With recent months of record low interest rates and a strengthening economy, individuals and families in Hawaii are increasingly looking into becoming homeowners. How realistic is this possibility? Do families have enough for the down payment, and will the median household income qualify for a loan? How will a monthly mortgage payment compare to the rent you are currently paying? This week’s UHERO 101 takes a look at the median income family on Oahu and examines how far that income will take them into the Oahu housing market.

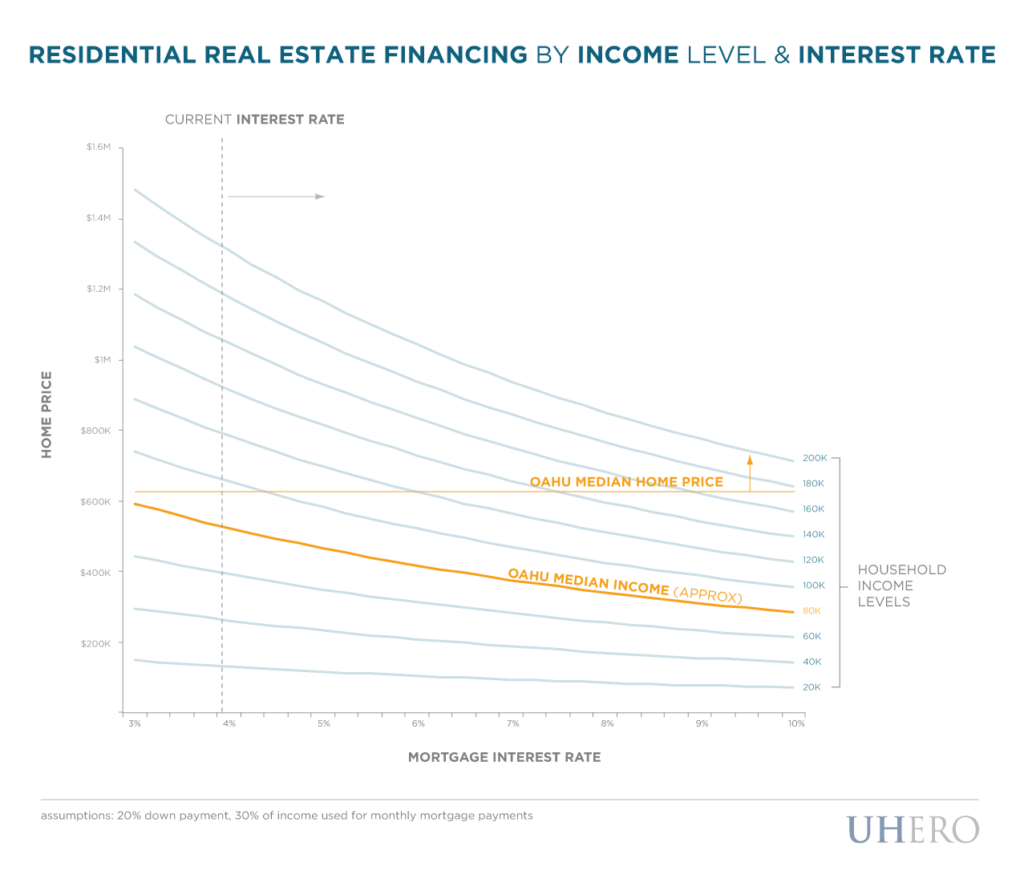

We start with very simple assumptions: a required down payment of 20% and an income in which 30% or less would go towards housing. In May of this year, the median single family home on Oahu was $630k and the median condo $315k. In our calculations below we assume a mortgage rate of 4.0%.

At current interest rates, if your dream is a single family home, you will need $126k to put down initially, and an income of right over $96k. Your monthly payment would be in the neighborhood of $2,400. If condos are more your style, your down payment would be in the $63k range, and you’d need an income around $48k. This leaves you with a monthly mortgage of $1,200.

How affordable is all of this to the median household on Oahu? As the chart below illustrates, even in today’s environment of relatively low interest rates, the median family income would not be able to afford the median-priced home. Only at rates well below 3% does the median home become affordable to the median household. To add insult to injury, the reality is that both interest rates and median home prices are likely to increase in the near future. Our graphic illustrates how much less affordable the median-priced home becomes in the face of increasing rates and home prices.

We hope this simple calculation helps shed light on the “affordability” of housing on Oahu. We may need to delay the housewarming party.

– Kimberly Burnett and James Jones