This is UHERO’s second interim forecast update to address dramatic recent developments associated with the novel coronavirus pandemic.

Much has changed since the interim forecast update that we released three weeks ago. COVID-19 has spread to more and more countries, with disastrous impacts being seen in several major European economies, including Italy and Spain. Nationally, the disease has exploded: the US as a whole now leads the world in detected cases. New York, the US epicenter, is struggling to address unprecedented demands on local health care. Business in many communities has largely shut down, either because of falling demand or stay-at-home regulations. Those rules are now in place in many communities and states, with no clear indication of when it will be safe to lift them.

The economic impact of these necessary actions will be a sharp temporary drop in measured activity and employment. New claims for unemployment compensation have surged dramatically over the past week nationwide. The stock market has tanked, as profit projections were yanked downward and fear set in. US gross domestic product will drop at a double-digit annual rate in the second quarter. Policymakers have responded quickly, yet it will take some time for the impacts to be felt. The Federal Reserve has slashed interest rates to zero and has brought back many of the extraordinary measures it developed during the 2007-2009 financial crisis to keep markets liquid and encourage lending to affected firms to get them through the crisis. The US Congress just enacted the largest economic recovery package ever, $2 trillion, including an array of tax incentives and support for airlines and other affected industries, expanded support for employment and income, direct grants to states, and other measures.

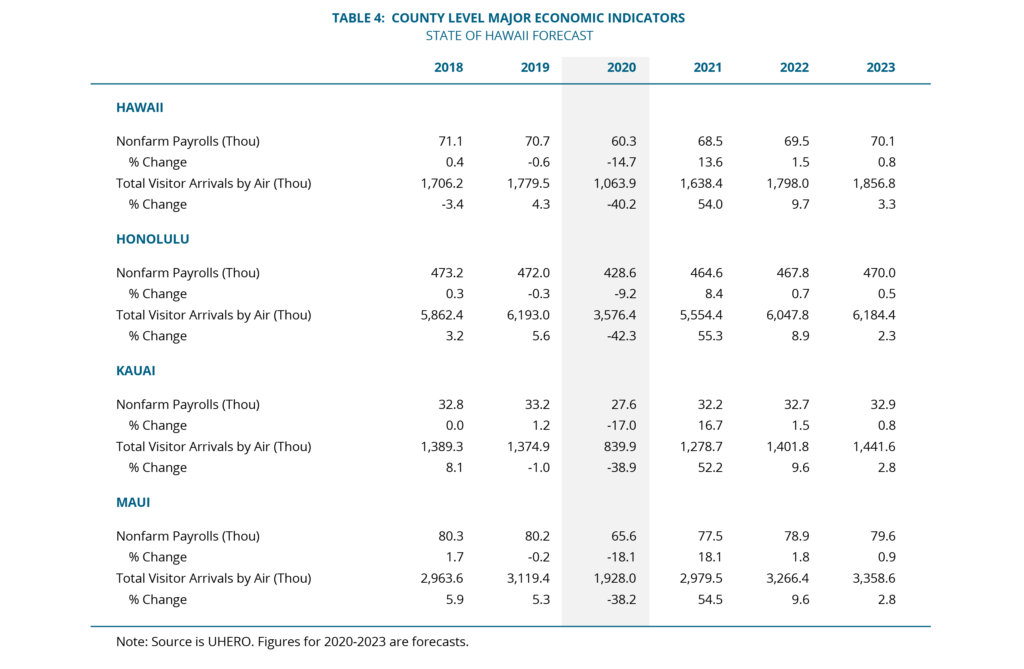

In Hawaii, tourism has been deliberately shut down to try to isolate the Islands from additional transmission from outside the state. The Governor’s initial plea to potential visitors to stay away for a month has been followed by a mandatory two-week quarantine requirement, which has brought visitor arrivals essentially to zero. Airline flights to Hawaii have been reduced to “bare bones” levels, as the CEO of Hawaiian Airlines put it, and a number of hotels have closed their doors for now. Following the lead of county Mayors, the Governor announced a state-wide stay-at-home order that is intended to limit participation at work places to essential workers and limit trips outside the home to essential activities. All entertainment venues and parks have been shut down, and restaurants are limited to take-out service only. Hard to believe, but all of these unprecedented changes have unfolded over only a week or so!

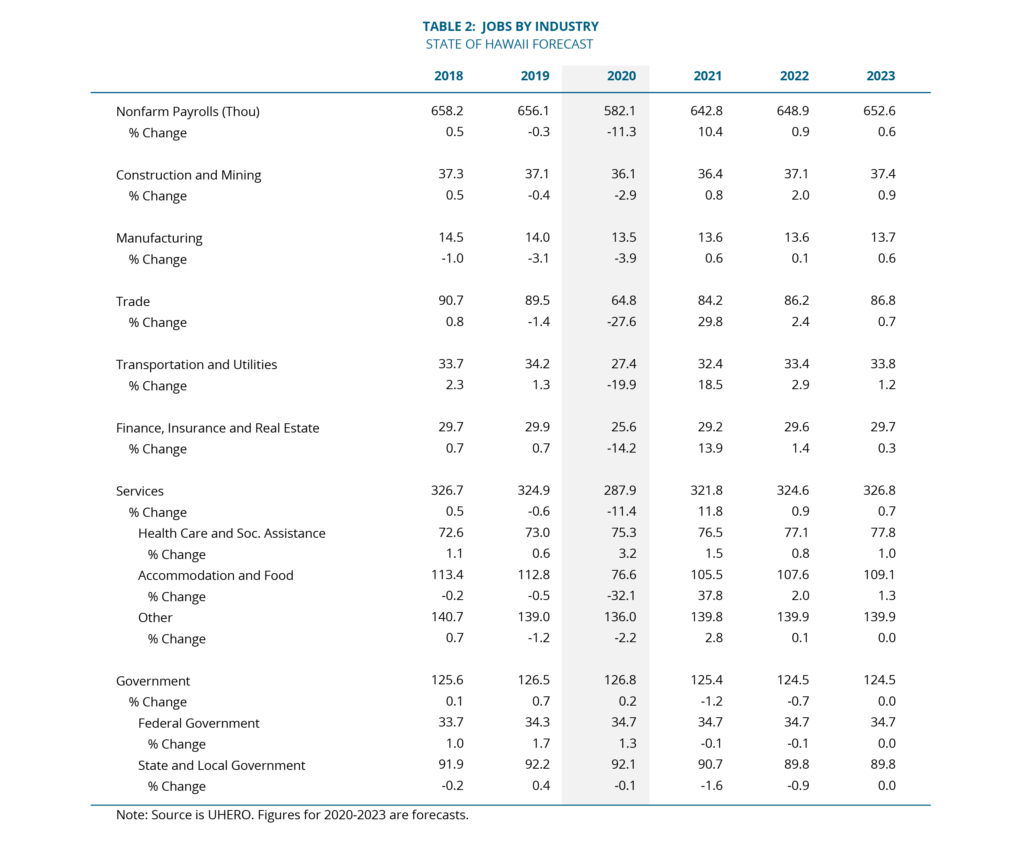

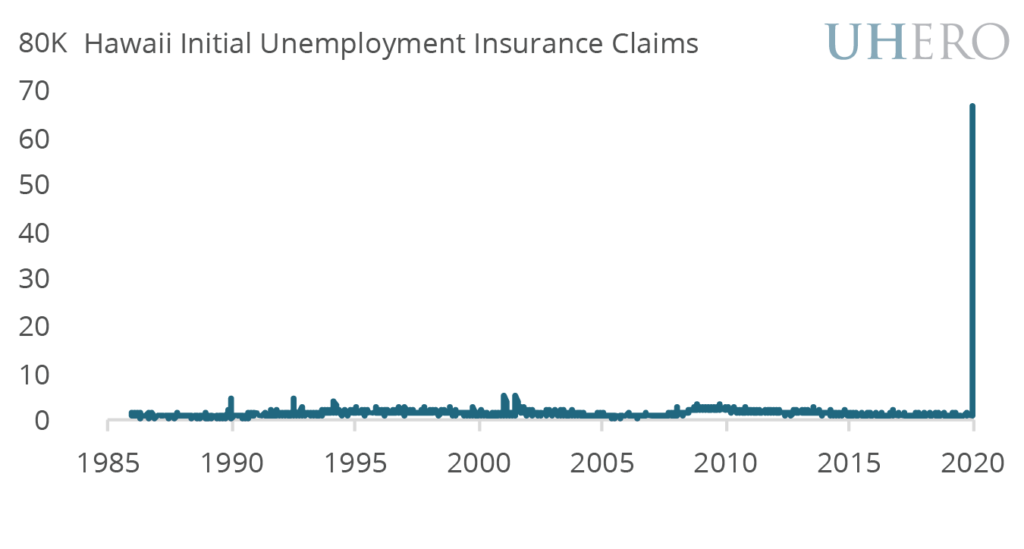

While it is too early to assess the full impact of these dramatic actions on Hawaii’s economy, it is clear that they will be sharp and painful. The clearest indication of this pain is the surge of 80,000 new unemployment claims so far in March, with several filing days remaining in the month. Job counts will fall precipitously in industries tied to tourism and local activities now banned by the stay-at-home order. Other industries will suffer from the general decline in spending.

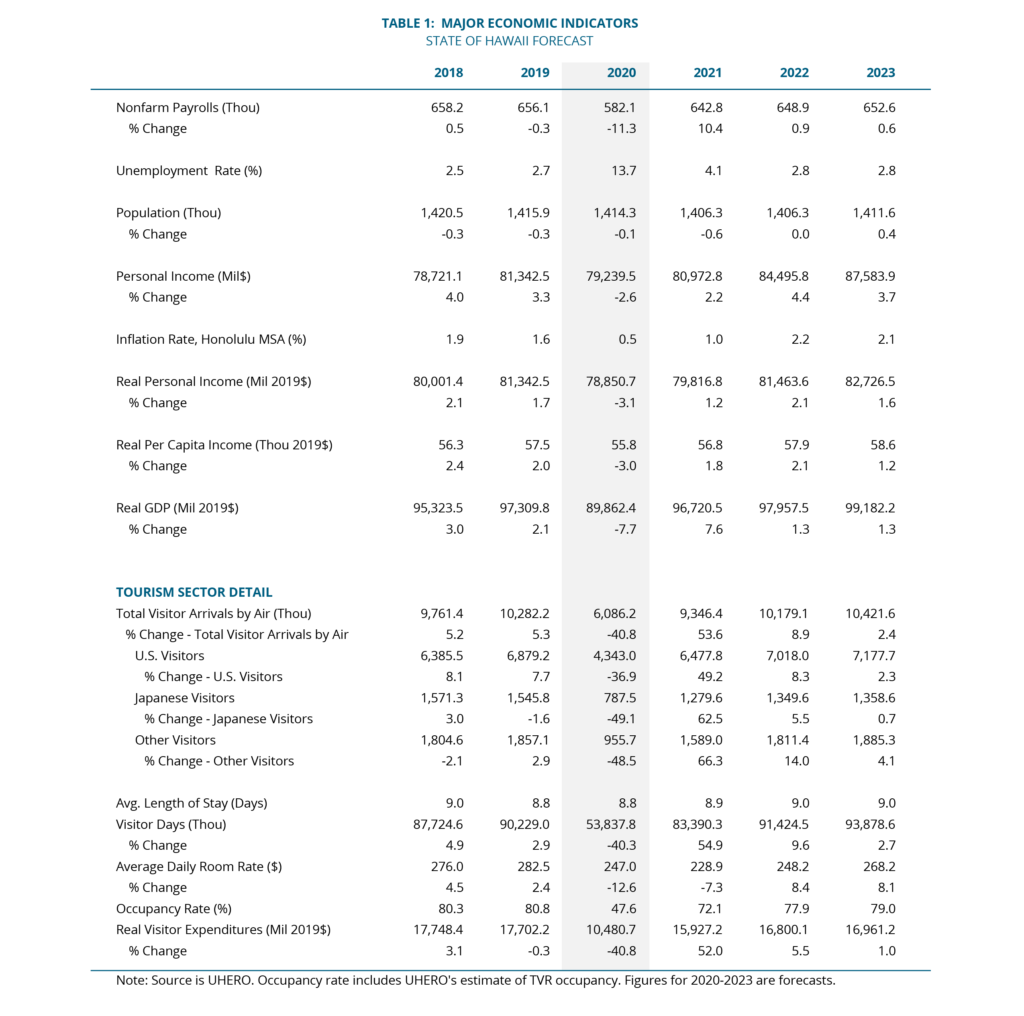

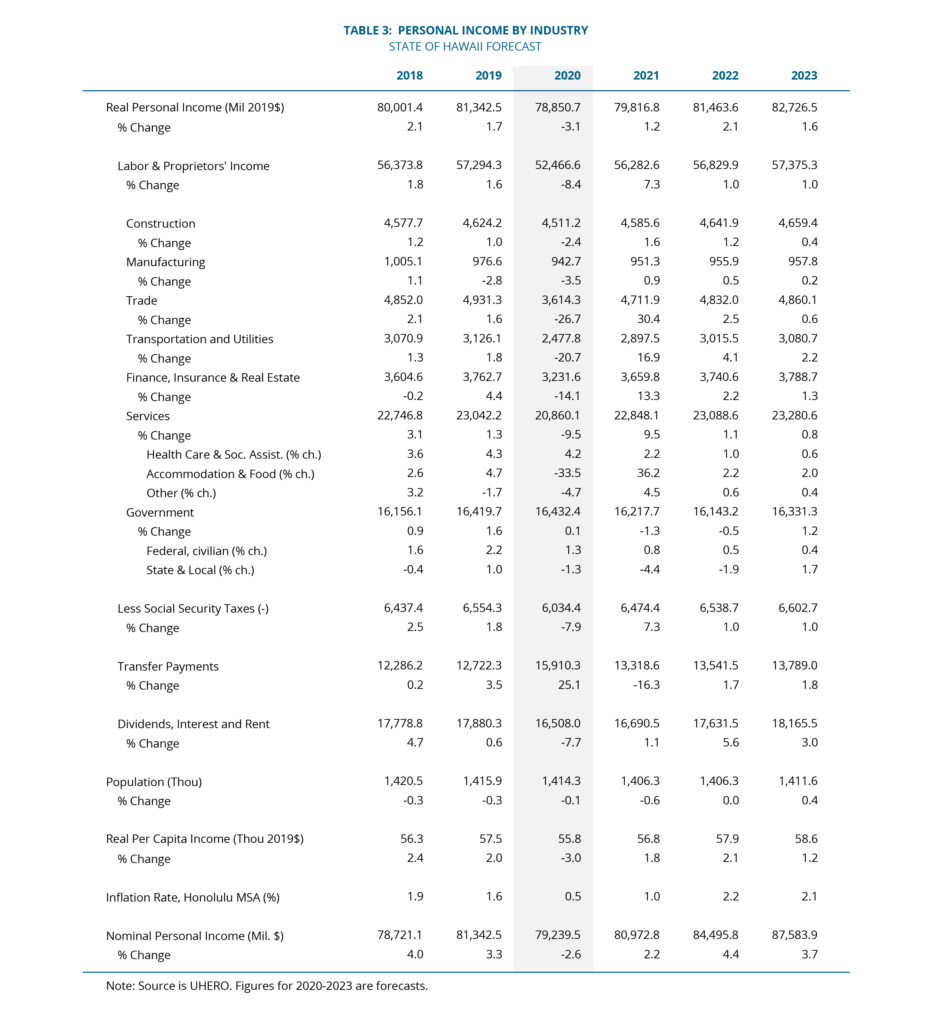

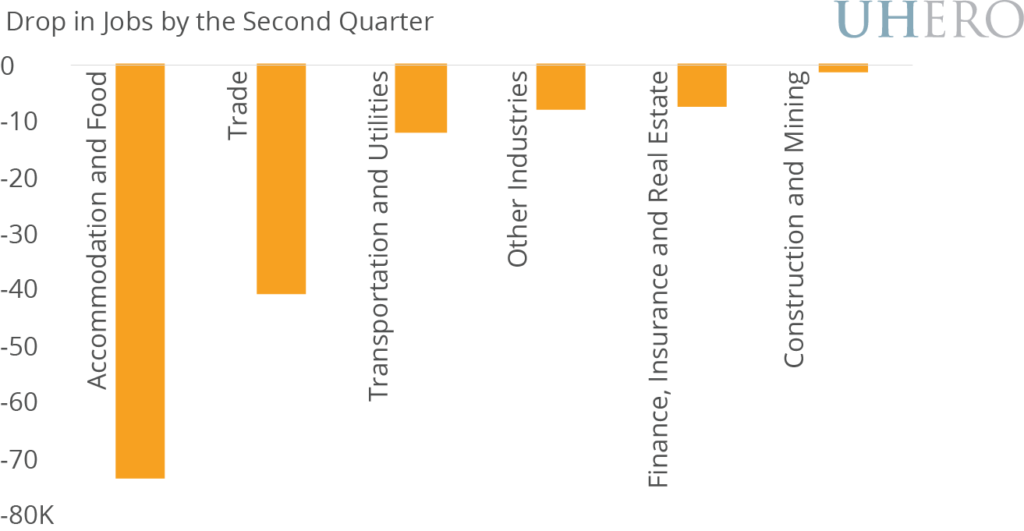

By the second quarter, we expect the non-farm job count to fall by more than 140,000 from its recent peak, a roughly 20% year-over-year decline. Losses to income will be somewhat less severe, because of enhanced unemployment benefits and the direct payments to US residents included in the recent federal recovery legislation, but they will still be historically large. Real personal income will fall about 5% by the fourth quarter. With a strong start to the year pre-virus and some recovery expected to commence by late spring and early summer, annual figures will show less severe drops. Still, the job count will average 11% lower than 2019 for the year as a whole, and real income will be more than 3% lower. Visitor arrivals for the year will be down an astounding 41%.

It is important to note that some aspects of the recent federal legislation will likely attenuate the job losses reported here and may further buoy income. Those aspects of the economic relief package will take time to evaluate and so are not incorporated in this interim forecast update. In addition, we expect further federal legislation focused on stimulating the economy as it begins to emerge from its current time-out.

The biggest unknown at this point is how long the shut-down will last, and how long the recovery will take when it eventually comes. We are assuming (for now) that the visitor and local shutdowns last through the officially-announced end date of April 30, but that recovery to “normal” after that will take quite some time. While local consumption of goods and services may resume relatively quickly, the return of air travel and the tourism economy is highly uncertain. First, there is the uncertainty about when the pandemic will peak and how long it takes before the near-global economic halt comes to an end. Even then, when and to what extent conditions and sentiment in major tourism markets will pick up is unknown. And both of these sources of uncertainty depend crucially on the policy response of governments at home and abroad. Our view is that recovery to normal conditions will be a very gradual process. To the extent that there is any lasting damage to the visitor industry—including airlines—or to local business and household finances, overall local economic recovery will take longer.

We will continue to track economic developments and policy responses in the weeks ahead and provide additional updates as warranted.