we begin to see sustained job growth to spur demand, residential investment will contribute very little to overall US growth.

– Carl Bonham