BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

By Byron Gangnes

Home from last week’s National Association for Business Economics Policy Conference in Washington DC. Not surprisingly, many of the sessions ended up touching on some aspects of artificial intelligence (AI). Back to this in a minute.

But one topic that showed up in several sessions was how the supply side of the economy is faring and where it might be headed.

I’ve written before about how supply sets the economy’s speed limit. Thinking about the factors that influence the growth of supply is key to understanding both medium-term inflation dynamics and long-run growth prospects. Increasing the economy’s potential to supply goods and services in the face of rising demand is key to low-inflation growth, and raising supply over time drives improvements in living standards.

Economists often think about supply growth as being driven by the accumulation or creation of inputs to production and how much businesses get out of those resources, known as productivity.

What’s happened to productivity over the past few years?

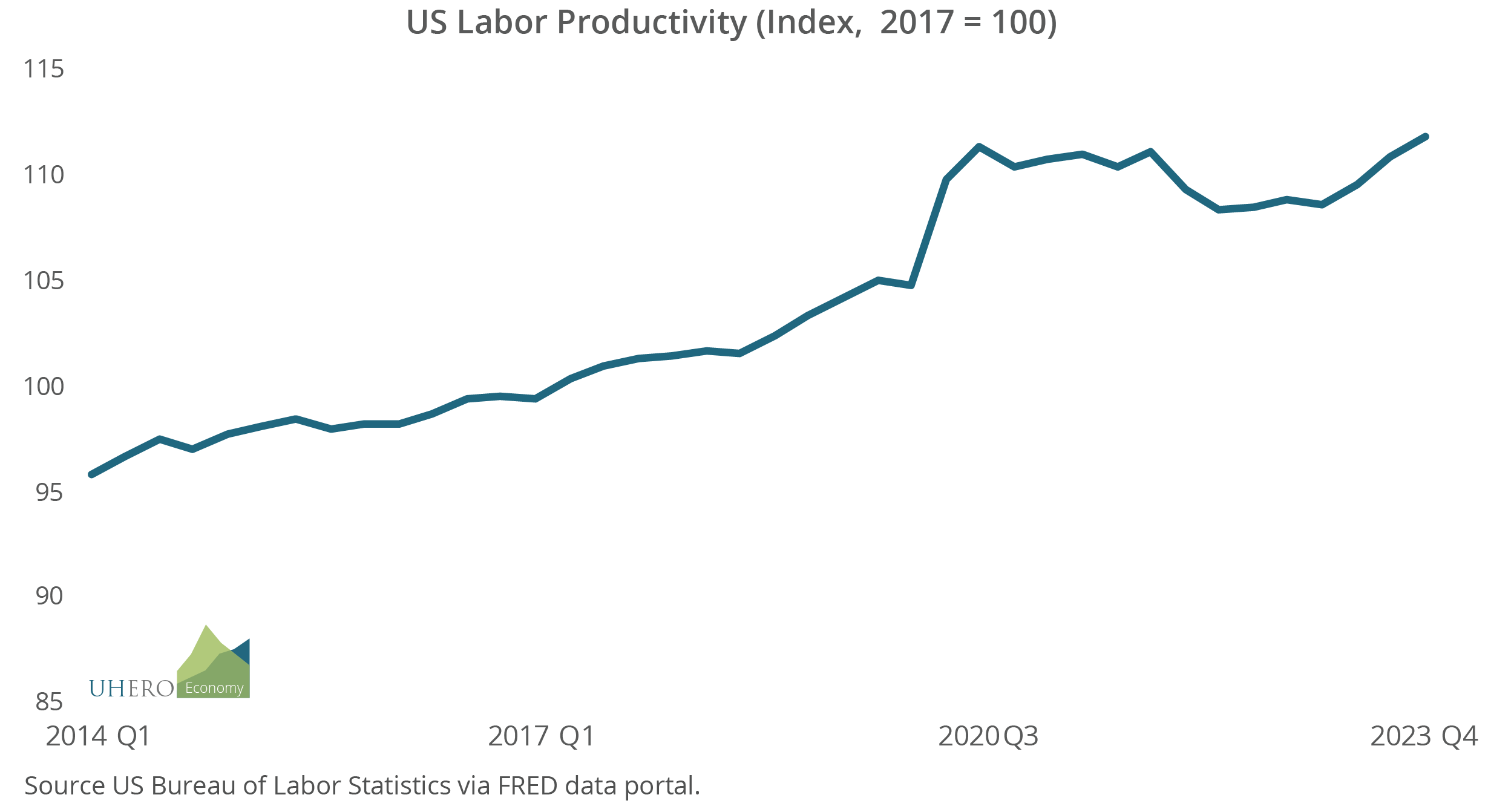

Labor productivity rose sharply during the pandemic, as some workers were laid off or stayed home while production changed by a smaller amount. And the workers laid off were disproportionately in public-facing low-productivity service industries, like food services and accommodations. Then, as people came back into employment, those trends reversed, and productivity fell. Since then, it has improved and has more or less recovered to the pre-pandemic norm.

Productivity has been growing at a brisk pace in recent quarters. This has helped the disinflation fight, because it has created efficiencies that allow firms to hold the line on prices even as wages rise. What’s behind the recent productivity improvement? Part of it is likely cyclical. The economy has grown faster than anticipated over the past year, and faster than the growth in employment. Measured productivity has risen as a result. The high rate of job switching over the past two years may also have moved some workers into jobs for which they are a better fit. Finally, worker hours have declined as the labor market softens, which boosts measured productivity even further.

The big question is whether this might also be the beginning of a more sustainable increase in the trend rate of productivity growth. Is there reason to think this might be the case?

One thing that can raise productivity is increasing the per-worker capital stock, but capital investment has been fairly anemic recently. Construction has been strong, but not necessarily in areas that will raise productive capacity. One promising development is that we have entered a period of more dynamic business activity. Measures of dynamism, such as new company formation, have risen after a long period of decline. New firms innovate and create jobs.

What about the future?

The outlook appears mixed. An important driver of productivity improvement in the past has been educational attainment, in recent decades especially among women and people of color. That may now have run its course. A more experienced workforce raised productivity during the prime aged peak of the Baby Boom. But now that group (OK, my group) is aging, and while we hate to admit it, aging folks tend to have declining productivity, especially those over the age of 65. What about work from home? It could help raise productivity by eliminating commute time and workplace distractions. But there are plenty of distractions at home, and so far there just isn’t enough evidence to know one way or the other.

So what about AI? Anecdotal stories abound about how some firms have dramatically raised their output per worker after integrating AI into their workflows. (See, e.g. NBER, MIT, Generative AI at Work.) And we see everywhere how businesses have automated basic tasks, like hotel check-in, to reduce labor requirements. While there is lots of hope—and hype—about how generative AI may transform work, it is far too early to know how large these effects might be. One study by Goldman Sachs estimates that generative AI could lift productivity growth by 1.5% annually over the next ten years, which would be a historically massive positive effect. A McKinsey & Company study estimates that generative AI could raise annual productivity growth by 0.1-0.6%, with larger additional gains from other types of AI automation, but that this depends on relocating affected labor to other productive jobs.

Finding new jobs for displaced workers will be a challenge. Historically, fundamental new technologies have raised living standards for society and most people, but some fare better than others, depending on how well suited they are to the emerging changes. So there will be distributional concerns as AI causes disruption to industry workforces. US policy makers have a poor track record when it comes to addressing distributional changes such as those that occurred during the wave of globalization during the 2000s.

There are other looming changes that could lower productivity, in particular the potentially vast investments needed to address and adapt to climate change. During the 1970s, measured productivity suffered when businesses had to deploy lots of new capital just to deal with a much higher energy cost environment.

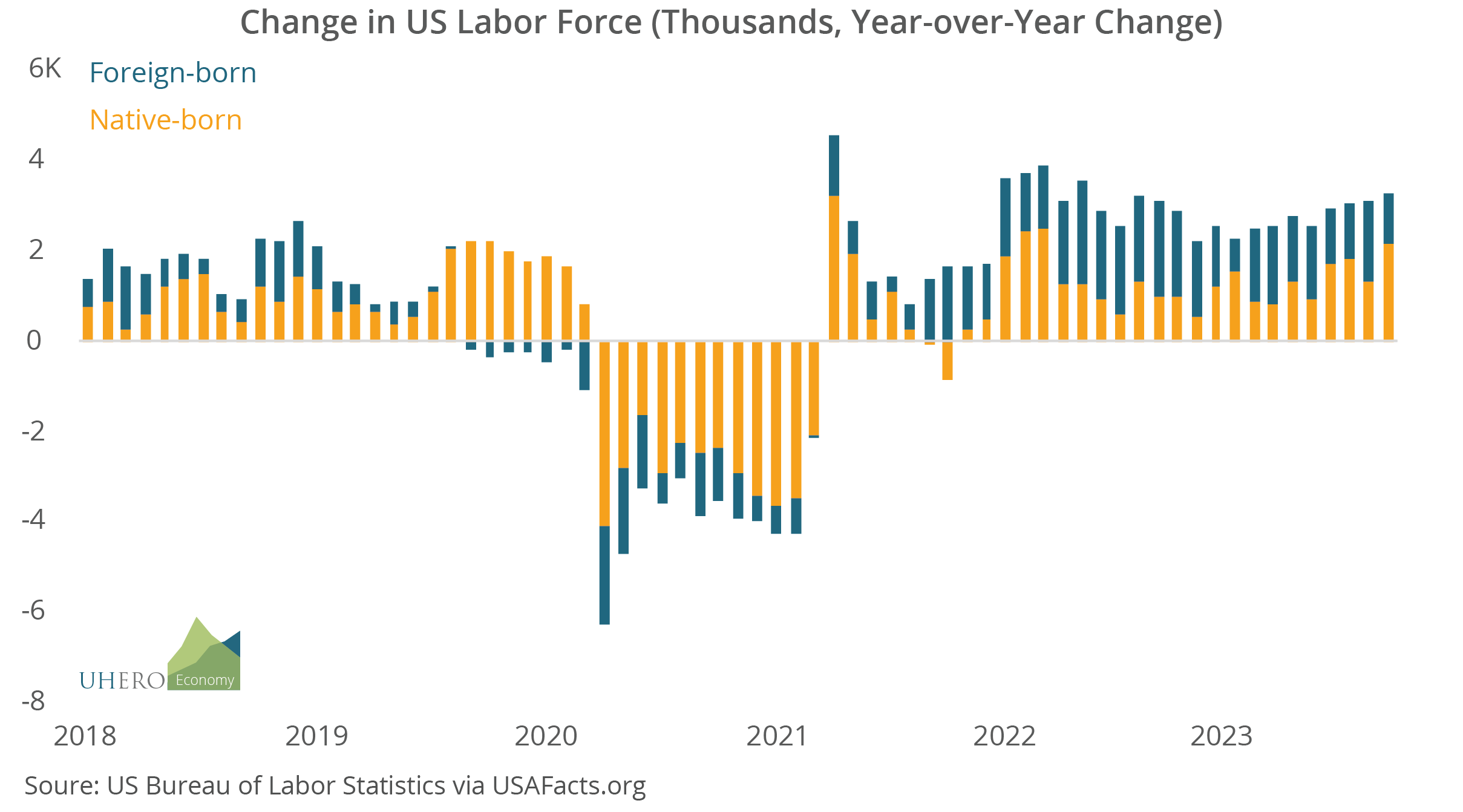

Besides productivity gains, there are other ways that a society can raise its long-run growth trend, that is, raise the rate of growth of supply. Among these, the most important is increasing the growth of the labor force, or preventing it from slowing. As the US population ages, this will be a major growth challenge. Whatever we can do to keep older workers in the labor force will help.

And immigration will be an essential part of the future growth picture. Just in the past couple of years, we have seen how a surge in immigration—most of them prime-aged workers—has helped to buttress the US labor force and permit strong growth at the same time that inflation has been falling. This will become more important in the future, as “natural” population growth from domestic births will fall short of losses through deaths. Much of this has been illegal immigration, so reforming US immigration policy to facilitate legal immigration will be important to maintaining economic growth in the face of a rapidly aging population.

In some ways there is no big secret about how to increase an economy’s supply—its “speed limit.” But technological change makes that hard to predict, and other sources of growth will need institutional support.