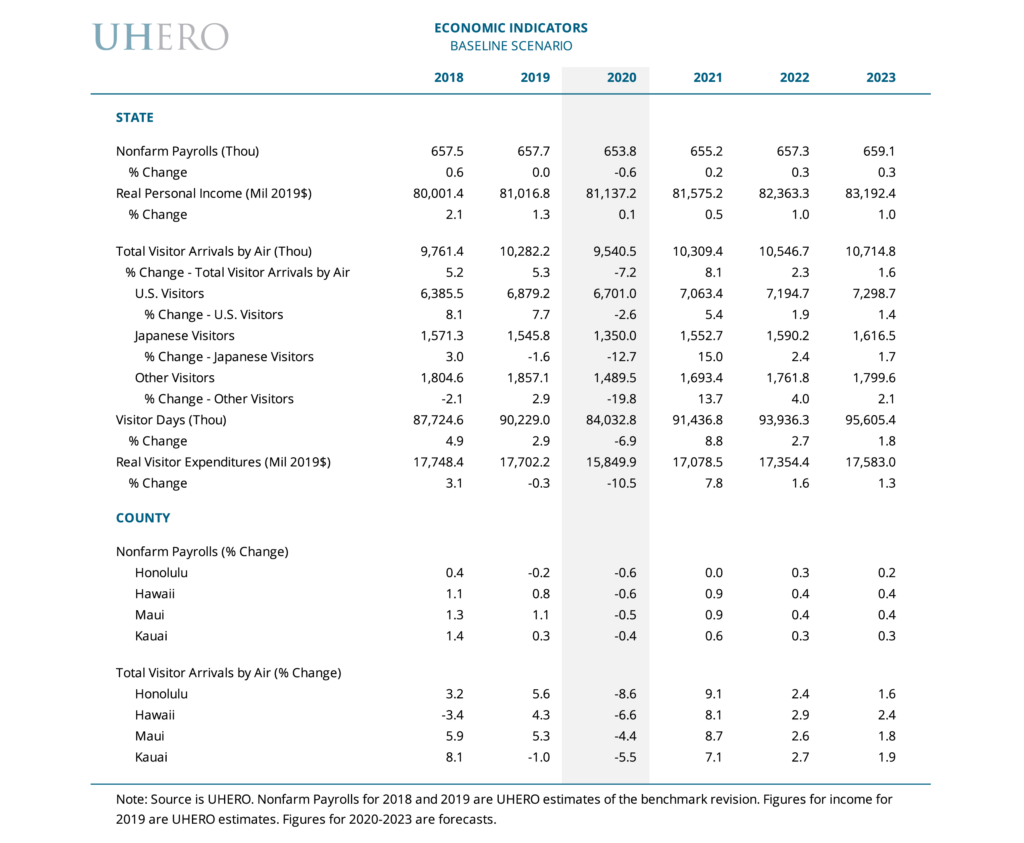

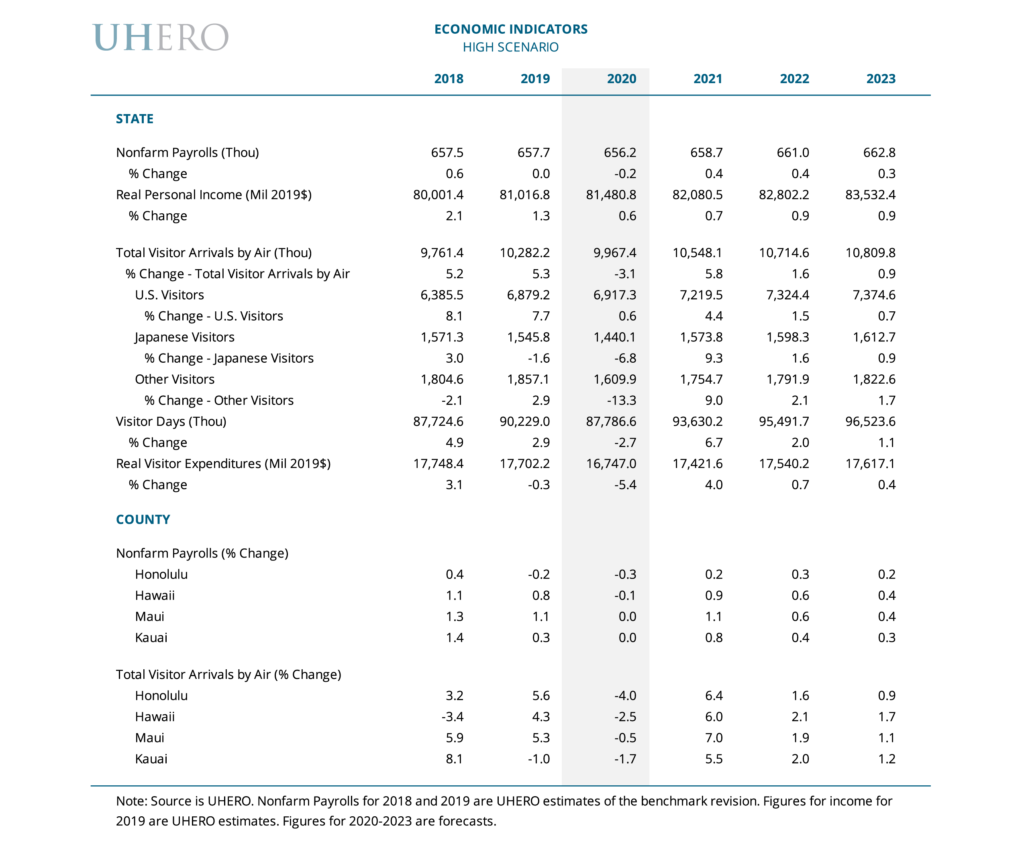

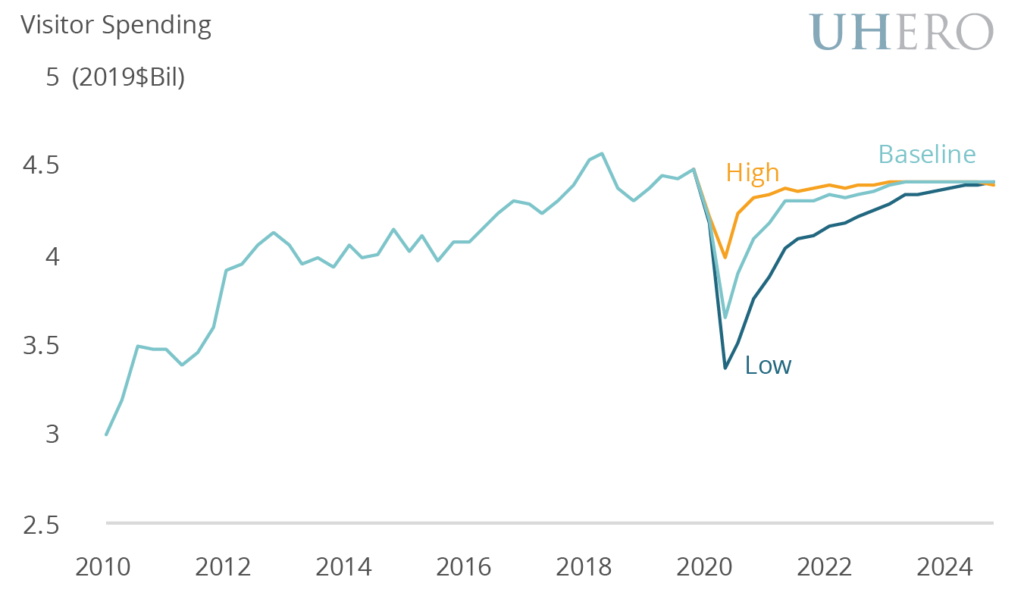

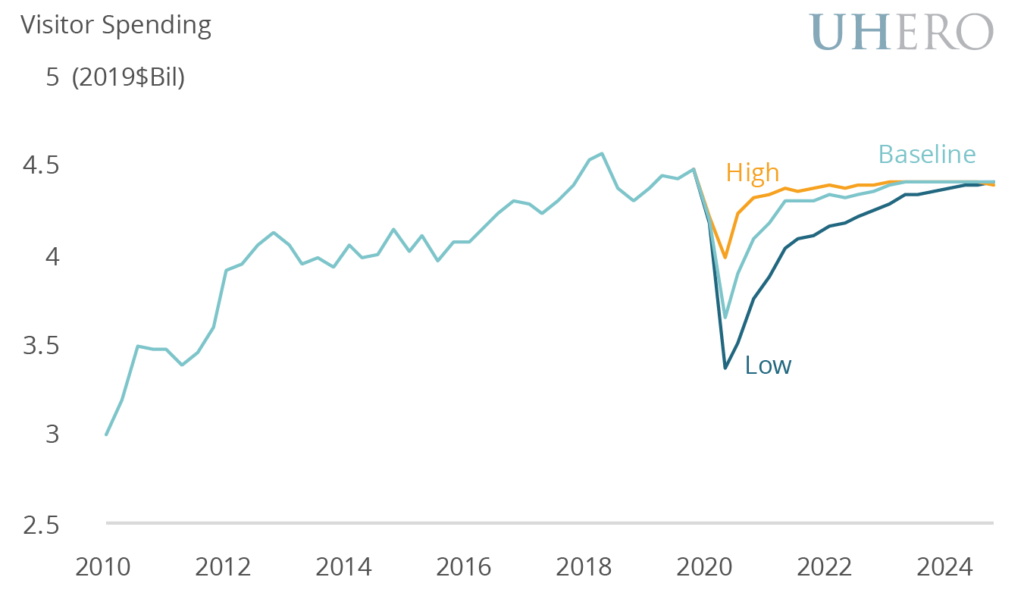

The spread of the novel coronavirus and recent visitor falloff lead us to lower sharply our outlook for the Hawaii economy. In the baseline forecast, real visitor spending is expected to fall more than 10% this year and payroll jobs by 0.6%, with an attenuated recovery path. Alternative scenarios reflect a wide range of possible outcomes.

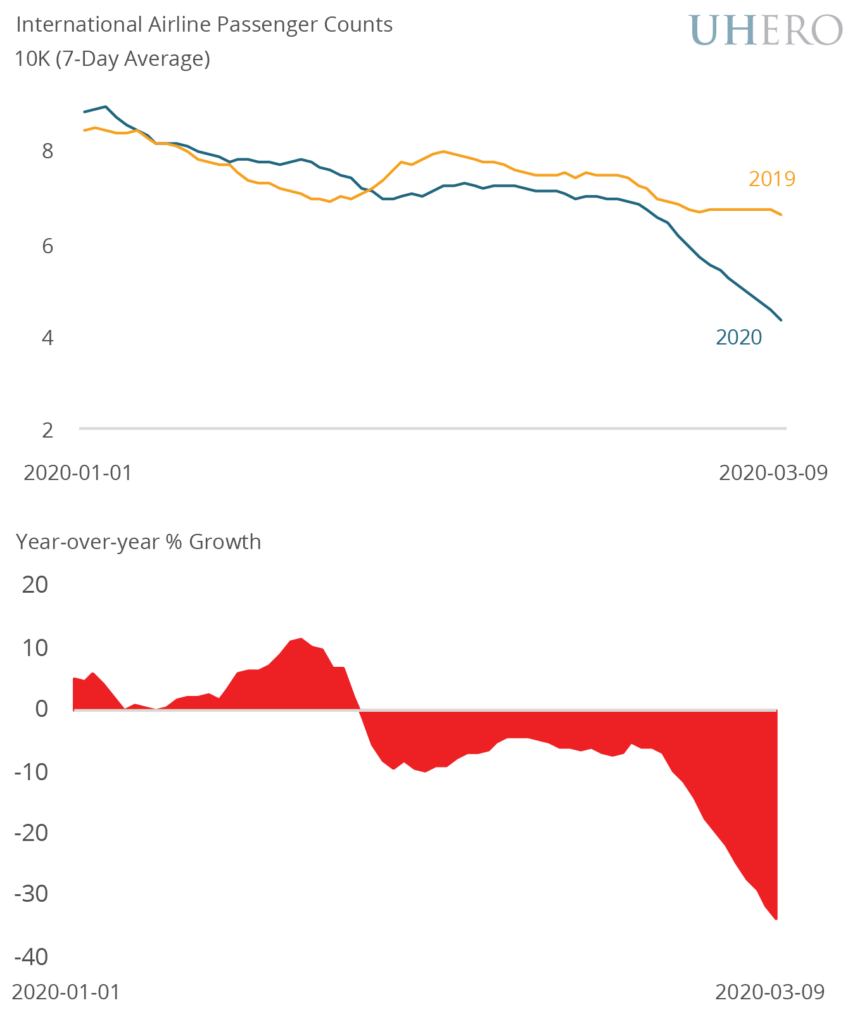

In our first quarter State Forecast Update, Coronavirus Presents Danger to Hawaii Tourism, we presented a fairly sanguine baseline forecast for the Hawaii economy, considering the very limited information about the coronavirus impact available at that time, and we discussed one possible scenario informed by the 2002-2003 SARS experience. At the time the forecast was released, there was limited evidence indicating an immediate downturn in state tourism. Although, passengers from international markets were off 7% compared with February 2019, the number of passengers from Japan was down less than 2% compared with the same period a year earlier. Domestic passenger counts were 9% higher than year-earlier levels.

Based on the data available at that time, a SARS-like impact on Hawaii tourism appeared a plausible alternative scenario. Developments similar to the 2002-2003 period would produce a V-like response, with a sharp drop in international visitors and spending, followed by a sharp recovery as the virus dies off quickly. The overall economic costs would be limited because of the rapid recovery.

In the past two weeks, things have changed markedly, and a SARS-type V-shaped path is now too optimistic. While new infections have slowed markedly in China, the spread of the novel coronavirus in South Korea, Iran, Italy, Japan, and now more than two-thirds of US states, suggests a more prolonged outbreak is in the cards. And the longer the virus spreads, the greater the human and economic toll. In Hawaii, between mid-February and the first week of March, we have seen a sharp drop in international passenger counts, and domestic passenger growth has begun to turn negative. Most notably, while international passenger counts were only 7% lower than year-earlier levels in mid February, by the first week of March, that gap widened to 32%. Japanese passenger growth rates have fallen from -1.4% in mid-February to -31% in the first week of March. Domestic passenger counts have only begun to fall slightly below last year’s levels, but we expect that to change quickly as the coronavirus spreads on the US mainland. Industry participants are reporting a pullback in future bookings, made more difficult to assess because of a shortening of the booking window as consumers adopt a more wait-and-see approach. Hotels report a marked drop in occupancy rates.

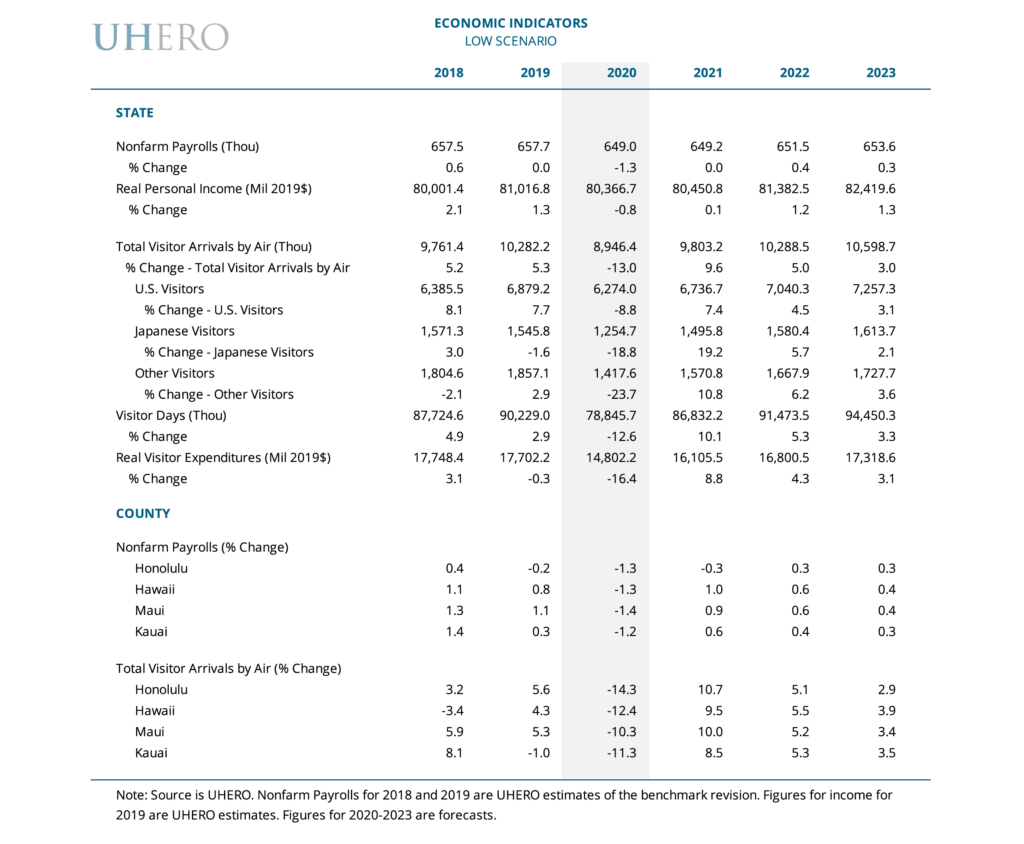

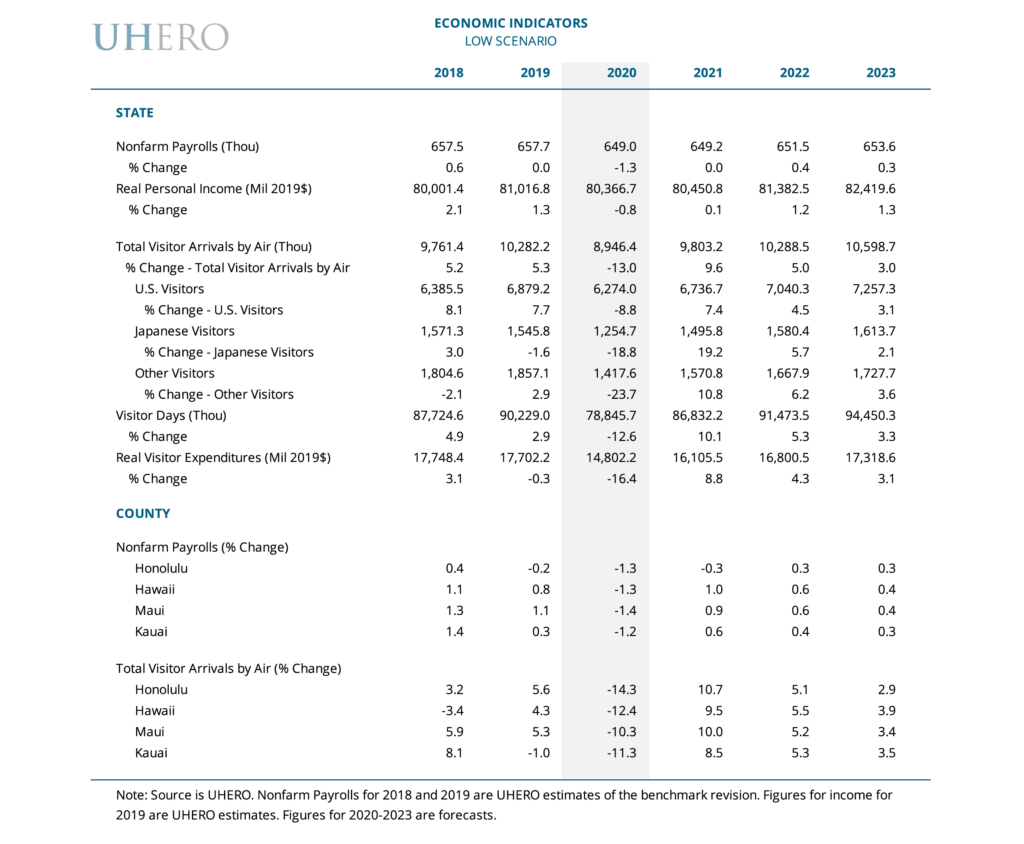

Based on these recent developments, we have now substantially marked-down our baseline forecast for Hawaii’s visitor industry and broader economy. The rolling nature of disease outbreaks—and the potential for significant knock-on macroeconomic effects—will likely result in a downturn that is much more severe than we saw with SARS. As of March 10, 2020, we now expect visitor arrivals to fall sharply, by 13% in the second quarter and by more than 7% for the year as a whole. While recovery begins this summer, we do not expect it to be complete until next summer. There will be a substantial 17% decline in real visitor spending in the second quarter, followed by a prolonged recovery thereafter. With a sharp downturn in tourism and a long recovery period, our macroeconomic forecast for Hawaii is now much more pessimistic, with job losses of nearly six thousand workers by the third quarter of this year, and a very restrained pace of hiring for the next several years. Among the counties, Honolulu is most adversely affected, because of its heavier reliance on international markets, but all islands see a substantial decline in visitor numbers this year and a protracted recovery period, as well as aggregate job losses.

Because of the high level of uncertainty about the eventual spread of the disease and pace of containment, the behavioral responses of the traveling public, and broader macroeconomic fallout in the US and global economies, we have also prepared alternative high and low scenarios. In the high scenario, the virus is well contained by the end of March and travel patterns begin to recover in April. The macroeconomic fallout in the US is very limited. As a result, visitor numbers take a much smaller hit, falling off 8% in the second quarter before rebounding quickly. This high scenario has a similar path to what we experienced during the SARS epidemic.

However, it is entirely possible that the virus spread and impacts will be more severe and longer-lasting than in our baseline forecast. This would impose larger direct adverse impacts on travel, and would likely also tip the US and global economies into recession. In our low scenario, then, the hit to the US visitor market in particular is much more severe than in the baseline, dragging overall arrivals down nearly 20% by the second quarter. The pace of recovery is also more attenuated, with arrivals remaining below their previous peak until the end of 2022. Job losses are larger, with a decline in payroll employment of 1.3% this year. It is important to note that we do not consider this a “worst case” scenario, which given current uncertainty is impossible to tie down.

Clearly, the situation is very fluid. In coming weeks and months, UHERO will continue to track developments closely and release revised forecasts when appropriate using blog posts such as this one for updates that occur between our regular quarterly forecast releases.