BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

By Byron Gangnes

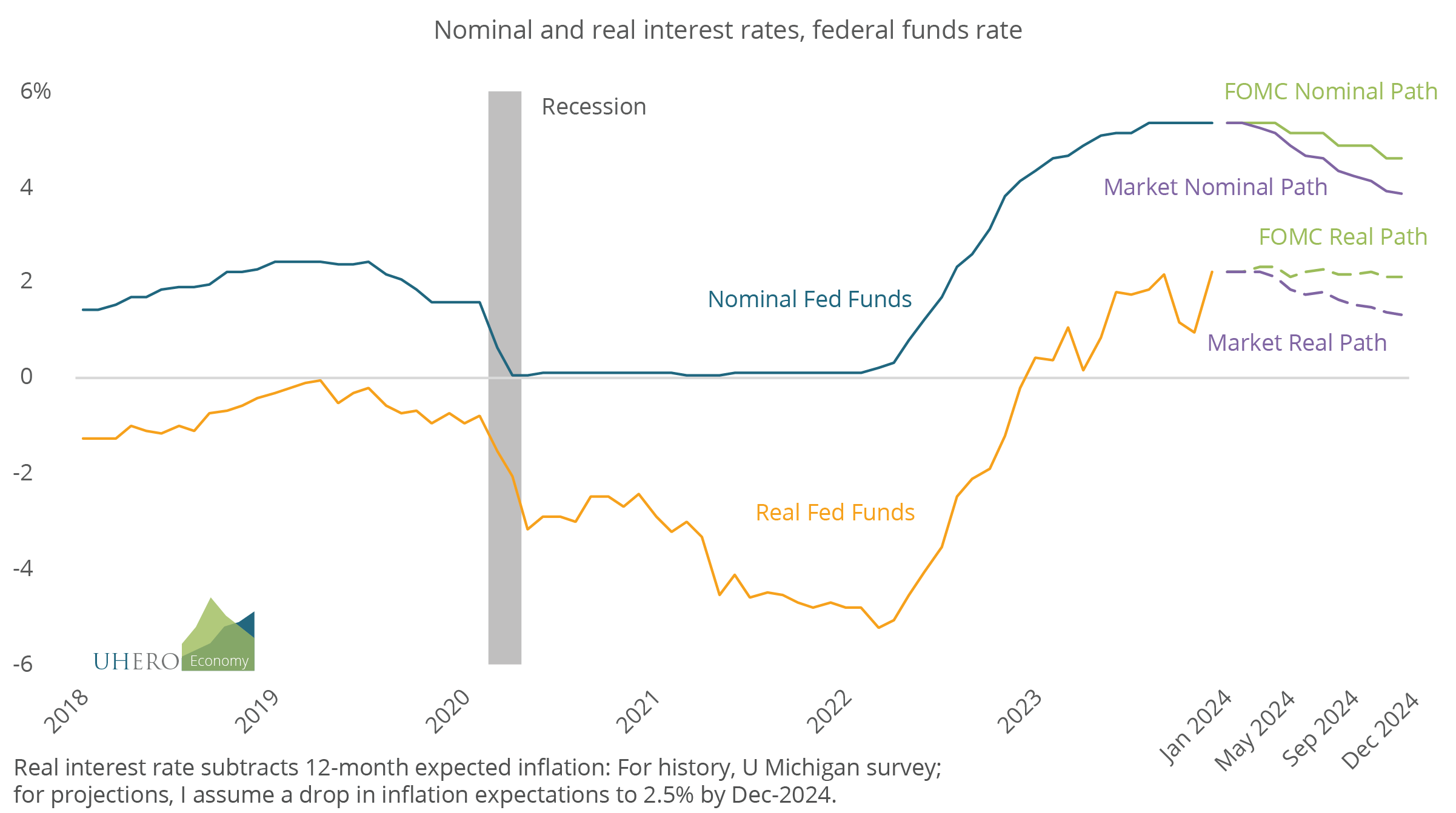

There is a marked difference between what Fed officials expect about their likely rate cuts this year and what the financial markets expect. According to the median estimate of Federal Open Market Committee (FOMC) members at their December 2023 meeting, three quarter-point cuts in the federal funds rate are likely this year. As of January 16, 2024, the actions of financial market participants imply that they expect six cuts, bringing the fed funds rate to the 3.75-4.00% range by year end [1].

Could the markets be right? Or perhaps a better way to say this: What would have to happen for the Fed to cut rates that much in 2024?

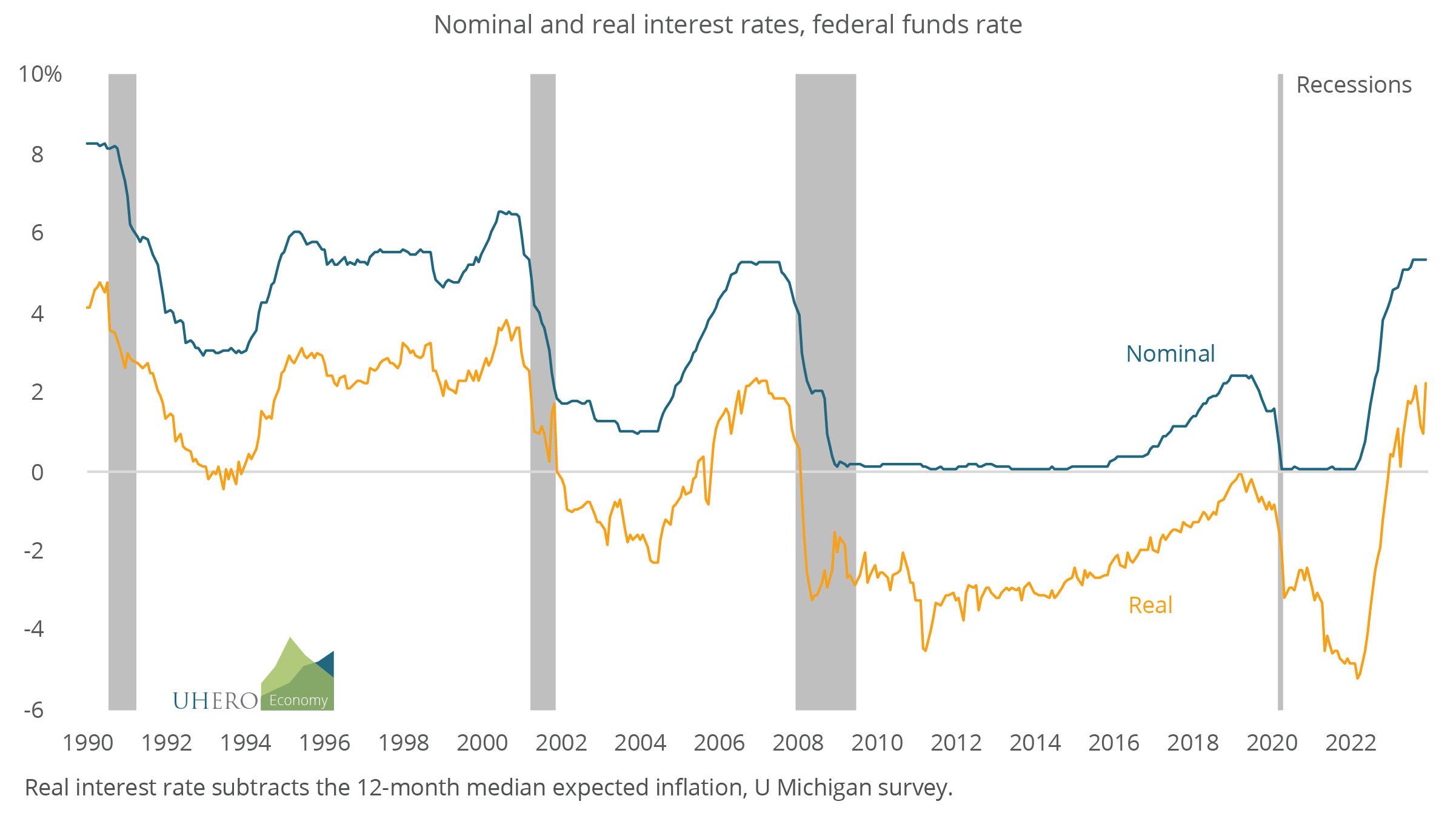

The Federal Reserve currently maintains the federal funds rate between 5.25% and 5.5% (the effective rate has been about 5.3%). Given the 3.1% twelve-month-ahead median inflation expectations from the December University of Michigan Survey of Consumers, the anticipated real interest rate is just over 2%, on par with real rates at the peak of past aggressive Fed tightening cycles.

The real rate of interest is the rate adjusted for inflation. When making financial decisions, investors or borrowers must form an expectation of what that rate will be in the future, therefore expected inflation is what is relevant when measuring real interest rates.

As inflation expectations fall, the Fed will need to reduce the federal funds rate to prevent real rates from rising well above 2%. Based on comments by FOMC members and Chair Jerome Powell, this is essentially what they have in mind: cutting rates enough to maintain the real interest rate near its current level, which they view as sufficiently high to continue to slow the economy without causing a recession.

If inflation expectations were to fall by a full percentage point this year—to the Fed’s long-run inflation goal of 2%—the Fed would need to make four quarter-point cuts to maintain roughly the current real rate of interest. In fact, the FOMC’s projections suggest that they believe expectations will not recede fully to target this year, but will stand at about 2.5% at year end. This is consistent with their projection of three rate cuts to maintain a roughly 2% real interest rate.

There are three scenarios in which substantially more than three rate cuts might be made: (1) if inflation and inflation expectations fall faster than expected, (2) if the Fed decides that they have fully achieved their inflation-fighting goals so that contractionary real interest rates in the 2% range are no longer needed, or related to this, (3) a recession begins, requiring accelerated rate cuts to support a slumping economy.

It is possible that the FOMC also expects conditions will warrant somewhat more than three cuts, but that members are hesitant to suggest larger anticipated rate reductions because markets tend to overreact to any hint of Fed easing. In that sense, the Fed may tend to adopt a “hawkish” bias, that is to err on the side of higher rate projections.

There is an important technical wrinkle in that we really don’t know what real interest rate is consistent with the economy settling onto a sustainable long-run track, what economists call the neutral rate of interest, or r* for short. There is an ongoing debate about this, but no consensus. Estimates of r* tend to lie between 0.5% and 1.5%. (See, e.g. What is the Neutral Rate of Interest and The Evolution of Short-run r* after the Pandemic.) Once the Fed is satisfied that its inflation fight is won, it will want to maintain an interest rate near a neutral level that neither restrains or stimulates the US economy.

The bottom line is that financial market participants could be right, but only if inflation and underlying macro conditions cool faster than predicted by the FOMC, or if their substantial past rate hikes tip the US economy into recession.

[1] There has been some volatility in market rate expectations in recent days, following a strong reading for December retail sales that might mean more delayed rate cuts. As of yesterday, markets continue to expect the equivalent of six quarter-point cuts this year.