By Sherilyn Wee and Michael Roberts

Spurred by low natural gas prices and a maturing market for liquefied natural gas (LNG), Hawai‘i Gas received their first shipment of LNG in containers in early April. In phase one of the gas utility’s plan, LNG serves as a backup fuel for locally produced synthetic natural gas (SNG). Even with high transportation costs, it is currently cheaper for Hawai’i Gas to import LNG than to process naphtha into SNG. While Hawai‘i Gas is the first entity to land LNG in Hawai‘i, Hawaiian Electric also plans to integrate LNG in the electric power sector. With the highest electricity rates in the nation and ambitious renewable energy goals, LNG could offer Hawai‘i lower costs. According to a 2012 report commissioned by the Hawai‘i Natural Energy Institute, bulk LNG yields fuel savings of 40-50% compared to oil on Oahu, and 22-44% on the neighbor islands. LNG also has a lower carbon footprint on a smokestack basis, with roughly half as much CO2 emissions as coal and 25% that of oil.

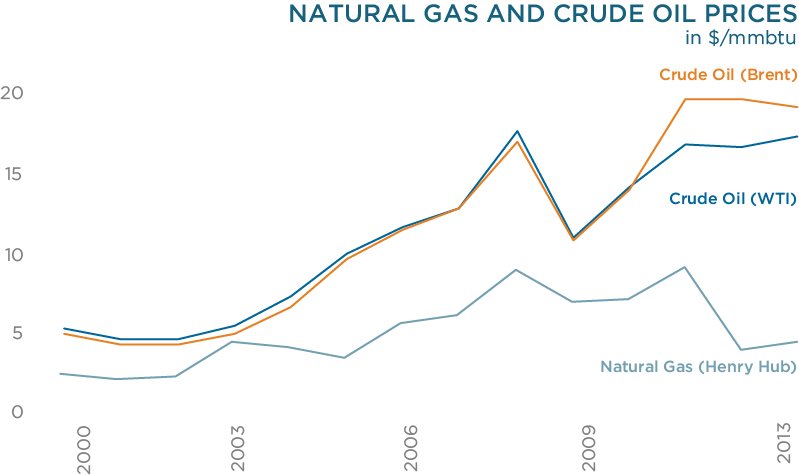

While oil prices remain high, natural gas prices in the United States have fallen due to the shale gas revolution, reaching an all-time low and dipping below $3/mmbtu ($17.4 per barrel of oil equivalent) in April 2012. Since then natural gas prices have roughly stabilized between $3-5/mmbtu. For Hawai‘i, the real question is whether gas-linked pricing from the US West Coast or US Gulf Coast can be secured over oil-linked pricing for almost all other LNG supplies elsewhere. If prices are tied to Henry Hub, the delivered cost of bulk LNG to Hawai‘i between 2020 – 2030 ranges from 13 – 19 $2012/mmbtu, whereas oil-linked pricing from Canada yields a higher delivered cost of 19 – 24 $2012/mmbtu (Facts Global Energy, 2012 and Galway Energy Advisors, 2012).

Besides potentially delivering substantial cost savings to the State, LNG is clean and flexible. It complements the growing share of intermittent renewable energy since gas turbines can be quickly ramped up and down. In addition, gas turbines are also more efficient, compared to the utilities’ old steam units operating at 30% efficiency. Hawai‘i has a wealth of renewable energy resources, particularly excellent wind and solar regimes. But the intermittent nature of renewables creates challenges in integrating large amounts into the grid, a difficulty that we are facing today. Reliability concerns dictate a need for some amount of firm power that can adjust with demand and renewable output in any given moment.

The State has already exceeded its 2015 renewable portfolio standards (RPS) goal of 15%, but to reach 40% by 2030—and levels beyond—is more challenging. LNG can help to achieve this goal. Unlike oil, LNG involves long-term contracts, mainly due to large capital investments for infrastructure (regasification plant, storage, pipelines) and requires the State to commit to a minimum demand for natural gas during the contract period. The 20-year time frame of contracting LNG is in line with the expected transition period from 75% oil to renewable energy as the dominant source, thereby allowing LNG to temporarily facilitate renewable energy adoption.

An alternative to LNG would be to remain on oil, deactivating antiquated oil-burning units and continuing to reduce the share of oil in power generation. Upcoming environmental regulations however, further motivate the use of LNG. Under the Clean Air Act, HECO’s oil-fired power plants (as well as the AES coal plant) are subject to the Mercury and Air Toxic Standards (MATS) while all of Hawaiian Electric Companies’ oil-fired plants must comply with the National Ambient Air Quality Standards (NAAQS). The compliance deadline for MATS is 2016-2017, and NAAQS, in 2022. Switching to LNG, as presented in the Hawaiian Electric Companies Fuel Master Plan, is the preferred approach due to its cost-effectiveness over more expensive ultra low sulfur diesel. Therefore, in order to expedite the introduction of LNG into their system to lower customers’ electric bills and comply with more stringent environmental regulations, HECO released an RFP in March for 800,000 tons of containerized LNG per year over 15 years, beginning in 2016 or 2017.

Although quicker to implement, importing containerized LNG is a limited measure and the economics of large-scale containers is not well studied to date. Considerable fuel savings can be realized with bulk LNG. Towards this end, Hawai‘i Gas and Hawaiian Electric Industries signed an MOU in December 2013 outlining their working relationship and guiding principles for bringing bulk LNG to Hawai‘i. Backed by the State, they intend to bring it to the market as soon as possible and in a way such that all islands and sectors benefit. This is an important framework moving forward as Hawai‘i’s path to clean energy lies not only in transforming Oahu’s electric sector, but also the neighbor islands’ and the State’s marine and ground transportation sectors.