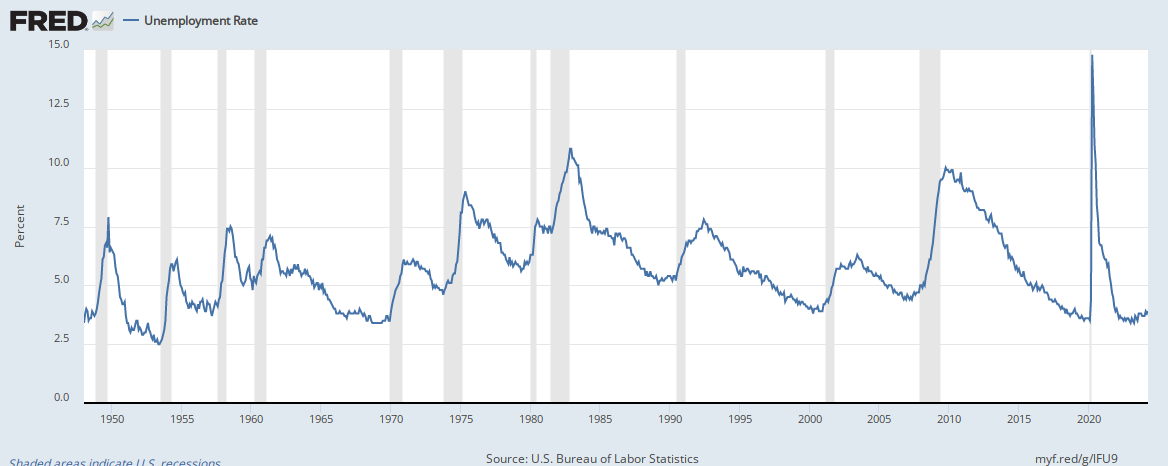

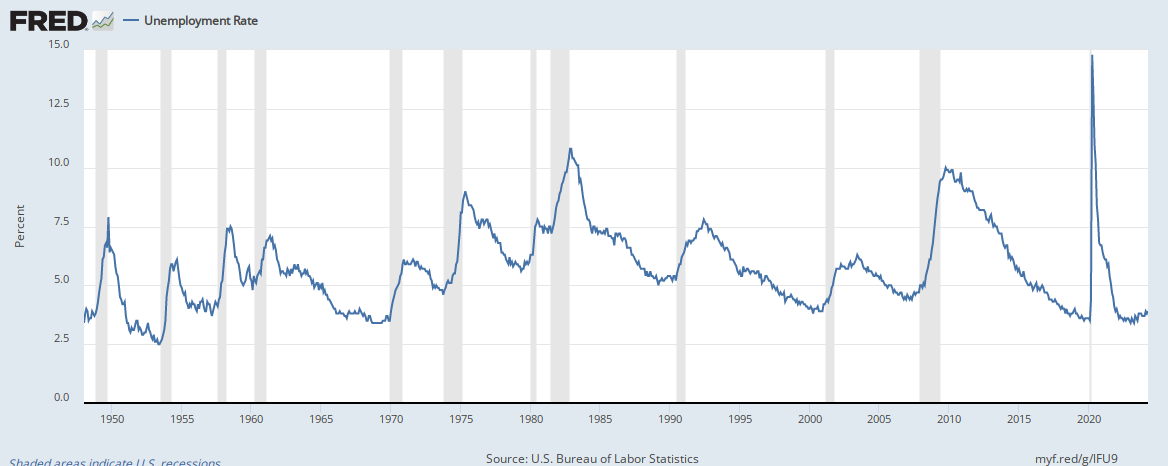

1. THE US BUREAU OF LABOR STATISTICS RELEASED ITS MONTHLY EMPLOYMENT REPORT THIS MORNING AND REPORTED ANOTHER DECREASE IN THE US UNEMPLOYMENT RATE?

Yes, this was a better jobs report than most economists expected. The consensus was for 135,000 jobs to be created in January and the total nonfarm job count posted an increase of 243,000 jobs. And job gains were widespread. Only the Information, Finance and Government sectors saw job losses in January.

2. WE ALSO SAW A DECLINE IN THE UNEMPLOYMENT RATE TO 8.3%, SO THIS WAS A REALLY GOOD REPORT?

To put the jobs report in perspective, for all of 2011, the US economy added about 150,000 jobs per month (thats an upward revision), and in 2005 the average was 208,000 jobs. So if this growth continued for most of 2012, that would be a very good year.

3. AS YOU KNOW, WE ARE FOCUSING ON PERSONAL FINANCE THIS WEEK. I KNOW THAT IS NOT THE FOCUS OF UHERO, BUT CAN YOU GIVE US ANY TIPS?

Actually, one tip that I have used is using the State’s unclaimed property search engine. I was very surprised to find that I was owed money from a previous mortgage refinancing. And you can find a link to the unclaimed property search on the as Seen on KITV site.

Another thing that is pretty standard advice, particularly around tax time is to adjust your tax withholding so that you are not providing Uncle Sam or Uncle Neil with an interest free loan. I know a lot of people like getting a surprise each year from the IRS, but if you get the same surprise year after year, its not a surprise anymore. And if you are carrying credit card debt during the year while you lend money to the government interest free, thats doubly bad. Take your tax return this year, pay down your credit card debt, adjust your withholding so that your after tax income goes up and you can pay off your credit card every month.

One last thing to keep an eye on is the potential for refinancing your mortgage. The nominal 30 year mortgage rate hit a record low this week. If you have the equity and the credit rating, and if your rate is in the high 4 percent range or above, it is worth looking into refinancing. If you don’t have the equity, keep your eyes out for news about refinancing opportunities. The president has proposed new programs that would facilitate refinancing even for home owners who may owe more than their home is worth.

– Carl Bonham