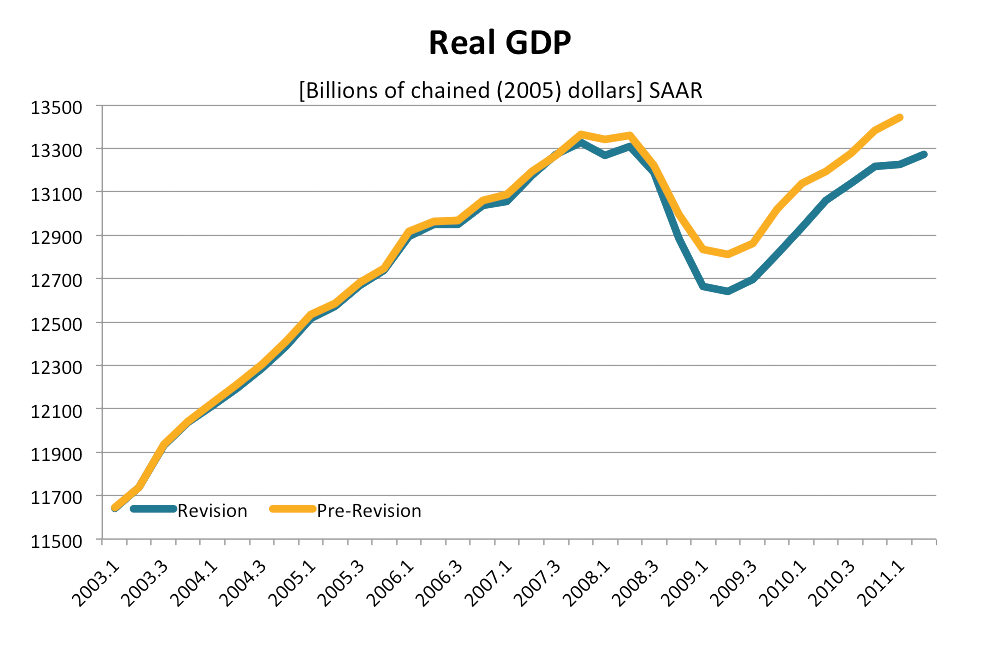

The US Bureau of Economic Analysis released second quarter data on the nations Gross Domestic Product this morning. Given all of the mixed economic news over the past several months, it does not come as a big surprise that this advance GDP estimate was very weak. The US economy expanded at a 1.3% annualized rate during the second quarter, and growth for the first quarter of 2011 was revised down from 1.8% to 0.4%. In fact, revisions to the history of GDP show that recession was much worse than previously thought, and real GDP is still below the level of output produced before the recession began at the end of 2007.

With the US economy growing at such an anemic pace during the first half of 2011 you would think policy makers would be focused on policies to spur economic growth. But, instead Washington has spent the last month worrying consumers, businesses, and financial markets about the prospects of a US default. The US economy has created an average of 126K jobs per month during the first half of 2011, barely enough to keep up with the growth in the labor force, and congress is debating ways to slow the economy further! All of the current plans for raising the debt ceiling involve near term reductions in federal spending, and if passed will slow the US economy further and aggravate the true crisis—the jobless recovery.

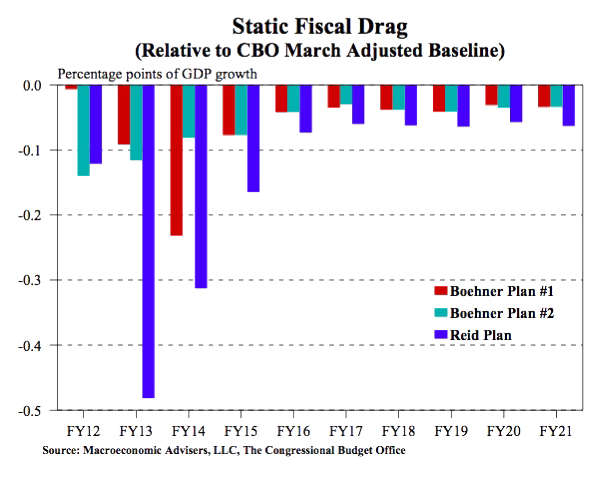

This week, the Congressional Budget Office “scored” the two prominent plans being discussed in the House and Senate. Based on the CBO estimates of the spending cuts in these plans, Macroeconomic Advisors has estimated the negative impact on the economy from both the House and the Senate plans over the next decade.

The Senate plan has the largest negative impact, an average of almost a quarter of one percentage point of growth each year though 2021. The House plan is more modest, only cutting economic growth by about 0.1 percentage point. Of course the house plan will also mean we will be right back in the middle of a debt ceiling crises six months from now! And neither plan solves the long-term deficit problem!

— Carl Bonham