BLOG POSTS ARE PRELIMINARY MATERIALS CIRCULATED TO STIMULATE DISCUSSION AND CRITICAL COMMENT. THE VIEWS EXPRESSED ARE THOSE OF THE INDIVIDUAL AUTHORS. WHILE BLOG POSTS BENEFIT FROM ACTIVE UHERO DISCUSSION, THEY HAVE NOT UNDERGONE FORMAL ACADEMIC PEER REVIEW.

By Byron Gangnes

Banking can be a risky business. A bank keeps only a fraction of its deposits as cash reserves, turning the rest into income-earning assets, primarily loans, but also federal government bonds and other securities. Fractional reserve banking, which goes back at least to the 17th century, provides a source of funding for households and firms, while permitting banks to pay depositors interest on their savings.

Generally, this works very well. The rate of deposit outflows is normally easy to predict, so that modest reserves can safely back up deposits. This is so predictable in fact, that the government’s required reserve ratios are very low. Prior to 2020, banks were required to hold 10% reserves on deposits above a certain level and 0% on savings accounts and CDs. Since 2020, there have been no legal reserve requirements for US banks. Of course, out of prudence banks still choose to hold some cash reserves, regardless of legal requirements. And the short-term federal government bonds they hold can easily be converted to cash if necessary.

But the fact that deposits are not fully backed by reserves makes fractional reserve banking inherently risky. Concerns that a bank may not have sufficient liquid balances to cover all deposits can lead to an abrupt withdrawal of funds as depositors fear bank failure and a loss of their money. Such bank runs are what happened recently, leading to the failure of Silicon Valley Bank and Signature Bank, and the subsequent withdrawals from other medium sized banks.

Deposit insurance and its discontents

To discourage bank runs and subsequent failures, the government provides deposit insurance through the Federal Deposit Insurance Corporation (FDIC) that guarantees protection of deposits up to a certain limit—currently up to $250,000 per depositor, per FDIC-insured bank, and per ownership category (for example, individual versus trust). These limits reflect the primary intent of deposit insurance to protect household savings. Deposits above these limits are not insured and are generally unprotected in the case of a bank failure. The government may still decide to extend insurance to larger deposits to halt further outflows from threatened institutions—as it did for Silicon Valley Bank and Signature Bank—but this is a rare event.

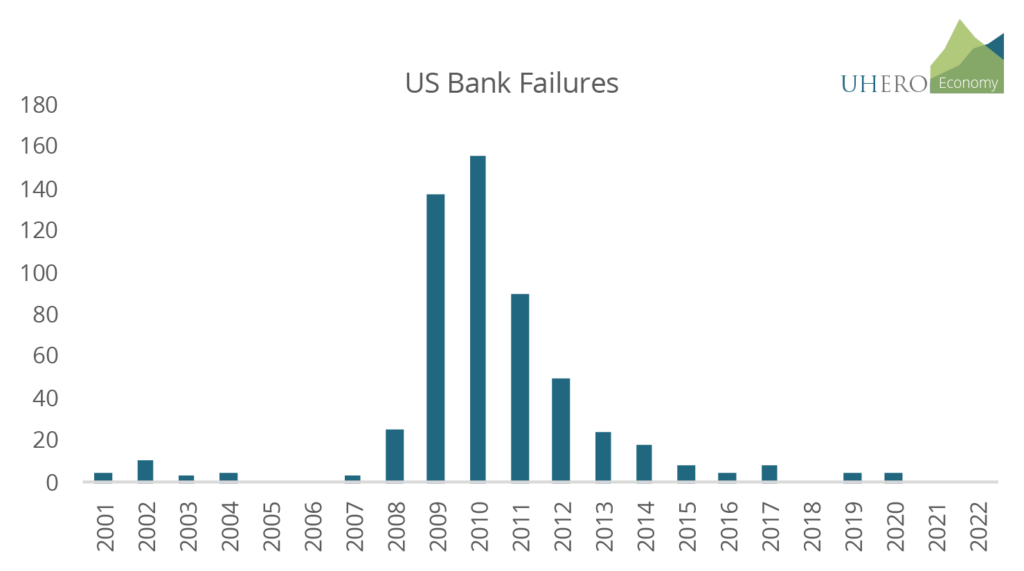

Banking insurance has been very successful in preventing bank runs. Bank failures were fairly common before the rollout of federal deposit insurance. During the 1930s more than 9,000 US banks failed (admittedly many of these were very small). Following the creation of the Federal Deposit Insurance Corporation in 1933, the number of failures fell dramatically, and these days in a typical year there are fewer than five failures, in some cases none.

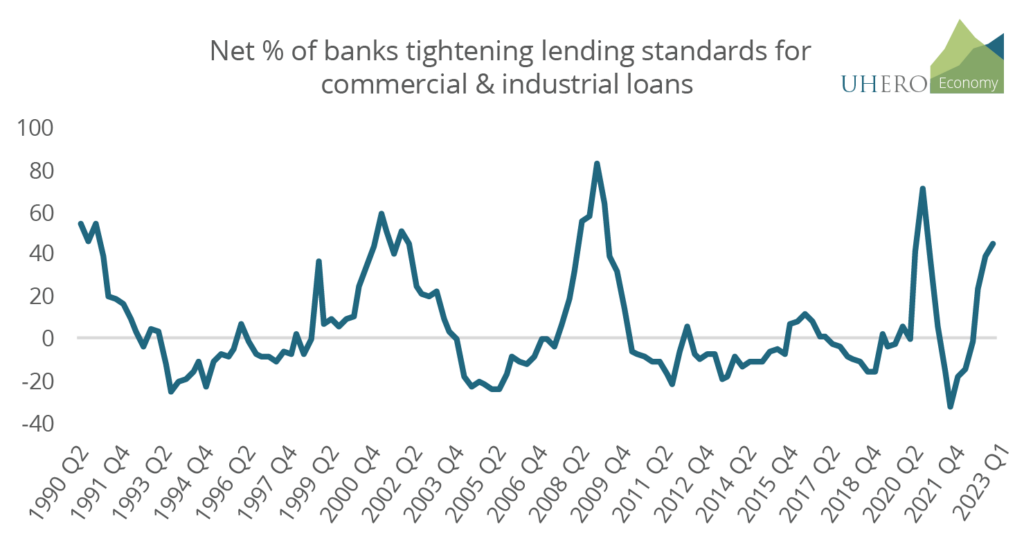

The prevention of bank failures matters for households but also for the broader economy. As we are seeing in the current episode, when banks are threatened with failure, lending conditions and loan availability can tighten (Fed Chair Jerome Powell has likened the current effect to “the equivalent of a rate hike or perhaps more.”) Higher borrowing costs can constrain household and business spending and perhaps precipitate a recession.

Insuring deposits against losses introduces a problem common to all insurance, known as moral hazard. An insured individual has little or no incentive to monitor the behavior of a financial institution because the depositor will not lose money even if the bank is badly managed and fails. As a result, insurance provides an incentive for the bank to take on more risk, increasing the likelihood of future bank failures.

The essential role of effective regulation

Banks face extensive regulation of their operation and investments to prevent excessive risk-taking that could lead to insolvency. Banks are reviewed for the overall riskiness of their investment portfolio of loans and securities, and the regulator can direct them to adjust their investment mix. Banks are further required to maintain an adequate equity cushion they can fall back on if assets decline in value. Penalties can be imposed on managers of larger institutions in the event of risk mismanagement. And to keep bank managers and investors on the hook, bank bailouts are supposed to be reserved for systemically important institutions, those whose failure would threaten the overall health of the US financial system.

In the wake of the Global Financial Crisis of 2007-2009, Congress enacted stricter rules on financial institution governance and gave the Fed a more overarching role in bank supervision. Among other measures, the landmark Dodd-Frank Act required increased bank supervision across a number of dimensions, raised capital requirements, and mandated stress tests to determine how exposed a bank might be to possible risks. Many of these regulations were rescinded or reduced for smaller banks during the Trump administration, with the justification that they unduly burdened institutions that were important to small and medium sized businesses and communities.

SVB was uniquely problematic.

Silicon Valley Bank had some peculiar characteristics that made it more vulnerable to a bank run and insolvency. Primarily because it was focused on banking for businesses, more than 90% of deposits in the bank were above FDIC limits and therefore uninsured, compared with 40-50% at many other banks. It had grown explosively, and it struggled to develop the more sophisticated internal risk management that this required. (It didn’t help that it was without a risk manager for most of last year!) Its growth was concentrated in high tech and related venture capital, which have seen a sharp pullback in activity. The bank invested an outsized proportion of its deposits in long-term bonds, which fell sharply in value as interest rates soared over the past year. It had largely neglected to hedge against such risk.

The failures of SVB and Signature Bank have impacted other small and medium sized institutions, with depositors moving funds to the larger money center banks that are viewed as too big to fail, and into financial market investments. Their stock market valuations have fallen by roughly 25% as a result, and credit conditions have tightened. Short-term actions to stabilize the system have been taken, including the creation of a special lending facility for SVB and Signature; the Fed’s encouragement for banks to borrow at the discount window; government arm twisting that got large banks to place $30 billion of new deposits in First Republic, another threatened California bank; and the government’s promise to protect all deposits in SVB and Signature bank. While the volume of bank borrowing from the Fed’s discount window has declined somewhat over the past week, it remains elevated, suggesting that the system has not yet stabilized.

The macroeconomic fallout from the SVB crisis will prove substantial. Regardless of whether we see additional bank failures, the uncertain environment for banks, their need to beef up balance sheets to forestall outflows and reassure regulators, and the profit squeeze from low interest rates on loans relative to deposits will cause further credit market tightening. In an already-precarious economy, this will likely tip the US into a recession before the end of the year.

Regulation and regulatory failure

The SVB failure exposed weaknesses in the regulatory framework. While evaluation is ongoing, the fact that stress tests do not normally involve assessing risks from sharp interest rate changes is surprising (shocking?) Under changes made in recent years, bank examiners have less latitude in deciding what to review. And even when shortcomings are identified, they may not be acted on quickly by the Federal Reserve system.

But it seems clear in this case that the failure to administer existing regulations was a key part of the problem. Despite repeated warnings from the State of California and the Fed itself, the Federal Reserve Bank of San Francisco, which had direct supervisory responsibility for SVB, did not take decisive action to force the bank to address these deficiencies.

To be sure, macroeconomic developments have played an important role in the current crisis. The once-in-forty-year’s pace of Fed interest rate hikes led to the sharp drop in long-term bond values that contributed to SVB’s asset losses. But since the bank’s supervisor is the Federal Reserve, there is no good reason why they would have failed to note these effects and require timely bank actions.

The Fed, the FDIC, and the Treasury are now in the process of reviewing the SVB failure and its aftermath. Among policies that have been floated are increased penalties for executives of poorly managed banks, including clawing back executive compensation after bank failures and to bar such managers from future work in the industry. The small and medium sized banking industry has called for temporary insurance of all deposits, including those above FDIC limits. The Treasury has leaned against this, likely for both cost and adverse moral hazard concerns.

Politics. Ugh.

At the heart of the US banking regulatory problems is—surprise, surprise—the political world in which they are developed. Banking is big business and so therefore is bank lobbying. No surprise then that SVB had spent lavishly to lobby for deregulation and was successful in gaining individual exemption from the Volcker rule that was intended to bar banks from investing in risky activities like venture capital. Even in the current environment, there have been few calls for substantive regulatory change. While there have been suggestions that regulations should be tightened for smaller institutions, much more emphasis has been put on bank management and enforcement failures. Given the political reality, it is hard not to be pessimistic about the possibility of meaningful and lasting banking reform.

It is important to note that for most of us there is little reason to worry about banking risk. After all, deposits on the usual household scale are fully insured against loss, especially when you consider that protection can be extended by holding accounts at different institutions or under more than one person’s name. For most of us there is no personal risk from regulatory failure, even if we could still suffer from the broader financial and economic fallout from these events, and potential costs to taxpayers from federal support to the industry during a crisis.