Federal Reserve Board Vice Chair Janet Yellen has laid out the argument for continued Fed action and the conditions the Fed will watch when deciding to ease off monetary stimulus.

In remarks to the policy conference of the National Association for Business Economics in Washington DC last week, Yellen elaborated on the Federal Open Market Committee’s recent pronouncements that policy will remain accommodative until there is significant improvement in the nation’s labor market. According to Yellen, the economy remains far short of potential output, with the current unemployment rate well above the “full-employment” rate of 5.2-6.0 percent. Against the backdrop of fiscal austerity, lingering financial market concerns, and the European recession, the FOMC is committed to easing labor market woes, particularly the persistent long-term unemployment plaguing the country. With measured inflation below two percent and inflationary expectations well anchored, the Fed sees little risk in this strategy.

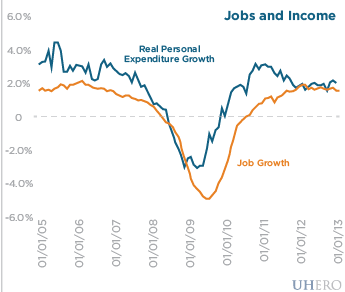

Yellen elaborated on the collection of labor market indicators she will be monitoring for signs that the Fed should ease off the monetary policy accelerator. These include not just the rate of unemployment–which she sees as the single best indicator of labor market health–but also payroll employment growth, the pace of layoffs and hiring, and the overall picture for spending growth. The idea is to look for a compelling body of evidence that households are in good enough shape to justify a pullback in Fed stimulus.

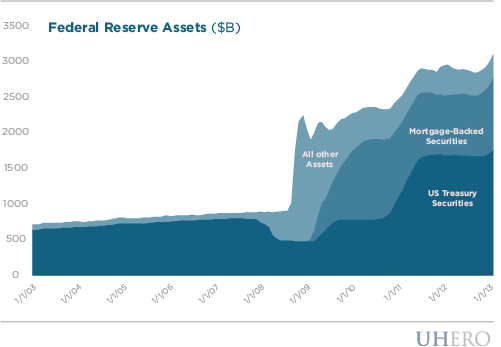

Yellen also addressed the potential costs and benefits of the Fed’s aggressive program of asset purchases. These programs have been directed at reducing long-term interest rates, particularly in mortgage markets, and at stimulating spending through wealth effects in an environment where short-term interest rates are at the zero lower bound. Potential costs might include an unexpected bout of inflation, distortion to private capital markets, and encouraging excessive risk taking by firms seeking better yield. In Yellen’s view these risks are all manageable and well worth taking in pursuit of the Fed’s dual mandate of price stability and full employment.

With the economy continuing to struggle and fiscal policy in retreat, accommodative monetary policy remains vitally important. So it is good to hear Yellen’s forceful expression of Fed commitment, as well as her clear-eyed explanation of how the Fed will go about gauging when it is time to turn away from its current expansionary stance.

– Byron Gangnes