By Michael Roberts

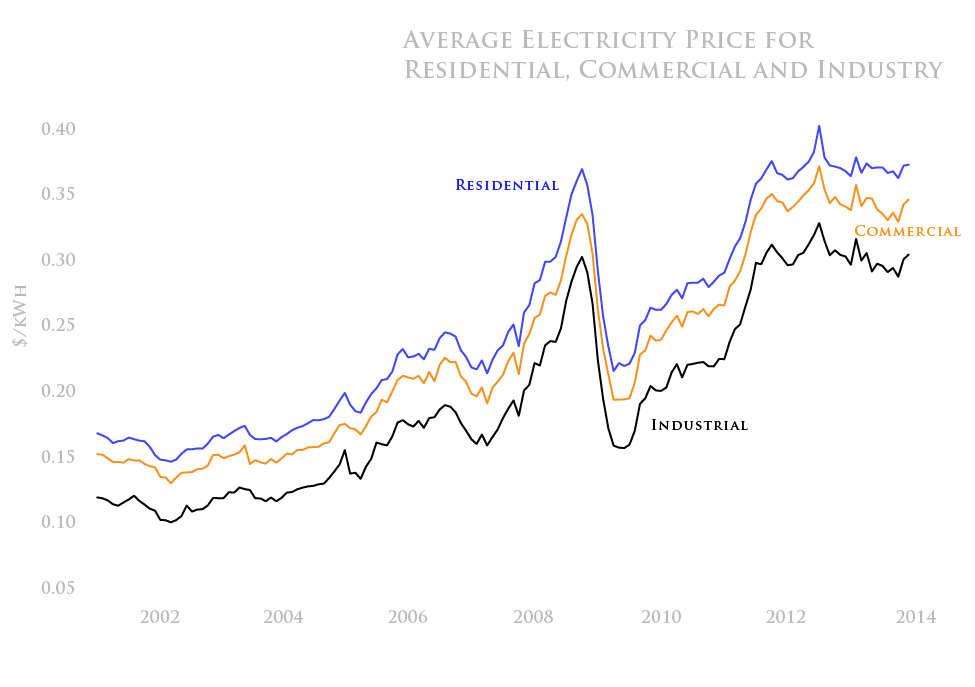

Excluding rooftop solar, Hawai’i residential consumers pay an average of about 37 cents for a kilowatt-hour of electricity. Taking refrigerators, water heaters, stoves, air conditioning and other uses into account, the average Hawai’i household uses about 18.5 kWh each day, for a monthly bill of about $205.

That’s a lot, between three and four times the average price on the mainland, and by far the highest price of any state. Thankfully, high electricity prices hurt a little less here than on the mainland, because our mild climate means we don’t have heating bills and we can usually get by without air conditioning.

But keep in mind that well over two thirds of the state’s generated electricity is used by commercial businesses and industry, which factor into the prices we pay for everything else. Businesses tend to pay less for electricity than households do, but the price is still high, so it’s easy to see how high prices are a burden on Hawai’i’s economy.

Electricity prices can be roughly boiled down to the price of oil, which is used to generate most of our electricity, plus price we pay for fixed costs like power plants, the grid and its management. These costs are fixed in the sense that they don’t vary with the amount of electricity generated and consumed. We have record high electricity prices because oil prices remain high, and because the fixed price of our infrastructure, averaged over the amount of electricity we use, is very high and rapidly growing.

Besides oil, there is one coal power plant on Oahu, which produces electricity much less expensively. Hawaiian Electric also buys electricity through a series purchasing power agreements (PPAs). Prices paid on PPAs vary across contracts and timing (peak or off-peak). These comprise a small share of total generation and the prices, on average, are roughly similar to the cost Hawaiian Electric’s reported cost for oil-generated electricity. Some new lower-cost PPAs should be coming online soon, and some older higher-cost PPAs expire relatively soon.

The Public Utilities Commission (PUC) allows Hawaiian Electric to adjust prices as oil prices change, but there is a bit of a lag between change in oil prices and changes in electricity prices. Every three years the PUC performs a rate case to evaluate costs more thoroughly. The three utilities, HECO, MECO and HELCO have rate cases performed on a rotating schedule. Some of the details remain confidential, and what is available can be difficult to discern from publicly available documents.

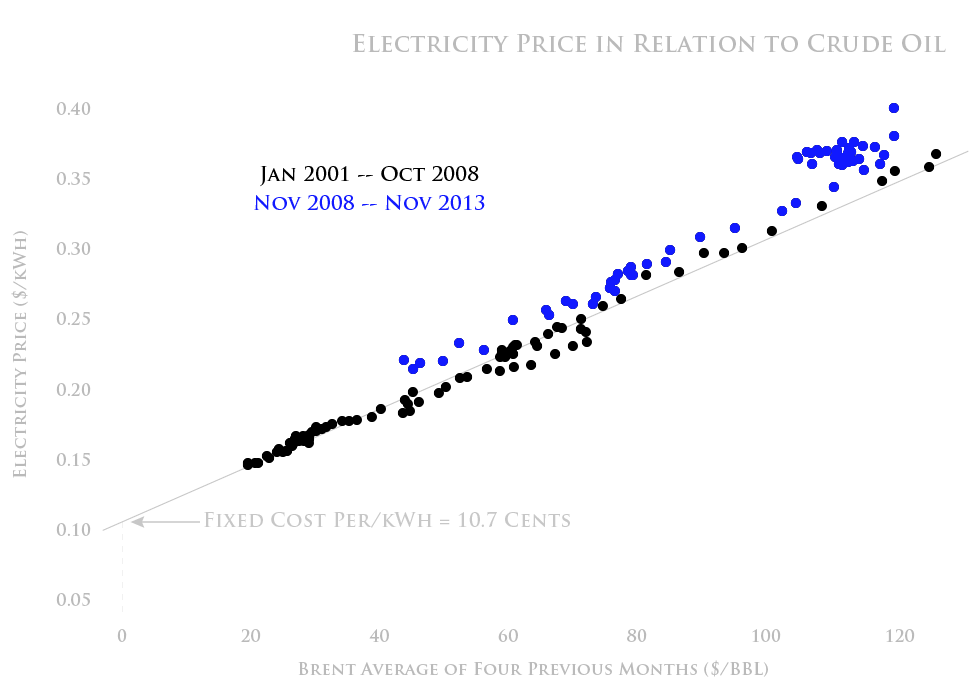

Historically, a good predictor of electricity prices in the current month is the average Brent crude oil price over the previous four months (figure 2). In our analysis we found Brent crude oil prices predicted Hawai’i’s average electricity price even better than prices reportedly paid by HECO.

Recently, however, we’ve seen prices drift up from the historical relationship. Statistically, a clear break occurred around November 2008, during the height of the financial crisis and the deepening recession. In the graph, we show months since this break in blue, and the historical relationship in black.

From the pre-November, 2008 relationship between electricity prices and crude oil prices, we can approximate the fixed-cost component of price at about 10.7 cents per kWh, which roughly equals the number reported by Hawaiian Electric. This margin covers cost maintaining the grid, infrastructure, billing and Hawaiian Electric’s profits. This fixed cost roughly equals the average retail price of electricity on the mainland. High fixed costs are partly a testament to the smaller scale and geographical constraints of an island economy. It’s hard to know whether or how much competition could reduce these costs.

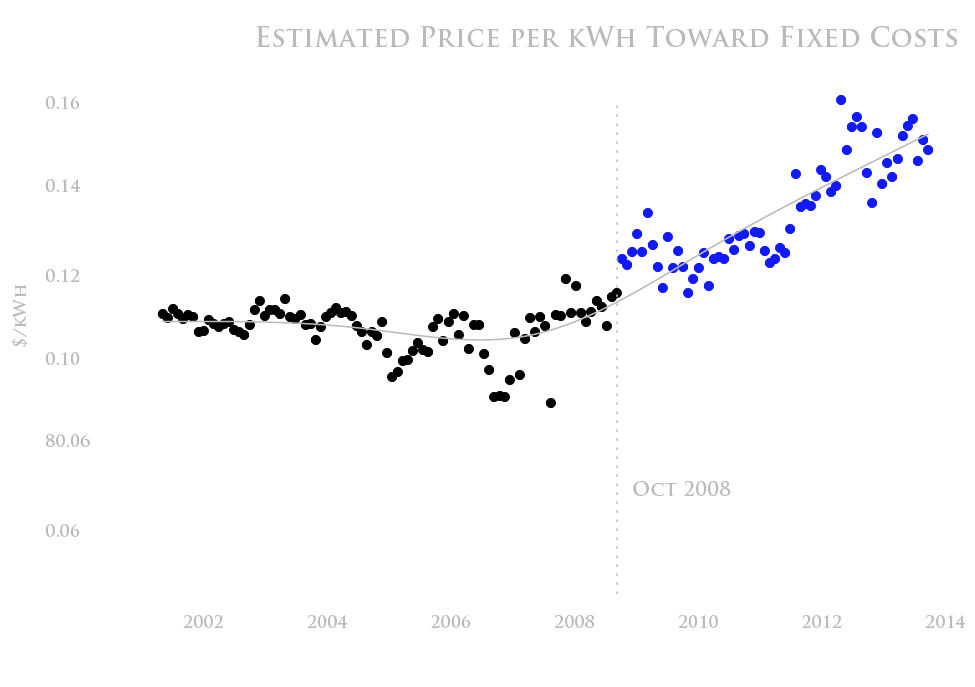

We can calculate the portion of electricity price left over after we have accounted for estimated variable (fuel) costs by adding 10.7 to the difference between each month’s price and the fitted line in figure 2. We’ll call this the “estimated price per kWh towards fixed costs” shown in figure 3. Since the break in November 2008, prices have drifted upward from the historical relationship, which suggests the fixed cost share of price has risen to around 15 cents per kWh, or about $83 dollars per household per month.

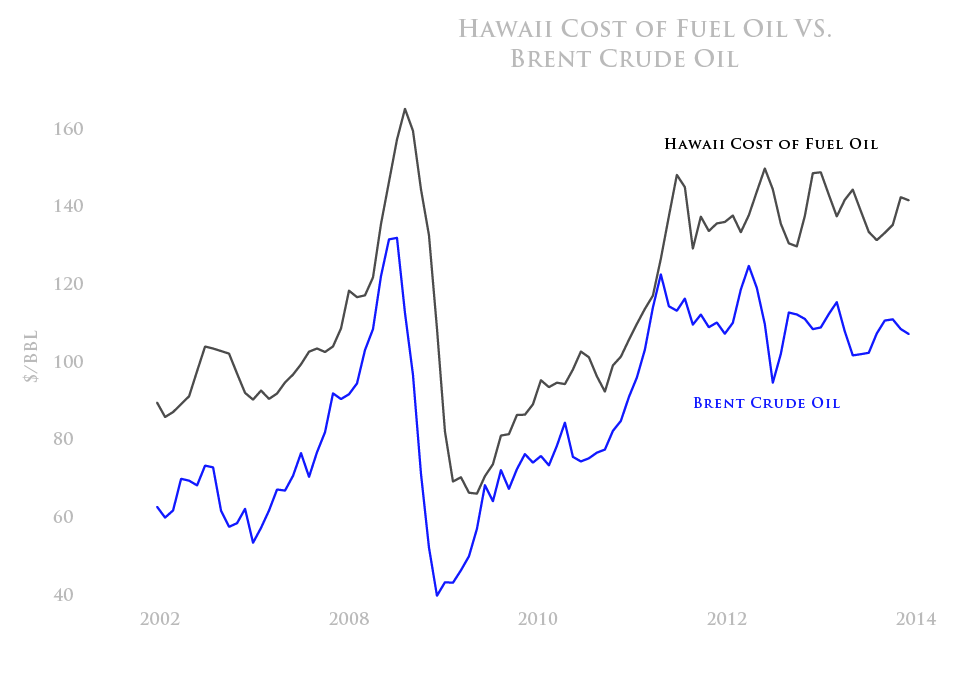

Fixed costs have drifted up due to a number of factors. A 2009 rate case granted Hawaiian Electric permission to raise Oahu prices 5.7 percent to finance new infrastructure and meet rate-of-return requirements. A $1/barrel tax was also implemented in 2010 to fund renewable energy and food security initiatives. But this tax amounts to only 0.2 cents per kWh. The spread between Hawaiian Electric’s oil costs and world Brent crude oil prices has also increased slightly since 2011 (figure 4).

Finally, there’s the revenue decoupling rule, which allows HECO to increase prices each year between rate cases to compensate for revenues lost due to energy efficiency and distributed generation (i.e., new solar installations). The intent of decoupling is to align HECO’s interests with those of competing solar providers, as described in my last post. With revenues stable, and generation costs falling, HECO can profit from this policy between rate cases. So far, revenue decoupling adds 1.3 cents per kWh, and a leaked document from the Public Utilities Commission suggests this will soon rise to 2.2 cents per kWh.

Looking forward, we might hope for electricity prices to come down. The cost of generating electricity from wind and solar is less than oil, and falling rapidly. Natural gas, a cheaper, cleaner and less expensive fuel, might be brought in to substitute for oil. But the intermittent nature of renewables and our antiquated grid will limit renewables, and rapidly growing fixed costs may limit how much residents and businesses will ultimately gain from lower generation costs.

An over arching concern is that fixed costs of the grid are approaching levels that could make battery backup to “unplugged” distributed systems a viable substitute for the grid. With PV solar and battery costs falling, and fixed costs rising, we may be setting up an unavoidable “death spiral” that makes the whole grid obsolete. We will navigate this issue in more detail in later post.

In the next post of the series we’ll review the costs and benefits of solar, net metering, the rapid growth of solar installations, and how this growth can stress the current grid infrastructure.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.