By Peter Fuleky

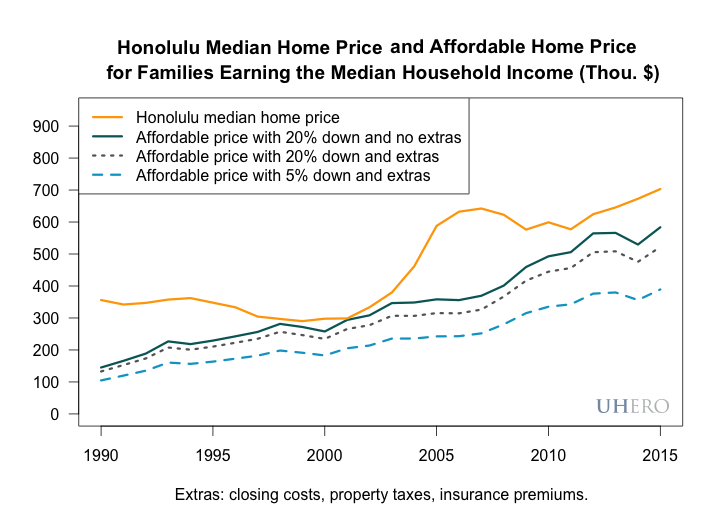

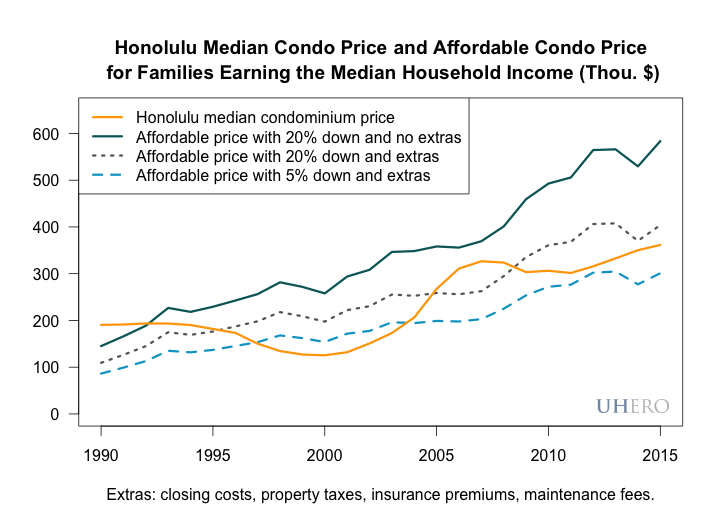

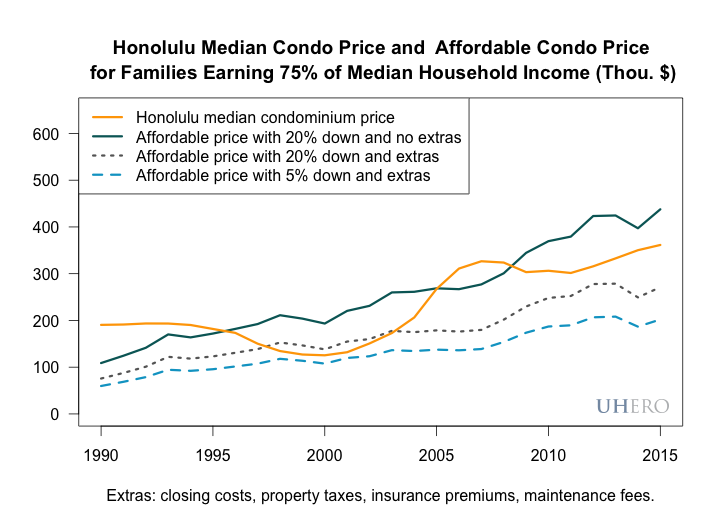

At a time of dwindling inventory and rising prices, housing affordability has once again become a hot topic in Hawaii. One way to quantify whether the typical single family home or condominium is “affordable” is to compare median sales prices to the value of a mortgage the median household income could support. However, mortgage payments do not capture all of the costs of homeownership. Below, we incorporate several additional costs and a number of different assumptions about mortgage characteristics to illustrate how they affect the affordability of a median priced homes and condos in Honolulu.

Beyond a down paymentand monthly mortgage payments, homeownership requires additional expenses. These include closing costs related to the purchase, which we estimate at 2% of the sale price, and periodic costs such as property taxes, insurance, and maintenance. Property taxes vary across counties, and residential property taxes as a percentage of the home’s assessed value range from 0.35% in Honolulu County to just over 1% in Hawaii County. Homeowner’s insurance is also quite variable, and a particular policy depends upon features of the home and surrounding area. We estimate insurance costs using the average of the 2015 premiums published by the State Department of Commerce and Consumer Affairs.

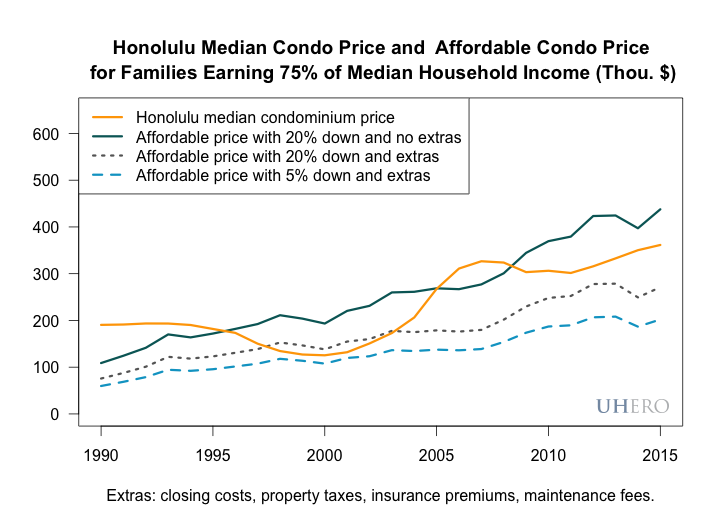

Condo association fees can range from less than $300 to well over $700 per month, and we take $500 per month as the approximate midpoint. All expenses associated with the structure, such as insurance and condo fees, are adjusted across time to reflect historical changes in construction costs. Finally, our estimates are contingent upon a buyer’s ability to come up with a down payment, which is a significant barrier to home ownership for many households. If a purchaser pays less than 20% as a down payment, lenders require insurance to cover non-payment of the mortgage. Based on data from the Federal Housing Administration, we use an annual mortgage insurance premium of 0.8% of the loan amount.

The first two figures plot single family home and condominium prices that are “affordable” for a family spending 30% of the median household income (estimated by the US Department of Housing and Urban Development) on homeownership under various scenarios. Not surprisingly, a simplified measure that focuses only on the downpayment and mortgage costs overstates the affordability of homes and condos in Honolulu. Using the assumptions listed above and UHERO’s forecasts for 2015 home prices and mortgage rates, the median household can only afford 75% of the median priced home. In contrast, condos remain within reach of the median household that can muster the 20% downpayment. For households making only a 5% downpayment, owning a median priced condo would require more than 30% of the median household income, with the exception of the period from 1997-2003 at the bottom of the last housing cycle. Finally, the last figure illustrates that families earning only 75% of the median household income can not afford a condominium if all the extra costs of ownership are factored in.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.