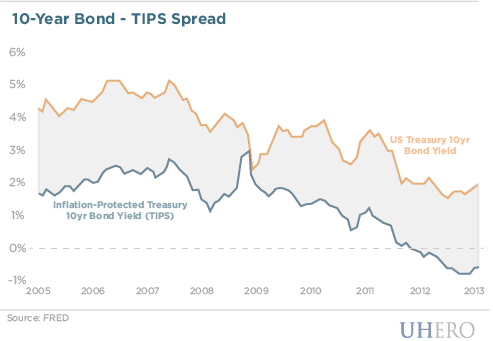

Despite the consumer price index only growing by a moderate 2% over the 12 months ending in February, some investors are worried about the possibility of higher inflation in the coming years. They can take advantage of Treasury Inflation Protected Securities, or TIPS, a bond type whose payments increase as the consumer price index rises, thereby compensating TIPS holders for inflation. The demand for bonds with such a feature has been strong recently: at this week’s auction, $13 billion worth of 10-year TIPS sold at a negative yield of -0.602%. This was the eighth TIPS auction in a row where the government was able to borrow at negative rates.

Negative yields imply that if the current interest rates and inflationary environment persist until the maturity of the bond, buyers will be paid back less than they originally lent to the government. However, the day before the auction the Federal Reserve reaffirmed its ongoing easy monetary policy, which some expect will eventually lead to higher inflation. The difference between yields on 10-year TIPS and comparable regular Treasuries reflects investors’ expectation for average annual inflation over the next decade. This spread has been widening over the past year and stood at 2.54% after the auction. Yet, this implied inflation rate is still relatively low considering some of the claims about high inflation risks.

– Peter Fuleky