By Peter Fuleky

The Federal Reserve is poised to raise interest rates, but whether the Fed begins liftoff tomorrow or early in the New Year, the climb thereafter is likely to be gradual. Futures contracts predict a gentle ramping up of interest rates, with the federal funds rate hitting about 1.4 percent by the end of 2017 and 1.7 percent by mid-2018. If investors are right, this will be the slowest interest rate normalization on record.

The expectation that rate hikes will happen at a gradual pace reflects mixed signals about the economy. As the Fed tries to fulfill its dual mandate of stable prices and full employment, it faces low headline numbers for inflation and unemployment. But as we discuss in our report, the devil is in the details. Unemployment is already at the “natural” rate” according to Congressional Budget Office estimates, and further declines would normally spark an increase in inflation. However, inflation remains very low, usually an indication of underutilization of resources like labor and machinery. One explanation for this dichotomy is the still elevated number of involuntary part time workers and those who were unsuccessful in landing a job within the last year. And as long as there is no shortage of people willing to work at prevailing wages, inflationary pressures will remain muted.

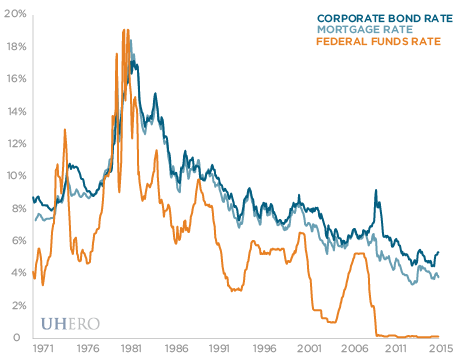

The current six-year expansion is already longer than most, and when the US economy hits the next recession the Fed will lower interest rates again. To combat recessions in the past, the Fed has typically brought down the federal funds rate—the interest rate at which banks trade balances held at the Fed—by 3 to 4 percentage points. But if the next recession hits prior to 2019, rates may begin to decline even before they reach 2%. In other words, for the foreseeable future the trajectory of the federal funds rate is likely to remain in the low single digits.

What about market interest rates that affect businesses and homeowners? The onset of monetary tightening will almost certainly nudge rates on business loans and mortgages somewhat higher. But if history is any indication, these rates will rise by less than the federal funds rate, with the spread between them tightening due to lower borrower default risk during an economic expansion.

BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.